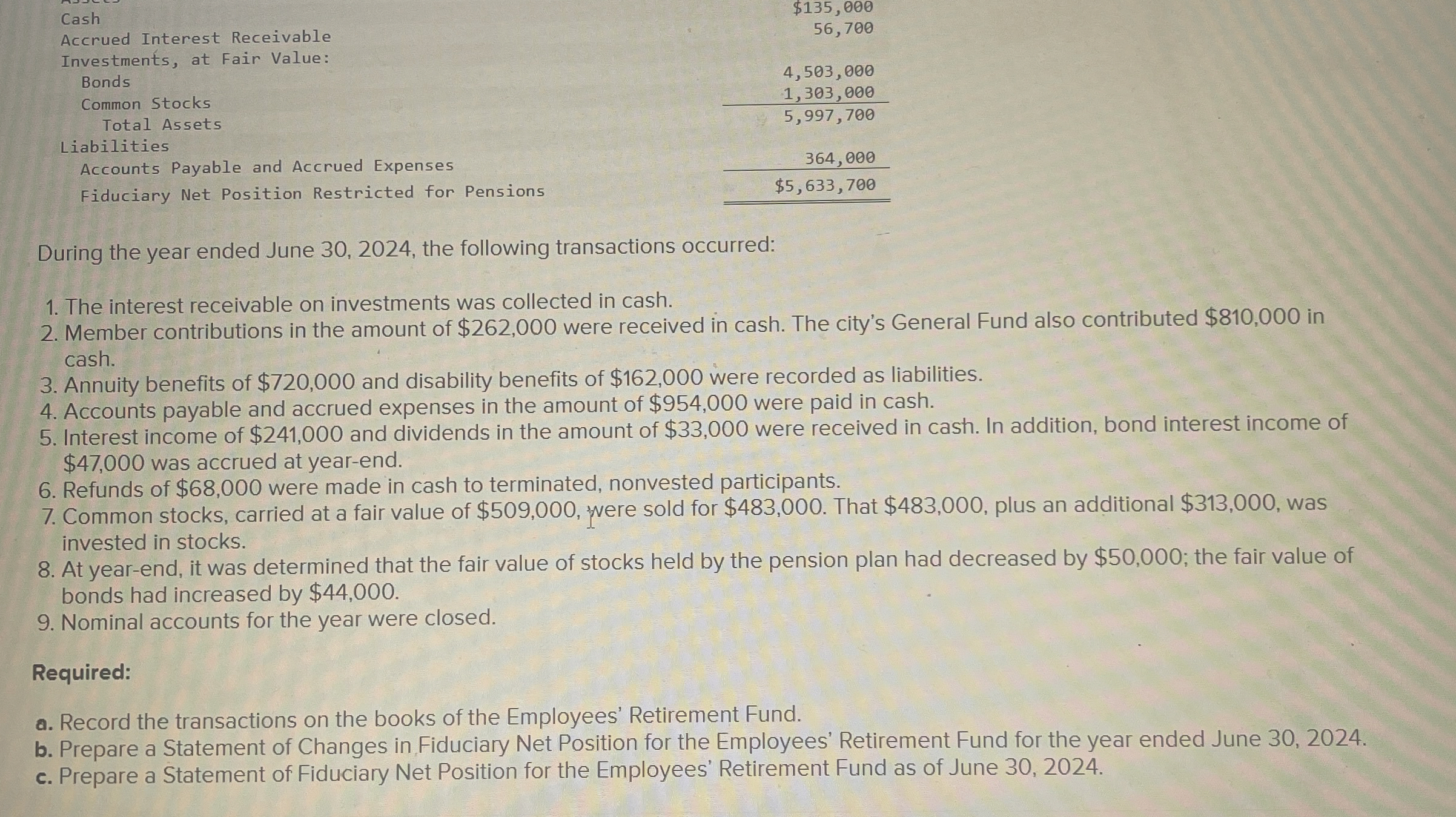

Question: During the year ended June 3 0 , 2 0 2 4 , the following transactions occurred: The interest receivable on investments was collected in

During the year ended June the following transactions occurred:

The interest receivable on investments was collected in cash.

Member contributions in the amount of $ were received in cash. The city's General Fund also contributed $ in

cash.

Annuity benefits of $ and disability benefits of $ were recorded as liabilities.

Accounts payable and accrued expenses in the amount of $ were paid in cash.

Interest income of $ and dividends in the amount of $ were received in cash. In addition, bond interest income of

$ was accrued at yearend.

Refunds of $ were made in cash to terminated, nonvested participants.

Common stocks, carried at a fair value of $ were sold for $ That $ plus an additional $ was

invested in stocks.

At yearend, it was determined that the fair value of stocks held by the pension plan had decreased by $; the fair value of

bonds had increased by $

Nominal accounts for the year were closed.

Required:

a Record the transactions on the books of the Employees' Retirement Fund.

b Prepare a Statement of Changes in Fiduciary Net Position for the Employees' Retirement Fund for the year ended June

c Prepare a Statement of Fiduciary Net Position for the Employees' Retirement Fund as of June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock