Question: Due Wednesday by 11:59pm Points 10 Submitting a file upload Assume that the following Comparable Sales for office properties are observed Comparable A: Sales Price

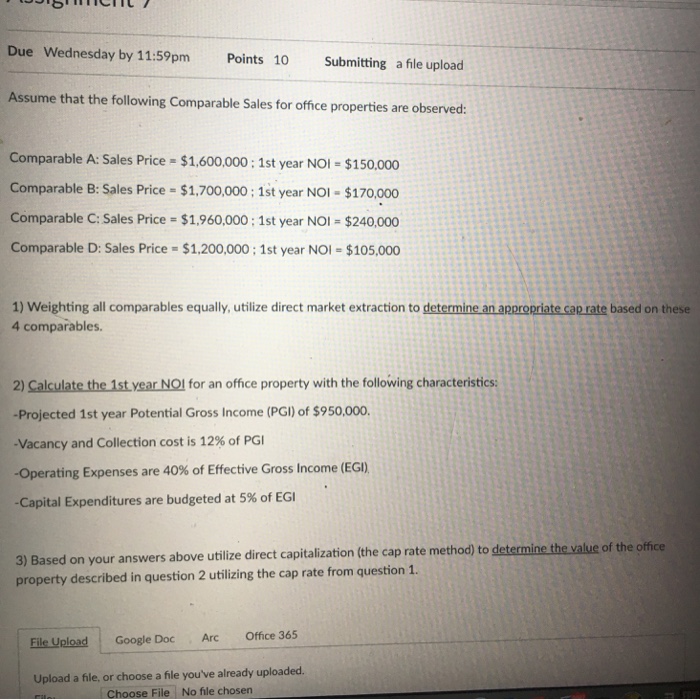

Due Wednesday by 11:59pm Points 10 Submitting a file upload Assume that the following Comparable Sales for office properties are observed Comparable A: Sales Price $1,600,000: 1st year NOI $150.000 Comparable B: Sales Price-$1,700,000; 1st year NOI-$170,000 Comparable C: Sales Price $1,960,000 1st year NOI $240,000 Comparable D: Sales Price $1,200,000; 1st year NOI- $105,000 1) Weighting all comparables equally, utilize direct market extraction to determine an appropriate cap rate based on these 4 comparables. 2) Calculate the 1st year NQl for an office property with the following characteristics -Projected 1st year Potential Gross Income (PGI) of $950,000. -Vacancy and Collection cost is 12% of PGI -Operating Expenses are 40% of Effective Gross Income (EGI -Capital Expenditures are budgeted at 5% of EGI 3) Based on your answers above utilize direct capitalization the cap rate method) to determine th property described in question 2 utilizing the cap rate from question 1. e value of the office Eile Upload Google Doc Arc Office 365 Upload a file, or choose a file you've already uploaded. File No file chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts