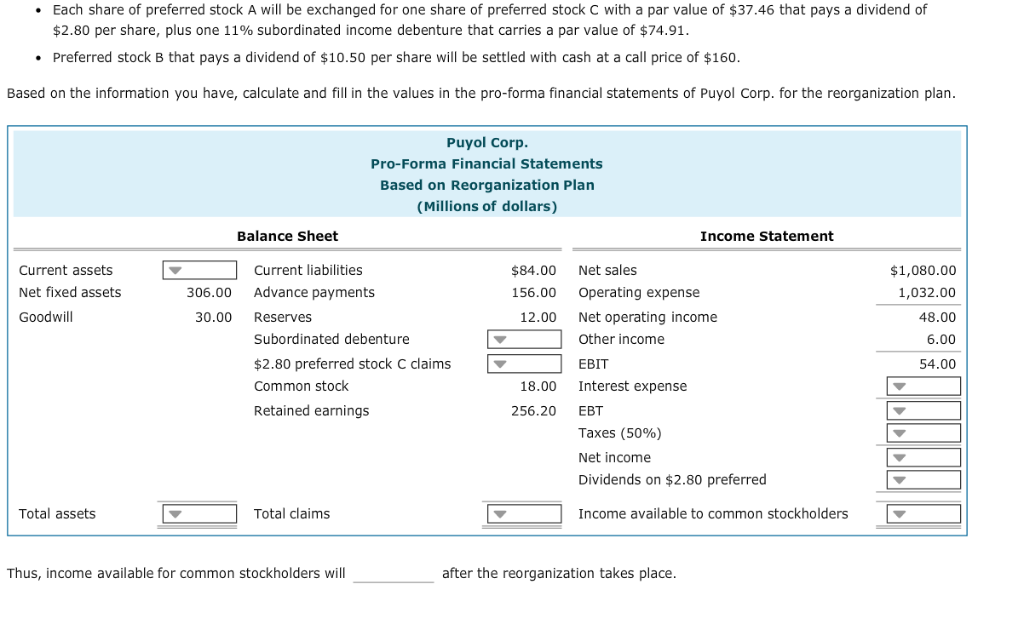

Question: Dropdown answers: 1. Current assets: 489, 359, 261, 326 2. Total assets: 662, 463, 597, 825 3. Subordinate debenture: 89, 116, 107, 44 4. $2.8

Dropdown answers:

1. Current assets: 489, 359, 261, 326

2. Total assets: 662, 463, 597, 825

3. Subordinate debenture: 89, 116, 107, 44

4. $2.8 preferred stock c claims: 31, 26, 44, 62

5. Total claims: 597, 463, 835, 661

6. Interest expense: 12, 9, 4, 11

7. EBT: 44, 41, 49, 42

8. Taxes (50%): 24, 21, 20,22

9. Net income:24, 21, 20,22

10. Dividends on 2.8 preferred: 32, 37, 75, 3

11. Income available to common stockholders: -17, 18, -7, 54

12. decrease or increase

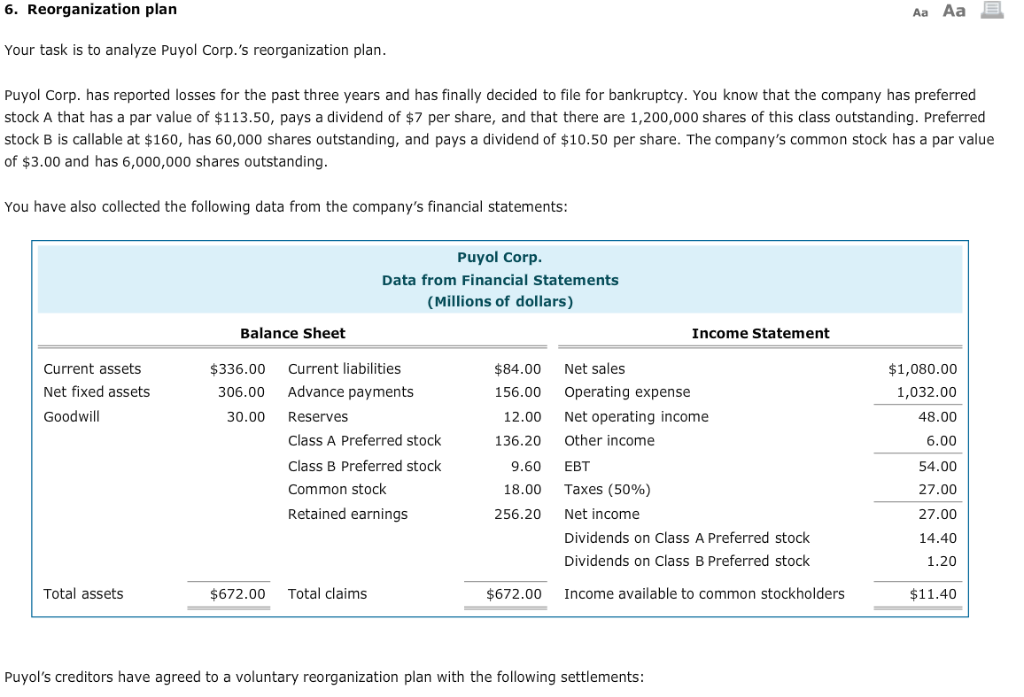

6. Reorganization plan Aa Aa Your task is to analyze Puyol Corp.'s reorganization plan. Puyol Corp. has reported losses for the past three years and has finally decided to file for bankruptcy. You know that the company has preferred stock A that has a par value of $113.50, pays a dividend of $7 per share, and that there are 1,200,000 shares of this class outstanding. Preferred stock B is callable at $160, has 60,000 shares outstanding, and pays a dividend of $10.50 per share. The company's common stock has a par value of $3.00 and has 6,000,000 shares outstanding. You have also collected the following data from the company's financial statements: Puyol Corp. Data from Financial Statements (Millions of dollars) Balance Sheet Income Statement Net sales Current assets Current liabilities $84.00 $1,080.00 $336.00 Net fixed assets Advance payments Operating expense 306.00 156.00 1,032.00 12.00 Goodwill 30.00 Net operating income Reserves 48.00 Class A Preferred stock Other income 136.20 6.00 Class B Preferred stock 9.60 EBT 54.00 18.00 Taxes (50%) Common stock 27.00 Retained earnings Net income 256.20 27.00 Dividends on Class A Preferred stock 14.40 Dividends on Class B Preferred stock 1.20 Total assets Total claims Income available to common stockholders $672.00 $672.00 $11.40 Puyol's creditors have agreed to voluntary reorganization plan with the following settlements: Each share of preferred stock A will be exchanged for one share of preferred stock C with a par value of $37.46 that pays a dividend of $2.80 per share, plus one 11% subordinated income debenture that carries a par value of $74.91. Preferred stock B that pays a dividend of $10.50 per share will be settled with cash at a call price of $160. Based on the information you have, calculate and fill in the values in the pro-forma financial statements of Puyol Corp. for the reorganization plan. Puyol Corp Pro-Forma Financial Statements Based on Reorganization Plan (Millions of dol la rs) Balance Sheet Income Statement Net sales Current assets Current liabilities $84.00 $1,080.00 Net fixed assets Advance payments Operating expense 1,032.00 306.00 156.00 Goodwill 30.00 12.00 Net operating income Reserves 48.00 Subordinated debenture Other income 6.00 $2.80 preferred stock C claims 54.00 EBIT Common stock Interest expense 18.00 Retained earnings 256.20 EBT Taxes (50%) Net income Dividends on $2.80 preferred Total assets Income available to common stockholders Total claims Thus, income available for common stockholders will after the reorganization takes place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts