Question: Dropdown boxes have gain or loss as an option. Please explain answer, thank you. Problem 20-46 (C) (LO. 6) Agipa, Reed, Sherry, and Erin form

Dropdown boxes have gain or loss as an option. Please explain answer, thank you.

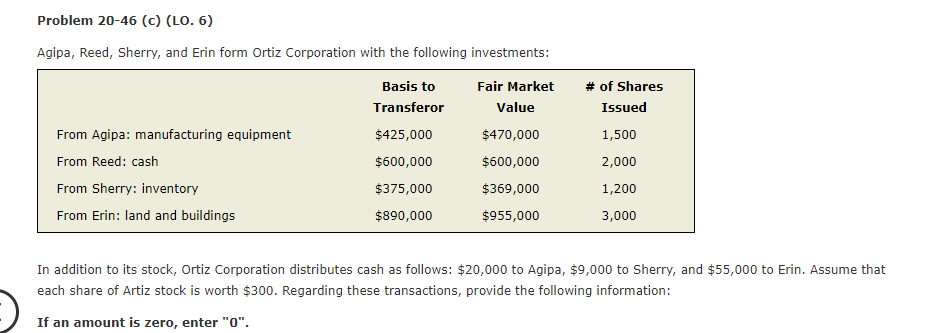

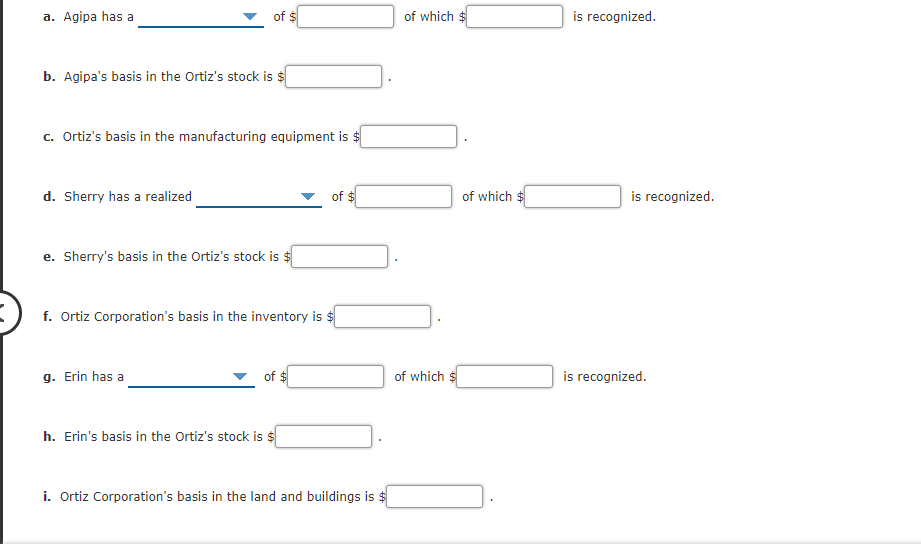

Problem 20-46 (C) (LO. 6) Agipa, Reed, Sherry, and Erin form Ortiz Corporation with the following investments: Fair Market Value # of Shares Issued $470,000 1,500 Basis to Transferor $425,000 $600,000 $375,000 $890,000 From Agipa: manufacturing equipment From Reed: cash From Sherry: inventory From Erin: land and buildings 2,000 $600,000 $369,000 $955,000 1,200 3,000 In addition to its stock, Ortiz Corporation distributes cash as follows: $20,000 to Agipa, $9,000 to Sherry, and $55,000 to Erin. Assume that each share of Artiz stock is worth $300. Regarding these transactions, provide the following information: If an amount is zero, enter "o". a. Agipa has a of $ of which $ is recognized b. Agipa's basis in the Ortiz's stock is $ c. Ortiz's basis in the manufacturing equipment is $ d. Sherry has a realized of $ of which $ is recognized. e. Sherry's basis in the Ortiz's stock is $ f. Ortiz Corporation's basis in the inventory is $ g. Erin has a of $ of which is recognized h. Erin's basis in the Ortiz's stock is $ i. Ortiz Corporation's basis in the land and buildings is $ Problem 20-46 (C) (LO. 6) Agipa, Reed, Sherry, and Erin form Ortiz Corporation with the following investments: Fair Market Value # of Shares Issued $470,000 1,500 Basis to Transferor $425,000 $600,000 $375,000 $890,000 From Agipa: manufacturing equipment From Reed: cash From Sherry: inventory From Erin: land and buildings 2,000 $600,000 $369,000 $955,000 1,200 3,000 In addition to its stock, Ortiz Corporation distributes cash as follows: $20,000 to Agipa, $9,000 to Sherry, and $55,000 to Erin. Assume that each share of Artiz stock is worth $300. Regarding these transactions, provide the following information: If an amount is zero, enter "o". a. Agipa has a of $ of which $ is recognized b. Agipa's basis in the Ortiz's stock is $ c. Ortiz's basis in the manufacturing equipment is $ d. Sherry has a realized of $ of which $ is recognized. e. Sherry's basis in the Ortiz's stock is $ f. Ortiz Corporation's basis in the inventory is $ g. Erin has a of $ of which is recognized h. Erin's basis in the Ortiz's stock is $ i. Ortiz Corporation's basis in the land and buildings is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts