Question: Due Date: November 2 3 , 2 0 2 4 ( Saturday ) 1 1 : 5 9 p . m . through BB Q

Due Date: November Saturday: pm through BB

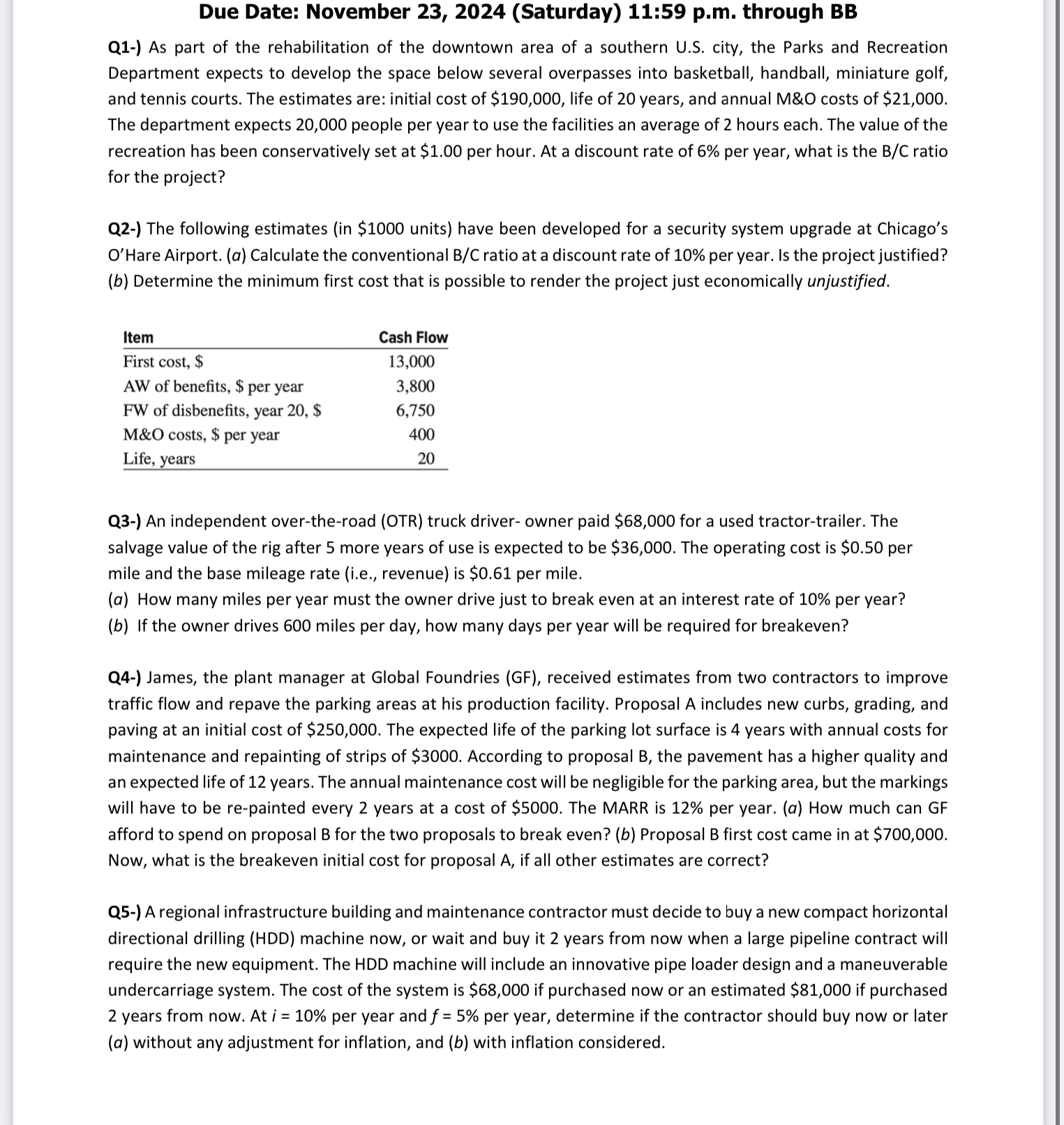

Q As part of the rehabilitation of the downtown area of a southern US city, the Parks and Recreation Department expects to develop the space below several overpasses into basketball, handball, miniature golf, and tennis courts. The estimates are: initial cost of $ life of years, and annual M&O costs of $ The department expects people per year to use the facilities an average of hours each. The value of the recreation has been conservatively set at $ per hour. At a discount rate of per year, what is the ratio for the project?

Q The following estimates in $ units have been developed for a security system upgrade at Chicago's O'Hare Airport. a Calculate the conventional BC ratio at a discount rate of per year. Is the project justified? b Determine the minimum first cost that is possible to render the project just economically unjustified.

tableItemCash FlowFirst cost $AW of benefits, $ per year,FW of disbenefits, year $M&O costs, $ per year,Life years,

Q An independent overtheroad OTR truck driver owner paid $ for a used tractortrailer. The salvage value of the rig after more years of use is expected to be $ The operating cost is $ per mile and the base mileage rate ie revenue is $ per mile.

a How many miles per year must the owner drive just to break even at an interest rate of per year?

b If the owner drives miles per day, how many days per year will be required for breakeven?

Q James, the plant manager at Global Foundries GF received estimates from two contractors to improve traffic flow and repave the parking areas at his production facility. Proposal A includes new curbs, grading, and paving at an initial cost of $ The expected life of the parking lot surface is years with annual costs for maintenance and repainting of strips of $ According to proposal B the pavement has a higher quality and an expected life of years. The annual maintenance cost will be negligible for the parking area, but the markings will have to be repainted every years at a cost of $ The MARR is per year. a How much can GF afford to spend on proposal B for the two proposals to break even? b Proposal B first cost came in at $ Now, what is the breakeven initial cost for proposal A if all other estimates are correct?

Q A regional infrastructure building and maintenance contractor must decide to buy a new compact horizontal directional drilling HDD machine now, or wait and buy it years from now when a large pipeline contract will require the new equipment. The HDD machine will include an innovative pipe loader design and a maneuverable undercarriage system. The cost of the system is $ if purchased now or an estimated $ if purchased years from now. At per year and per year, determine if the contractor should buy now or later a without any adjustment for inflation, and b with inflation considered.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock