Question: During the current year, DEF Partnership (owned equally by D, E and F) had $150,000 ordinary business revenues, a $3,000 capital loss, $80,000 ordinary

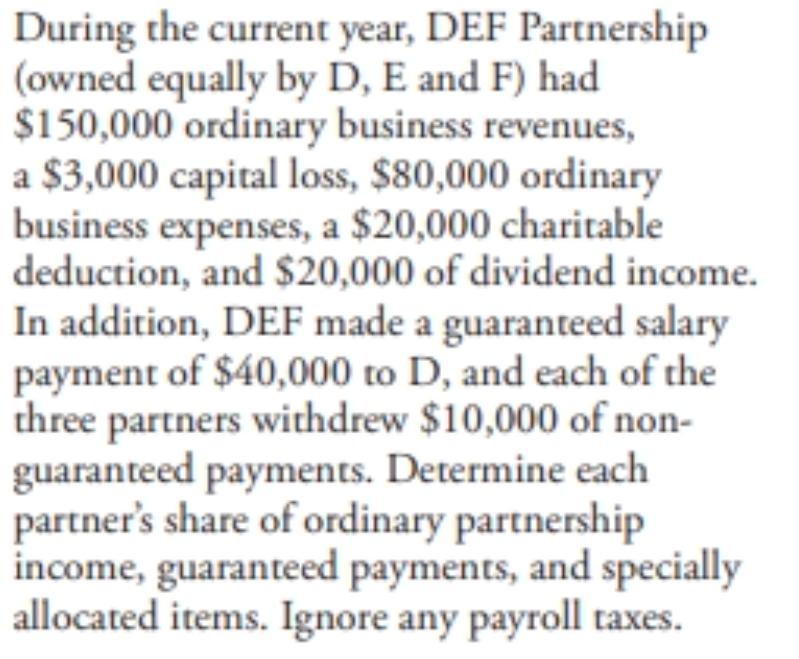

During the current year, DEF Partnership (owned equally by D, E and F) had $150,000 ordinary business revenues, a $3,000 capital loss, $80,000 ordinary business expenses, a $20,000 charitable deduction, and $20,000 of dividend income. In addition, DEF made a guaranteed salary payment of $40,000 to D, and each of the three partners withdrew $10,000 of non- guaranteed payments. Determine each partner's share of ordinary partnership income, guaranteed payments, and specially allocated items. Ignore any payroll taxes.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Answer In the absence of Profit share ratio it is ... View full answer

Get step-by-step solutions from verified subject matter experts