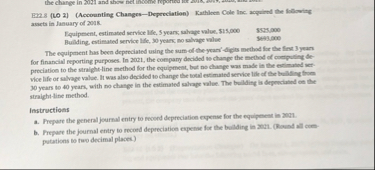

Question: E 2 2 . 8 ( LO 2 ) ( Accounting Changes - Depecelation ) Kathleen Cole Inc. acparmd the lollowity assets in January of

ELO Accounting ChangesDepecelation Kathleen Cole Inc. acparmd the lollowity assets in January of k

Equipment, estimated aervice life, yeark, mahape value, Bulliding, estimated servicr like, yeark no nalvage valoe

for financial reporting parposes. In the company Ancldst to ctarpe the metbod of compating teprociation to the straightline method for the equipment, bot no dhape was made it the extimated rervice life or calvage valae. It was also decided to change the notal ext mated service lide of the lowling frum years to years, with no chatge in the extimated salvape valoe. The bellding is depenciuted ee the straightine method.

Instructions

a Frepare the general journal entry to moond depreciation eqpense for the equipoent is

b Frepare the journal entry to reoued depreciation expenae for the buiding in nal. Rowat all come pritations to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock