Question: Dynamic Capital Structures and Corporate Valuation Graded Assignment | Read Chapter 21 | Back to Assignment Due Thursday 05.10.18 at 05:00 PM Attempts: Average: /8

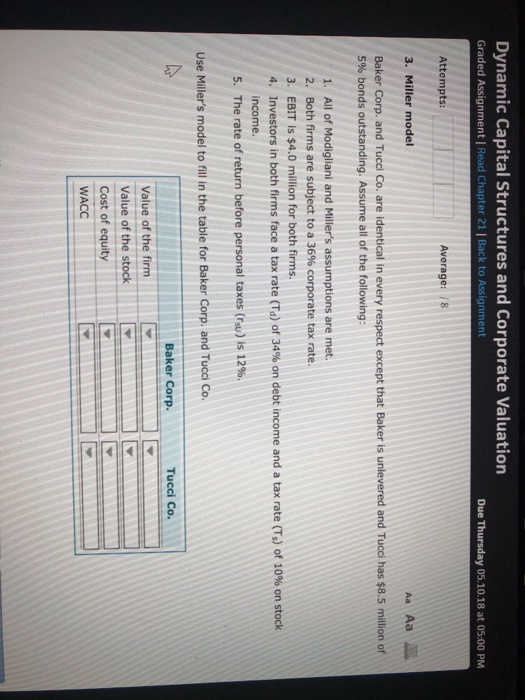

Dynamic Capital Structures and Corporate Valuation Graded Assignment | Read Chapter 21 | Back to Assignment Due Thursday 05.10.18 at 05:00 PM Attempts: Average: /8 Aa Aa 3. Miller model Baker Corp. and Tucci Co. are identical in every respect except that Baker is unlevered and Tucci has $8.5 million of 5% bonds outstanding. Assume all of the following: 1. All of Modigliani and Miller's assumptions are met. 2. Both firms are subject to a 36% corporate tax rate. 3. EBIT is $4.0 million for both firms 4, investors in both firms face a tax rate (Td) of 34% on debt income and a tax rate (Ts) of 10% on stock income. 5. The rate of return before personal taxes (rs) is 12%. Use Miller's model to fill in the table for Baker Corp. and Tucci Co. Tucci Co. Value of the firmRTT Value of the stock WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts