Question: Drop-down option one: mortgage points, down payment Drop-down option two: mortgage points, loan origination fee Drop-down down option three: credit report fee, appraisal and survey

Drop-down option one: mortgage points, down payment

Drop-down option two: mortgage points, loan origination fee

Drop-down down option three: credit report fee, appraisal and survey fees

Drop-down option four: loan origination fee, a home termite and radon inspections

Drop-down option five: Title insurance bank policy, appraisal and survey fees

Drop-down option six: attorney fees, lot survey fee

Drop down option seven: title search and deed recording fee, home termite and radon inspections

Drop down option eight: Messenger and document fees, title search and deed recording fee

Drop down option nine: messenger and document fees, title insurance Dash homeowner policy

Drop-down option 10: title insurance bank policy, attorney fees

Drop-down option 11: loan payments(p&i), title insurance homeowner policy

Drop-down option 12: warranty insurance policy, loan payments(p&i)

Drop-down option 13: notary fee, mortgage insurance policy

Drop-down option 14: property taxes, warrantee insurance policy

Dropdown option 15:property taxes, homeowners insurance policy

Drop-down option 16: Less: amount owed by seller, homeowners insurance policy

Drop-down options 17: total costs, subtotal

Drop down option 18:property taxes, less: amount owed by seller

Drop-down option 19: total costs, subtotal

Drop down option 20: 19.84%, 51.78%

Drop-down option 21:59.40%, 18.97%

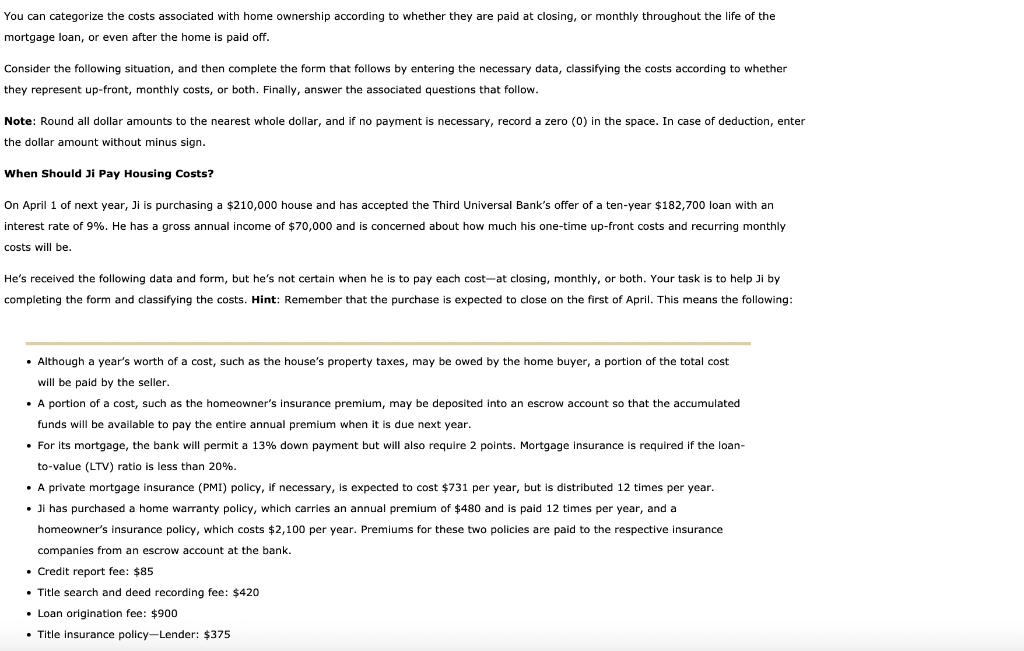

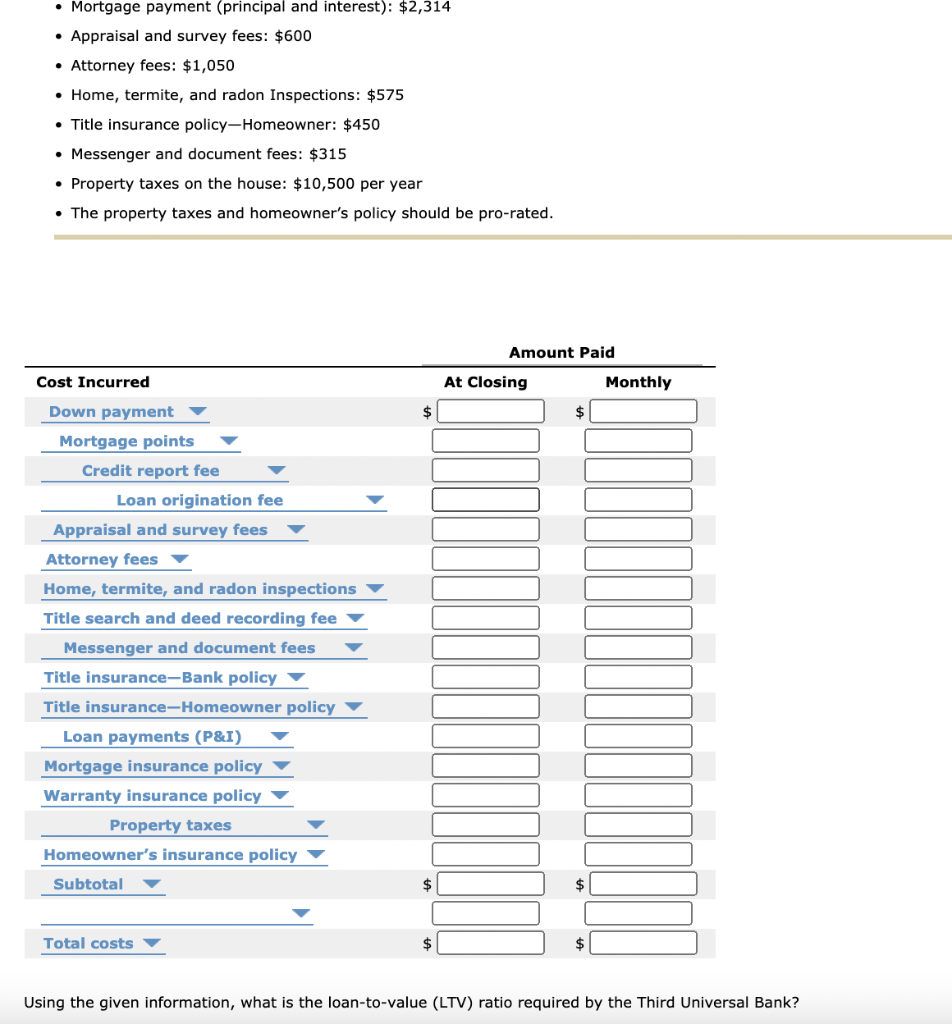

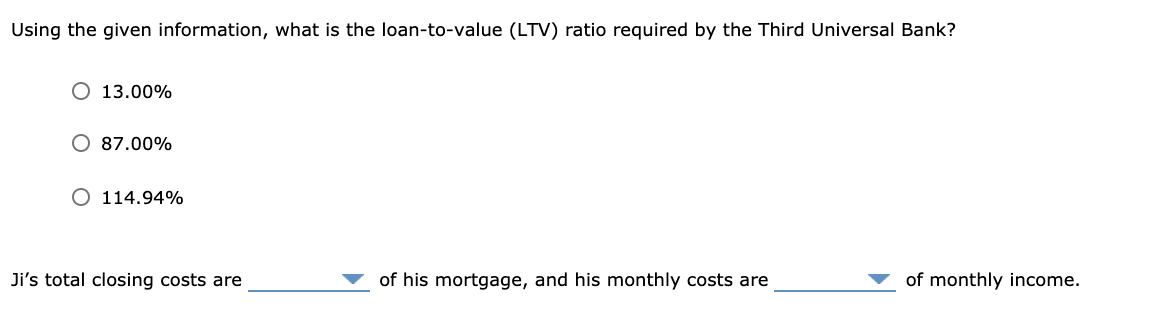

You can categorize the costs associated with home ownership according to whether they are paid at closing, or monthly throughout the life of the mortgage loan, or even after the home is paid off. Consider the following situation, and then complete the form that follows by entering the necessary data, classifying the costs according to whether they represent up-front, monthly costs, or both. Finally, answer the associated questions that follow. Note: Round all dollar amounts to the nearest whole dollar, and if no payment is necessary, record a zero (0) in the space. In case of deduction, enter the dollar amount without minus sign. When Should Ji Pay Housing Costs? On April 1 of next year, Ji is purchasing a $210,000 house and has accepted the Third Universal Bank's offer of a ten-year $182,700 loan with an interest rate of 9%. He has a gross annual income of $70,000 and is concerned about how much his one-time up-front costs and recurring monthly costs will be. He's received the following data and form, but he's not certain when he is to pay each cost-at closing, monthly, or both. Your task is to help Ji by completing the form and classifying the costs. Hint: Remember that the purchase is expected to close on the first of April. This means the following: . Although a year's worth of a cost, such as the house's property taxes, may be owed by the home buyer, portion of the total cost will be paid by the seller. A portion of a cost, such as the homeowner's insurance premium, may be deposited into an escrow account so that the accumulated funds will be available to pay the entire annual premium when it is due next year. For its mortgage, the bank will permit a 13% down payment but will also require 2 points. Mortgage insurance is required if the loan- to-value (LTV) ratio is less than 20%. A private mortgage insurance (PMI) policy, if necessary, is expected to cost $731 per year, but is distributed 12 times per year. Ji has purchased a home warranty policy, which carries an annual premium of $480 and is paid 12 times per year, and a homeowner's insurance policy, which costs $2,100 per year. Premiums for these two policies are paid to the respective insurance companies from an escrow account at the bank. Credit report fee: $85 Title search and deed recording fee: $420 Loan origination fee: $900 Title insurance policy-Lender: $375 Mortgage payment (principal and interest): $2,314 Appraisal and survey fees: $600 Attorney fees: $1,050 Home, termite, and radon Inspections: $575 Title insurance policy-Homeowner: $450 Messenger and document fees: $315 Property taxes on the house: $10,500 per year The property taxes and homeowner's policy should be pro-rated. Amount Paid Cost Incurred At Closing Monthly Down payment $ $ Mortgage points Credit report fee Loan origination fee Appraisal and survey fees Attorney fees Home, termite, and radon inspections Title search and deed recording fee Messenger and document fees Title insurance-Bank policy Title insurance-Homeowner policy Loan payments (P&I) Mortgage insurance policy Warranty insurance policy Property taxes Homeowner's insurance policy Subtotal $ $ Total costs $ Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? O 13.00% 0 87.00% O 114.94% Ji's total closing costs are of his mortgage, and his monthly costs are of monthly income. You can categorize the costs associated with home ownership according to whether they are paid at closing, or monthly throughout the life of the mortgage loan, or even after the home is paid off. Consider the following situation, and then complete the form that follows by entering the necessary data, classifying the costs according to whether they represent up-front, monthly costs, or both. Finally, answer the associated questions that follow. Note: Round all dollar amounts to the nearest whole dollar, and if no payment is necessary, record a zero (0) in the space. In case of deduction, enter the dollar amount without minus sign. When Should Ji Pay Housing Costs? On April 1 of next year, Ji is purchasing a $210,000 house and has accepted the Third Universal Bank's offer of a ten-year $182,700 loan with an interest rate of 9%. He has a gross annual income of $70,000 and is concerned about how much his one-time up-front costs and recurring monthly costs will be. He's received the following data and form, but he's not certain when he is to pay each cost-at closing, monthly, or both. Your task is to help Ji by completing the form and classifying the costs. Hint: Remember that the purchase is expected to close on the first of April. This means the following: . Although a year's worth of a cost, such as the house's property taxes, may be owed by the home buyer, portion of the total cost will be paid by the seller. A portion of a cost, such as the homeowner's insurance premium, may be deposited into an escrow account so that the accumulated funds will be available to pay the entire annual premium when it is due next year. For its mortgage, the bank will permit a 13% down payment but will also require 2 points. Mortgage insurance is required if the loan- to-value (LTV) ratio is less than 20%. A private mortgage insurance (PMI) policy, if necessary, is expected to cost $731 per year, but is distributed 12 times per year. Ji has purchased a home warranty policy, which carries an annual premium of $480 and is paid 12 times per year, and a homeowner's insurance policy, which costs $2,100 per year. Premiums for these two policies are paid to the respective insurance companies from an escrow account at the bank. Credit report fee: $85 Title search and deed recording fee: $420 Loan origination fee: $900 Title insurance policy-Lender: $375 Mortgage payment (principal and interest): $2,314 Appraisal and survey fees: $600 Attorney fees: $1,050 Home, termite, and radon Inspections: $575 Title insurance policy-Homeowner: $450 Messenger and document fees: $315 Property taxes on the house: $10,500 per year The property taxes and homeowner's policy should be pro-rated. Amount Paid Cost Incurred At Closing Monthly Down payment $ $ Mortgage points Credit report fee Loan origination fee Appraisal and survey fees Attorney fees Home, termite, and radon inspections Title search and deed recording fee Messenger and document fees Title insurance-Bank policy Title insurance-Homeowner policy Loan payments (P&I) Mortgage insurance policy Warranty insurance policy Property taxes Homeowner's insurance policy Subtotal $ $ Total costs $ Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? Using the given information, what is the loan-to-value (LTV) ratio required by the Third Universal Bank? O 13.00% 0 87.00% O 114.94% Ji's total closing costs are of his mortgage, and his monthly costs are of monthly income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts