Question: Drop down questions for part 1 Cash Contributed capital Dividends Par value Sales $0.10 $15 $800 $8000 $120000 Additional paid capital Cash Dividends Inventory Revenue

Drop down questions for part 1

Cash

Contributed capital

Dividends

Par value

Sales

$0.10

$15

$800

$8000

$120000

Additional paid capital

Cash

Dividends

Inventory

Revenue

part 2:

Additional paid-in capital

Repurchases

Sales

Stock buybacks

Treasury stock

$17

$75

$750

$10,700

$12,750

Cash

Common stock

Dividends payable

Repurchases

Sales

part 3:

Cash

Common stock

Re-insurance

Sales

Shares

14

17

200

238

2800

3400

47600

Cost of goods sold

Inventory

Profit

Revenue

Supplies

Treasury stock

part 4:

Buybacks

Cash

Cost of goods sold

Repurchases

Revenue

17

19

323

400

6800

7600

129200

Accounts receivable

Loss of sale

Repurchases

Share expenses

Treasury stock

Additional paid in capital

Inventory

Purchasss

Re-insurances

Sales

part 5:

Cash

Dividends

Revenues

Stock expenses

Supplies expenses

No journey entry

.10

800

8000

10750

No journal entry

Cash

Dividends payable

Inventory

Sales

Shares

No journal entry

part 6:

Cash

Dividends

Dividends payable

Record

Revenue

No journal entry

.10

800

8000

10750

No journal entry

Accounts receivable

Cash

Dividends

Record

Revenue

No journal entry

part 7:

Additional paid-in capital

Common stock

Dividends

Dividends payable

Investors

Revuenue

No journal entry

.10

800

8000

10750

No journal entry

Additional paid-in capital

Common stock

Cash

Dividends

Retained earnings

Revenue

No journal entry

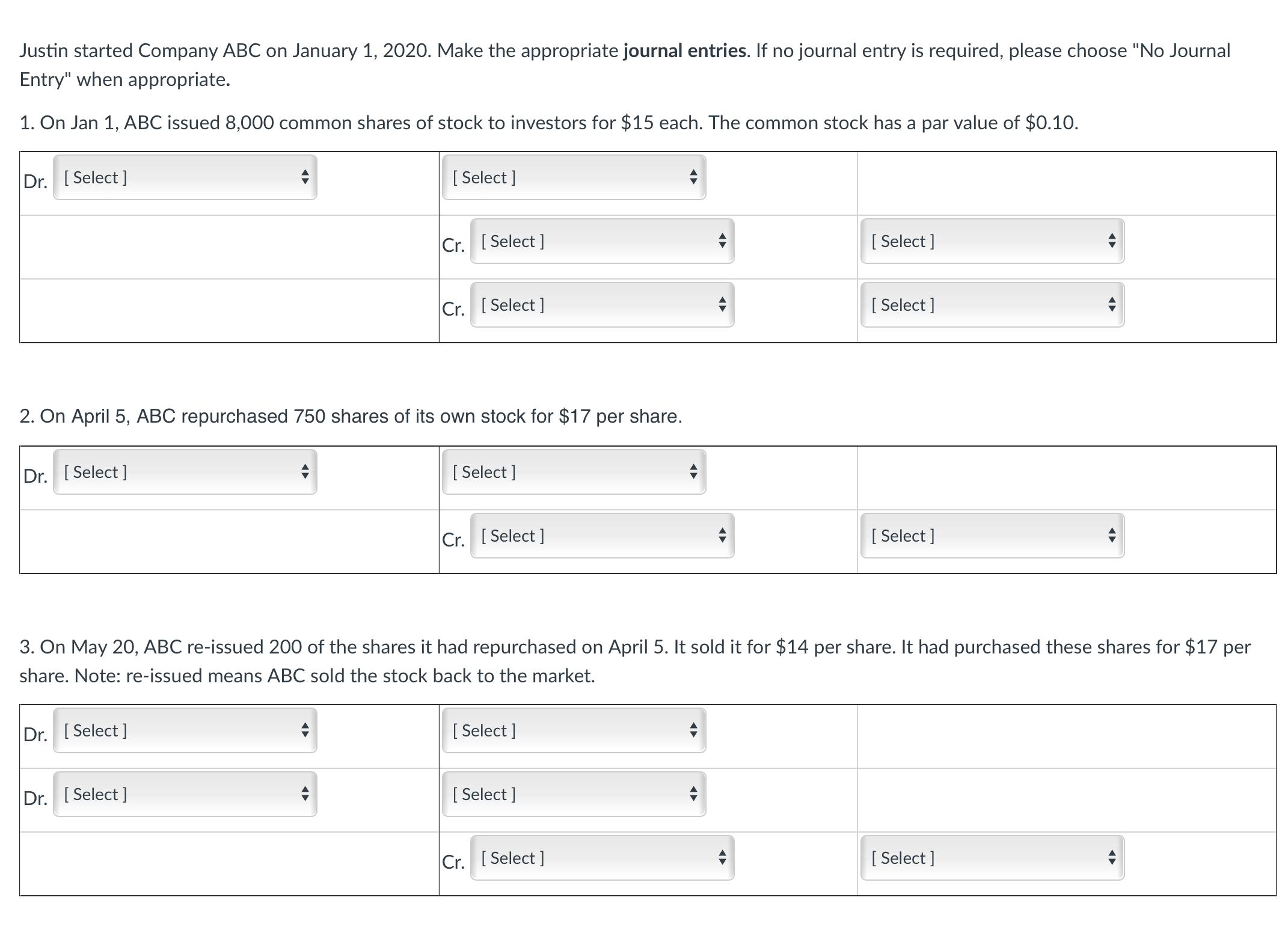

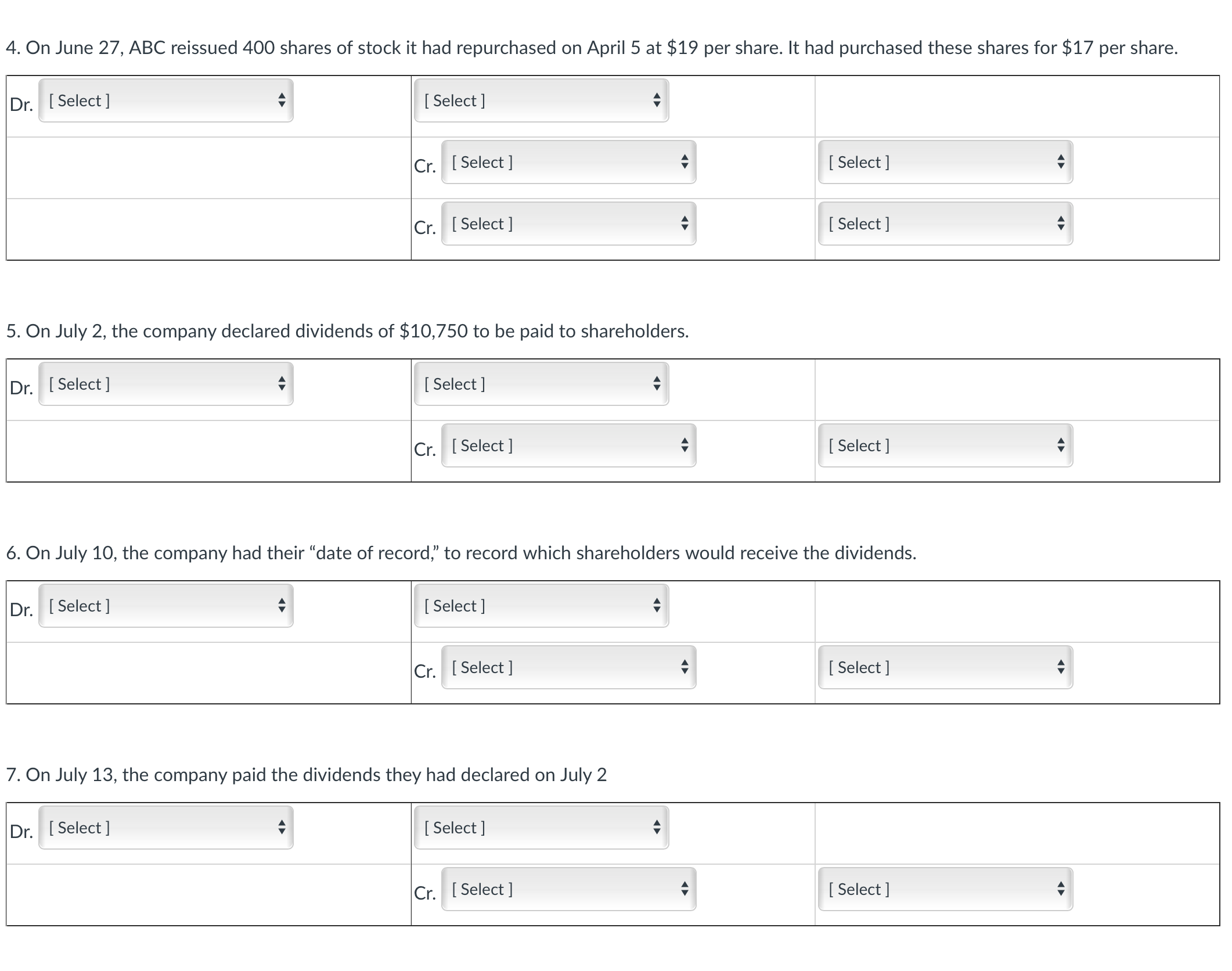

Justin started Company ABC on January 1, 2020. Make the appropriate journal entries. If no journal entry is required, please choose "No Journal Entry" when appropriate. 1. On Jan 1, ABC issued 8,000 common shares of stock to investors for $15 each. The common stock has a par value of $0.10. Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] 2. On April 5, ABC repurchased 750 shares of its own stock for $17 per share. Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] 3. On May 20, ABC re-issued 200 of the shares it had repurchased on April 5. It sold it for $14 per share. It had purchased these shares for $17 per share. Note: re-issued means ABC sold the stock back to the market. Dr. [ Select ] [ Select ] Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ]4. On June 27, ABC reissued 400 shares of stock it had repurchased on April 5 at $19 per share. It had purchased these shares for $17 per share. Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] 5. On July 2, the company declared dividends of $10,750 to be paid to shareholders. Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] 6. On July 10, the company had their "date of record," to record which shareholders would receive the dividends. Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ] 7. On July 13, the company paid the dividends they had declared on July 2 Dr. [ Select ] [ Select ] Cr. [ Select ] [ Select ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts