Question: During 2 0 2 4 , Jackson, a single taxpayer, had the following capital gains and losses: Gain from the sale of coin collection (

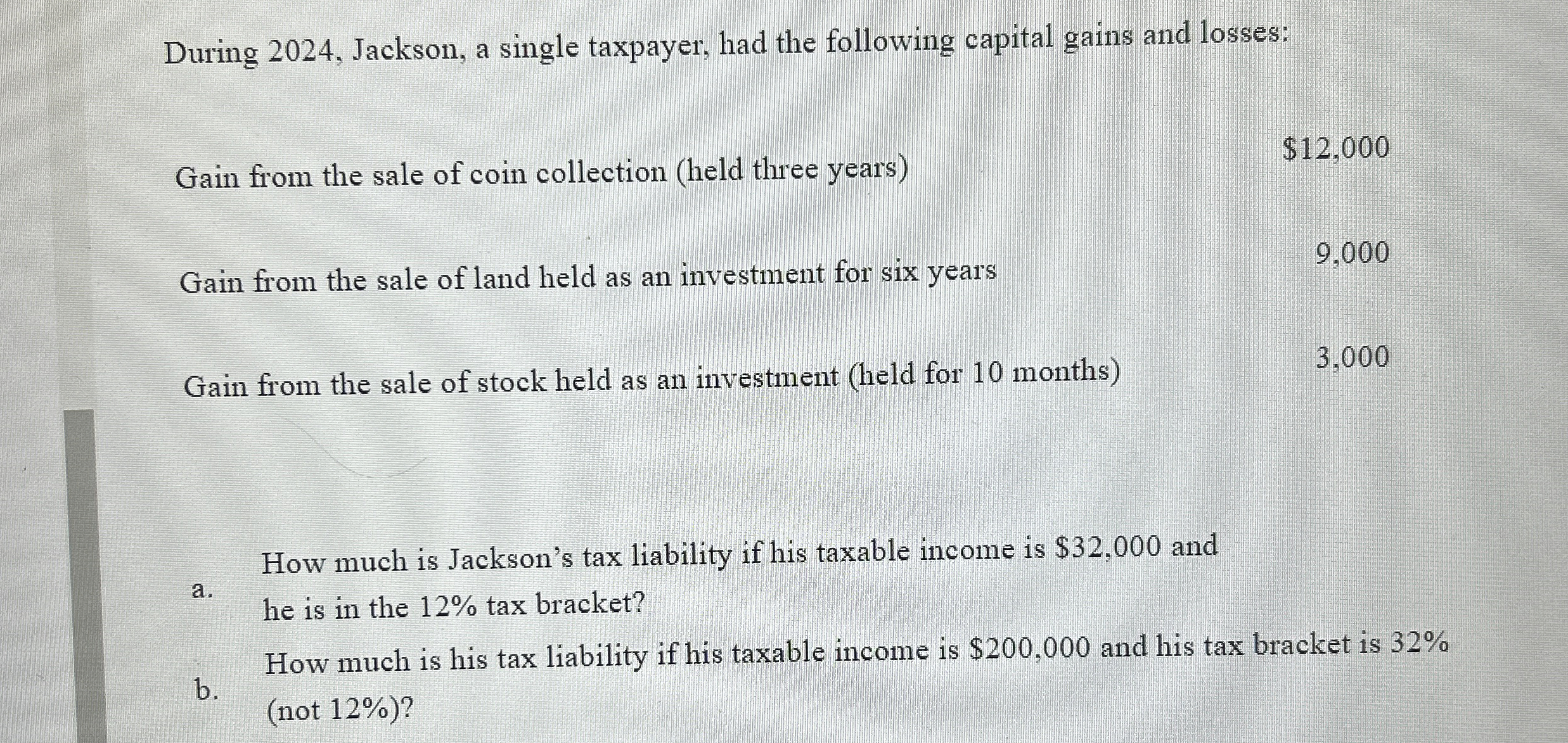

During Jackson, a single taxpayer, had the following capital gains and losses:

Gain from the sale of coin collection held three years

Gain from the sale of land held as an investment for six years

Gain from the sale of stock held as an investment held for months

How much is Jackson's tax liability if his taxable income is $ and

a

he is in the tax bracket?

How much is his tax liability if his taxable income is $ and his tax bracket is

b

not

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock