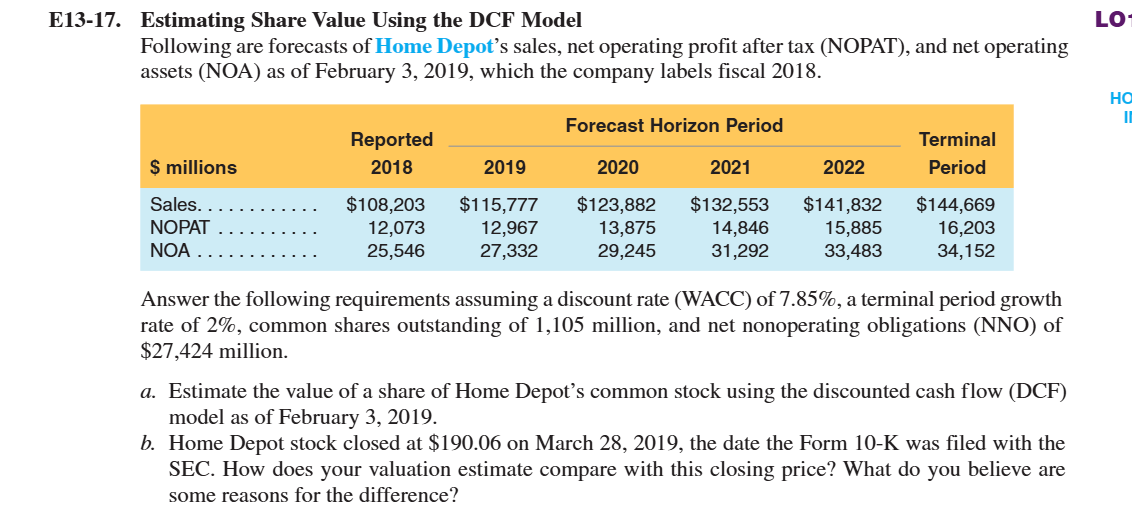

Question: E 1 3 - 1 7 . Estimating Share Value Using the DCF Model Following are forecasts of Home Depot's sales, net operating profit after

E Estimating Share Value Using the DCF Model Following are forecasts of Home Depot's sales, net operating profit after tax NOPAT and net operating assets NOA as of February which the company labels fiscal Answer the following requirements assuming a discount rate WACC of a terminal period growth rate of common shares outstanding of million, and net nonoperating obligations NNO of $ million. a Estimate the value of a share of Home Depot's common stock using the discounted cash flow DCF model as of February b Home Depot stock closed at $ on March the date the Form K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock