Question: E. 11.5% (ERIT. 12. Jonny T.'s expected earnings before interest and taxes are $5,000. Its debt has both a face and a market value of

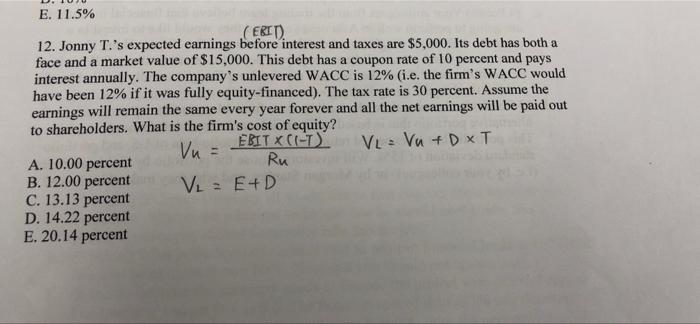

E. 11.5% (ERIT. 12. Jonny T.'s expected earnings before interest and taxes are $5,000. Its debt has both a face and a market value of $15,000. This debt has a coupon rate of 10 percent and pays interest annually. The company's unlevered WACC is 12% (i.e. the firm's WACC would have been 12% if it was fully equity-financed). The tax rate is 30 percent. Assume the earnings will remain the same every year forever and all the net earnings will be paid out to shareholders. What is the firm's cost of equity? Vu ERIT X (-D VL = Vu + DXT A. 10.00 percent Ru B. 12.00 percent VL = E+D C. 13.13 percent D. 14.22 percent E. 20.14 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock