Question: Investment Banks Graded Assignment | Read Chapter 18 | Back to Assignment Due Thursday 05.10.18 at 05.00 PM Attempts Average: 6 1. Financing a start-up

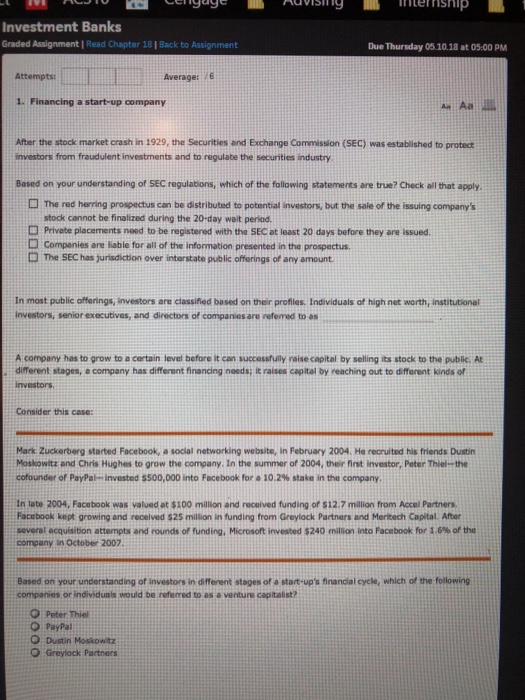

Investment Banks Graded Assignment | Read Chapter 18 | Back to Assignment Due Thursday 05.10.18 at 05.00 PM Attempts Average: 6 1. Financing a start-up company After the stock market crash in 1929, the Securities and Exchange Commission (SEC) was established to protect investors from fraudulent investments and to regulabe the securities industry Based on your understanding of SEC regulations, which of the following statements are true? Check all that apply The red herring prospectus con be distributed to potential investors, but the sale of the issuing company's stock cannot be finalized during the 20-day wait period. Private placements need to be registered with the SEC at least 20 days before they are issued D Companies are liable for all of the information presented in the prospectus The SEC has jurisdiction over interstate public offerings of any amount. In most public offerings, investors are classified based on their profiles. Individuals of high net worth, institutional investors, senior executives, and directors of companies are referred to es A company has to grow to a certain level before it can successfully raise capital by selling its stock to the public. A different stages, a company has different financing needs; it raises capital by reaching out to different kinds of investors Consider this case Mark Zuckerberg started Facebook, a social networking website, in February 2004. He recruited his friends Dustin Moskowitz and Chris Hughes to grow the company. In the summer of 2004, their first investor, Peter Thiel the cofounder of PayPal-invested $500,000 into Facebook for a 10.2% stak in thu company In late 2004, Facebook was valued at $100 milion and received funding of $12.7 million from Accel Partners Facebook kept growing and recelved $25 million in funding from Greylock Partners and Meritech Capital. After several acquisition attempts and rounds of funding. Microsoft invested $240 million into Facebook for 1.6% of the company in October 2007 Based on your understanding of investors in different stages of a start-up's financial cycle, which of the following companies or individunls would be refenred to as a venture capitalist? O Peter Thiel O PayPal O Dustin Moskowtz O Greylock Partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts