Question: During 2 0 2 3 , Kory, a 4 0 - year - old single taxpayer, reports the following items of income and expense: View

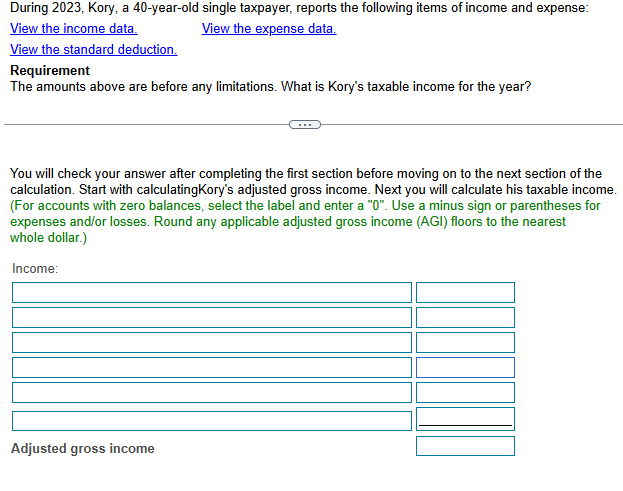

During Kory, a yearold single taxpayer, reports the following items of income and expense: View the income data. View the expense data. View the standard deduction. Requirement The amounts above are before any limitations What is Kory's taxable income for the year? You will check your answer after completing the first section before moving on to the next section of the calculation. Start with calculatingKory's adjusted gross income. Next you will calculate his taxable income. For accounts with zero balances, select the label and enter a Use a minus sign or parentheses for expenses andor losses. Round any applicable adjusted gross income AGI floors to the nearest whole dollar. Income: Adjusted gross income Income Expenses begintabularlrr

hline multicolumnc Filing Status & begintabularc

Standard

Deduction

endtabular

hline Married individuals filing joint returns and surviving spouses & $ &

hline Heads of households & $ &

hline Unmarried individuals other than surviving spouses and heads of households & $ &

hline Married individuals filing separate returns & $ &

hline Additional standard deduction for the aged and the blind; Individual who is married and & $

surviving spouses & $

hline Additional standard deduction for the aged and the blind; Individual who is unmarried and not a

surviving spouse &

hline Taxpayer claimed as dependent on another taxpayer's return: Greater of earned income plus $ or

hline mathbf$

endtabular

These amounts are $ and $ respectively, for a taxpayer who is both aged and blind.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock