Question: DVR, Inc. can borrow dollars for five years at a coupon rate of 2.75 percent. Alternatively, it can borrow yen for five years at a

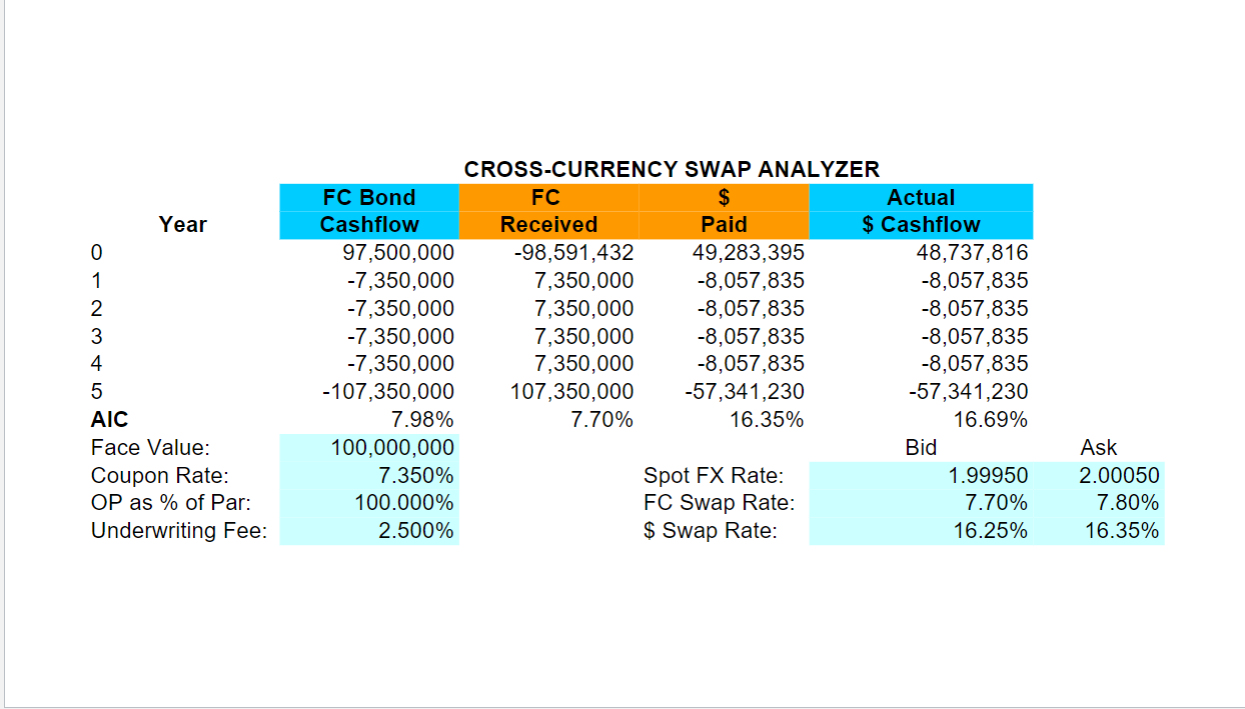

DVR, Inc. can borrow dollars for five years at a coupon rate of 2.75 percent. Alternatively, it can borrow yen for five years at a rate of .85 percent. The five-year yen swap rates are .64--.70 percent and the dollar swap rates are 2.41--2.44 percent. The current /$ exchange rate is 87.575. Determine the dollar AIC and the dollar cash flow that DVR would have to pay under a currency swap where it borrows 1,750,000,000 and swaps the debt service into dollars.

I added a worksheet. CURSWAP (2).xls

Download CURSWAP (2).xls

Year 5 AIC Face Value: Coupon Rate: OP as % of Par: Underwriting Fee: 1 AW NO 1 2 3 4 FC Bond Cashflow 97,500,000 -7,350,000 -7,350,000 -7,350,000 -7,350,000 -107,350,000 7.98% 100,000,000 7.350% 100.000% 2.500% CROSS-CURRENCY SWAP ANALYZER FC $ Received Paid -98,591,432 49,283,395 7,350,000 -8,057,835 7,350,000 -8,057,835 7,350,000 -8,057,835 7,350,000 -8,057,835 107,350,000 -57,341,230 7.70% 16.35% Spot FX Rate: FC Swap Rate: $ Swap Rate: Actual $ Cashflow 48,737,816 -8,057,835 -8,057,835 -8,057,835 -8,057,835 -57,341,230 16.69% Bid 1.99950 7.70% 16.25% Ask 2.00050 7.80% 16.35% Year 5 AIC Face Value: Coupon Rate: OP as % of Par: Underwriting Fee: 1 AW NO 1 2 3 4 FC Bond Cashflow 97,500,000 -7,350,000 -7,350,000 -7,350,000 -7,350,000 -107,350,000 7.98% 100,000,000 7.350% 100.000% 2.500% CROSS-CURRENCY SWAP ANALYZER FC $ Received Paid -98,591,432 49,283,395 7,350,000 -8,057,835 7,350,000 -8,057,835 7,350,000 -8,057,835 7,350,000 -8,057,835 107,350,000 -57,341,230 7.70% 16.35% Spot FX Rate: FC Swap Rate: $ Swap Rate: Actual $ Cashflow 48,737,816 -8,057,835 -8,057,835 -8,057,835 -8,057,835 -57,341,230 16.69% Bid 1.99950 7.70% 16.25% Ask 2.00050 7.80% 16.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts