Question: The spread calculated in class is the first table below. Problem 3. (2 points) This problem builds on the example in Lecture 19, where we

The spread calculated in class is the first table below.

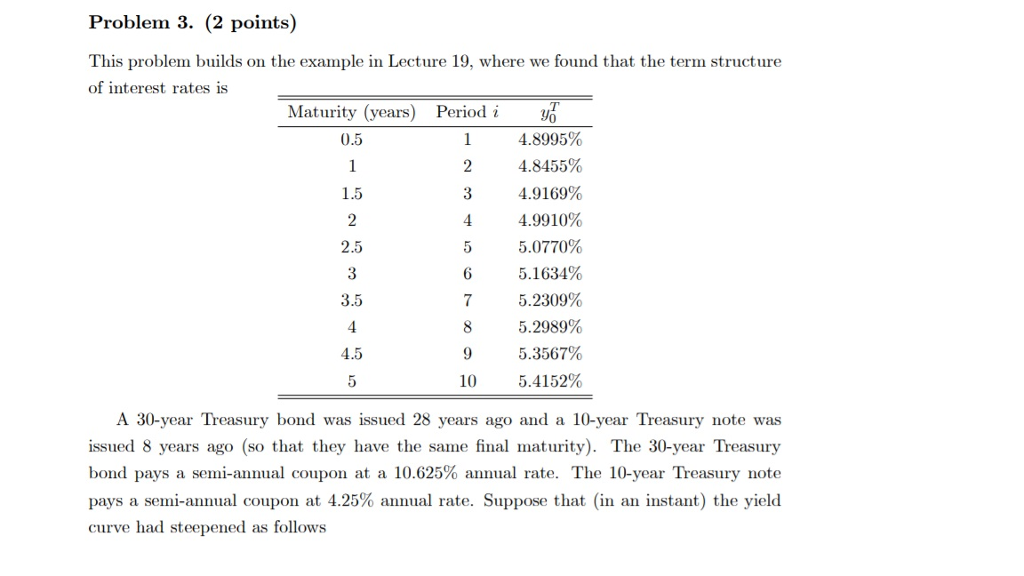

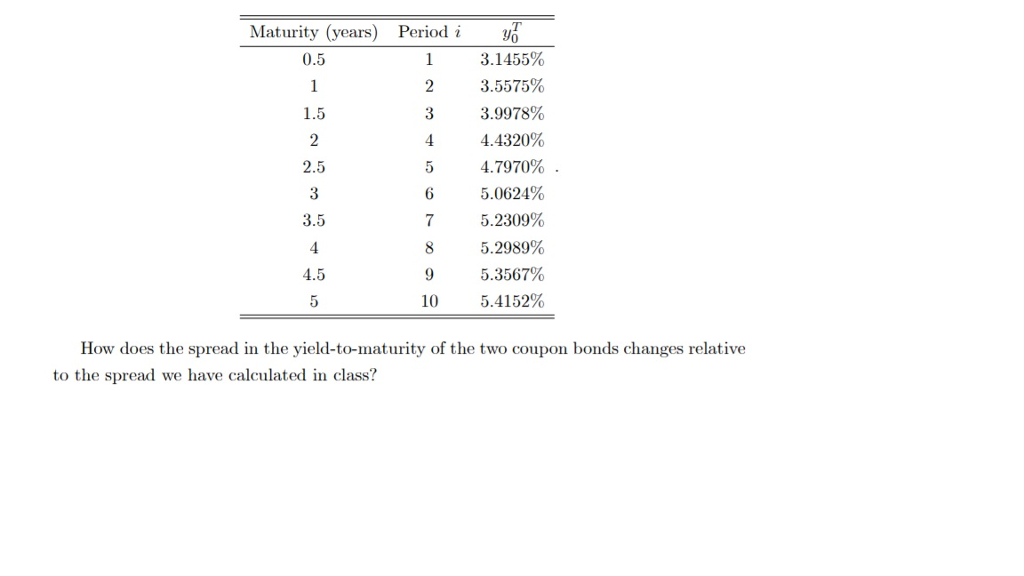

Problem 3. (2 points) This problem builds on the example in Lecture 19, where we found that the term structure of interest rates is Maturity (years) Period i yT 0 0:5 1 4:8995% 1 2 4:8455% 1:5 3 4:9169% 2 4 4:9910% 2:5 5 5:0770% 3 6 5:1634% 3:5 7 5:2309% 4 8 5:2989% 4:5 9 5:3567% 5 10 5:4152% A 30-year Treasury bond was issued 28 years ago and a 10-year Treasury note was issued 8 years ago (so that they have the same nal maturity). The 30-year Treasury bond pays a semi-annual coupon at a 10.625% annual rate. The 10-year Treasury note pays a semi-annual coupon at 4.25% annual rate. Suppose that (in an instant) the yield curve had steepened as follows Maturity (years) Period i yT 0 0:5 1 3:1455% 1 2 3:5575% 1:5 3 3:9978% 2 4 4:4320% 2:5 5 4:7970% 3 6 5:0624% 3:5 7 5:2309% 4 8 5:2989% 4:5 9 5:3567% 5 10 5:4152% : How does the spread in the yield-to-maturity of the two coupon bonds changes relative to the spread we have calculated in class?

Problem 3. (2 points) This problem builds on the example in Lecture 19, where we found that the term structure of interest rates is Maturity (years) Periodi 0.5 4.8995% 4.8455% 4.9169% 4.9910% 5.0770% 5.1634% 5.2309% 5.2989% 5.3567% 5.4152% 1.5 2.5 6 3.5 4.5 10 A 30-year Treasury bond was issued 28 years ago and a 10-year Treasury note was issued 8 years ago (so that they have the same final maturity). The 30-year Treasury bond pays a semi-annual coupon at a 10.625% annual rate. The 10-year Treasury note pays a semi-annual coupon at 4.25% annual rate. Suppose that (in an instant) the yield curve had steepened as follows Problem 3. (2 points) This problem builds on the example in Lecture 19, where we found that the term structure of interest rates is Maturity (years) Periodi 0.5 4.8995% 4.8455% 4.9169% 4.9910% 5.0770% 5.1634% 5.2309% 5.2989% 5.3567% 5.4152% 1.5 2.5 6 3.5 4.5 10 A 30-year Treasury bond was issued 28 years ago and a 10-year Treasury note was issued 8 years ago (so that they have the same final maturity). The 30-year Treasury bond pays a semi-annual coupon at a 10.625% annual rate. The 10-year Treasury note pays a semi-annual coupon at 4.25% annual rate. Suppose that (in an instant) the yield curve had steepened as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts