Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, the Town of Mashpee had a number of transactions that affected net position of its town golf course, which is

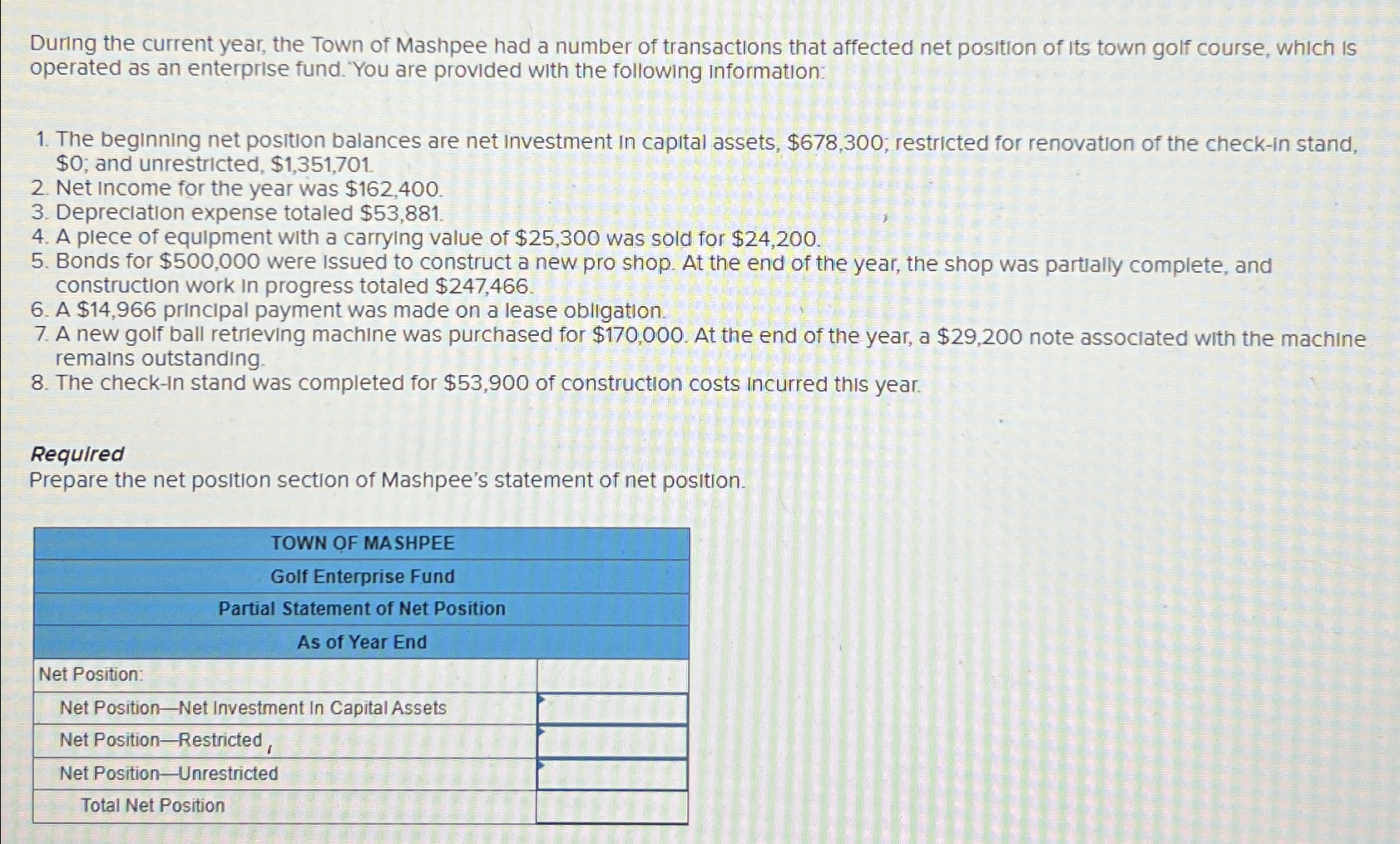

During the current year, the Town of Mashpee had a number of transactions that affected net position of its town golf course, which is operated as an enterprise fund. "You are provided with the following Information: 1. The beginning net position balances are net Investment in capital assets, $678,300; restricted for renovation of the check-in stand, $0; and unrestricted, $1,351,701. 2. Net Income for the year was $162,400. 3. Depreciation expense totaled $53,881. 4. A plece of equipment with a carrying value of $25,300 was sold for $24,200. 5. Bonds for $500,000 were Issued to construct a new pro shop. At the end of the year, the shop was partially complete, and construction work in progress totaled $247,466. 6. A $14,966 principal payment was made on a lease obligation. 7. A new golf ball retrieving machine was purchased for $170,000. At the end of the year, a $29,200 note associated with the machine remains outstanding. 8. The check-in stand was completed for $53,900 of construction costs incurred this year. Required Prepare the net position section of Mashpee's statement of net position. TOWN OF MASHPEE Golf Enterprise Fund Partial Statement of Net Position As of Year End Net Position: Net Position-Net Investment In Capital Assets Net Position-Restricted, Net Position-Unrestricted Total Net Position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the net position section of Mashpees statement of net position we need to calculate the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663de08eaf082_961443.pdf

180 KBs PDF File

663de08eaf082_961443.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started