Question: drop down options: first drop down , you ___ (should/should not) exercise... second drop down , it is ____ (at the money/ in the money/

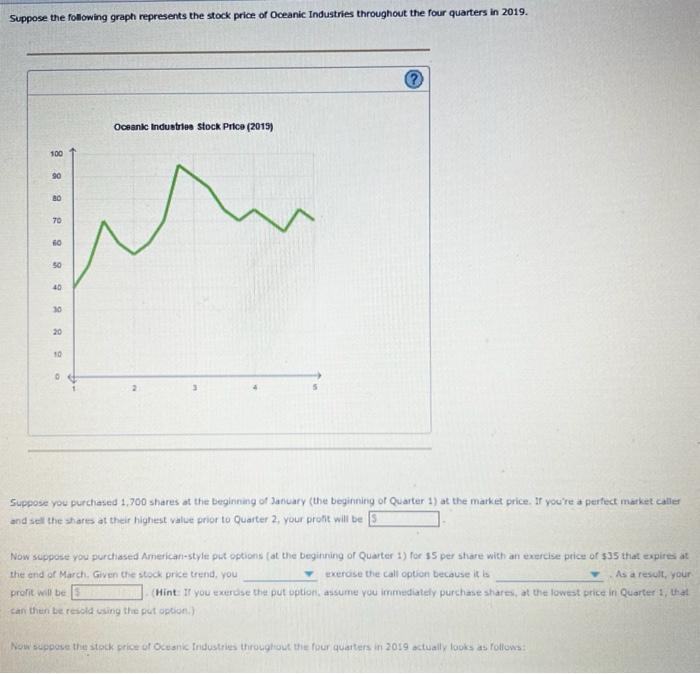

Suppose the following graph represents the stock price of Oceanic Industries throughout the four quarters in 2019. Oceanic Industries Stock Price (2015) 100 90 9 BO w 70 10 30 9 9 9 29 30 20 Suppose you purchased 1,700 shares at the beginning of January (the beginning of Quarter 1) at the market price. If you're a perfect market calle and sell the shares at their highest value prior to Quarter 2. your profit will be As a result, your Now suppose you purchased Aretican-style put options at the beginning or Quarter 1) for 55 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you txercise the call option because it is profit will be (Hint: If you exurdise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option) Now suppose the stock price of Oceanic Industries throughout the four quarters in 2019 actually looks as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts