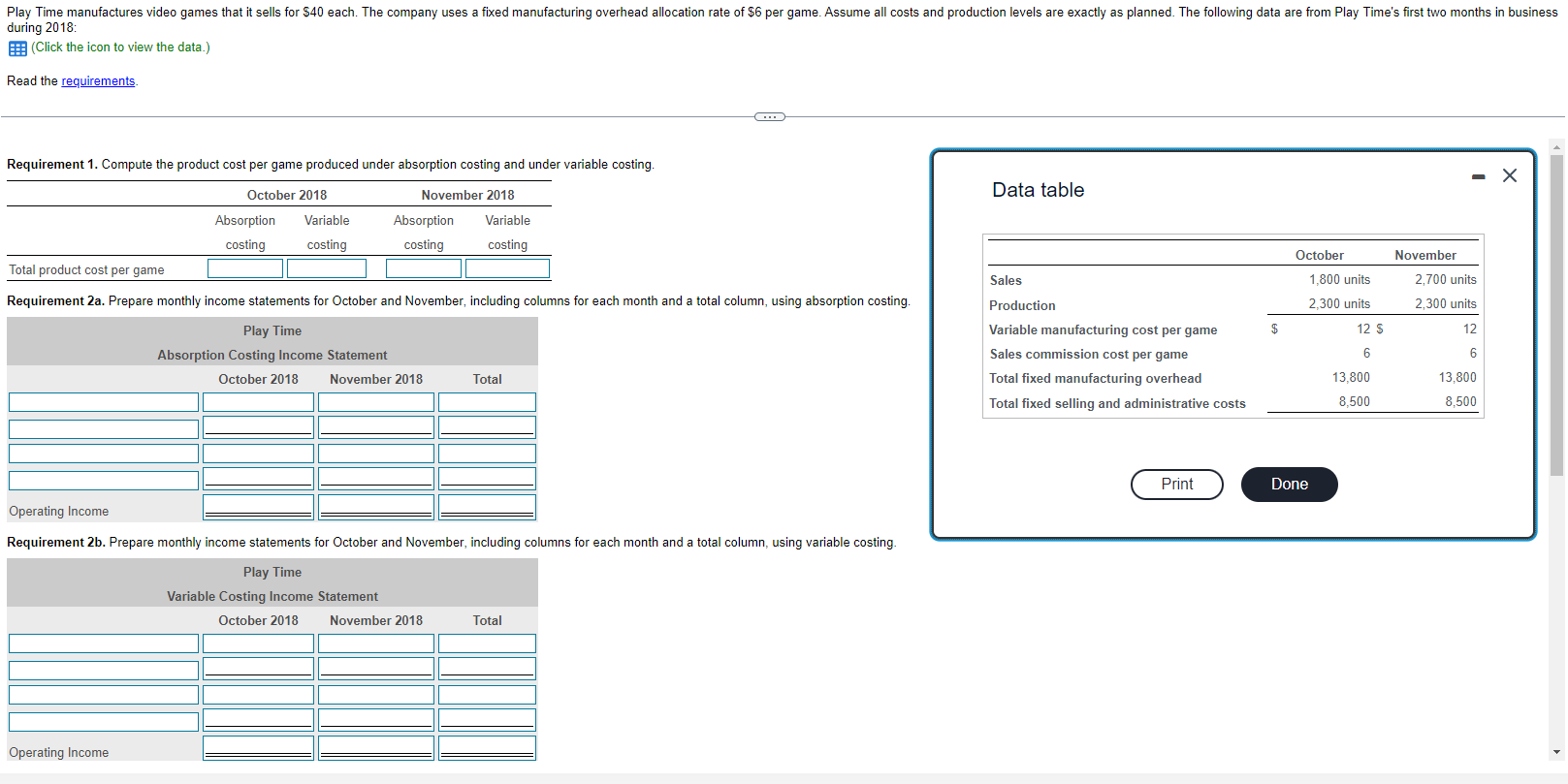

Question: during 2018: (Click the icon to view the data.) Read the Requirement 1. Compute the product cost per game produced under absorption costing and under

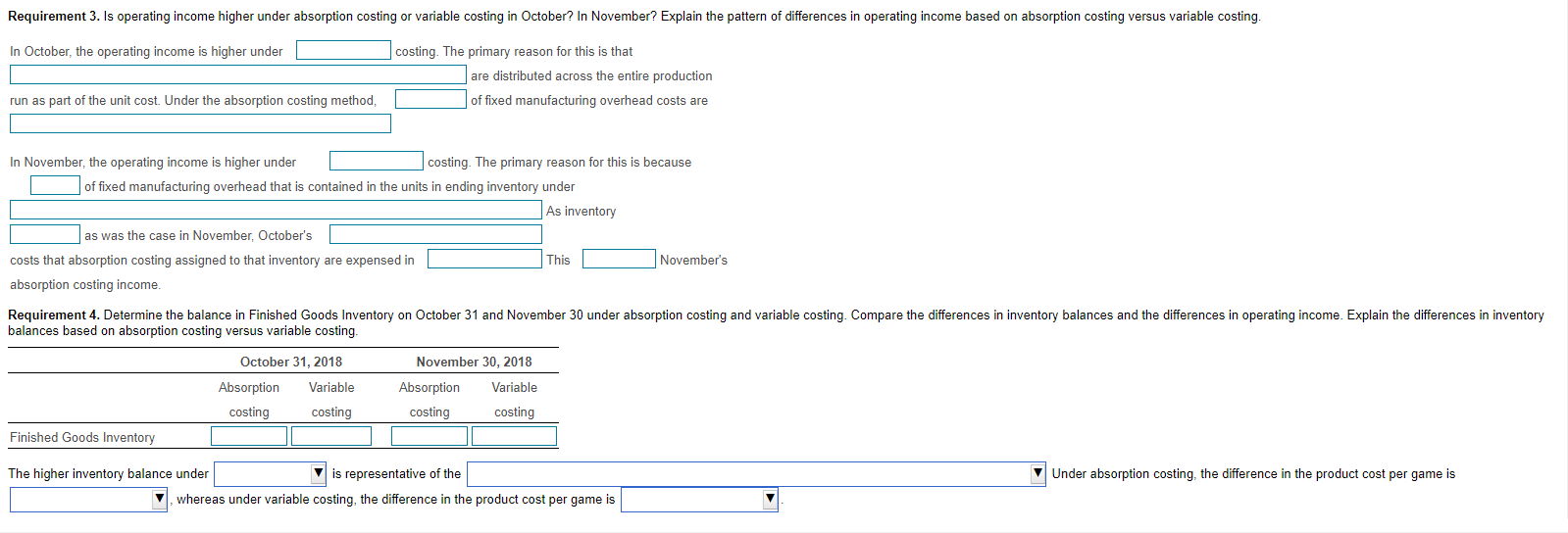

during 2018: (Click the icon to view the data.) Read the Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing. Data table Requirement 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing. In October, the operating income is higher under costing. The primary reason for this is that run as part of the unit cost. Under the absorption costing method, are distributed across the entire production of fixed manufacturing overhead costs are In November, the operating income is higher under costing. The primary reason for this is because of fixed manufacturing overhead that is contained in the units in ending inventory under as was the case in November, October's costs that absorption costing assigned to that inventory are expensed in This November's absorption costing income. balances based on absorption costing versus variable costing. The higher inventory balance under is representative of the Under absorption costing, the difference in the product cost per game is whereas under variable costing, the difference in the product cost per game is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts