Question: E 5 - 4 2 . Analyzing and Interpreting Foreign Currency Translation Effects and Non - GAAP Disclosures Kellogg Co . reports the following table

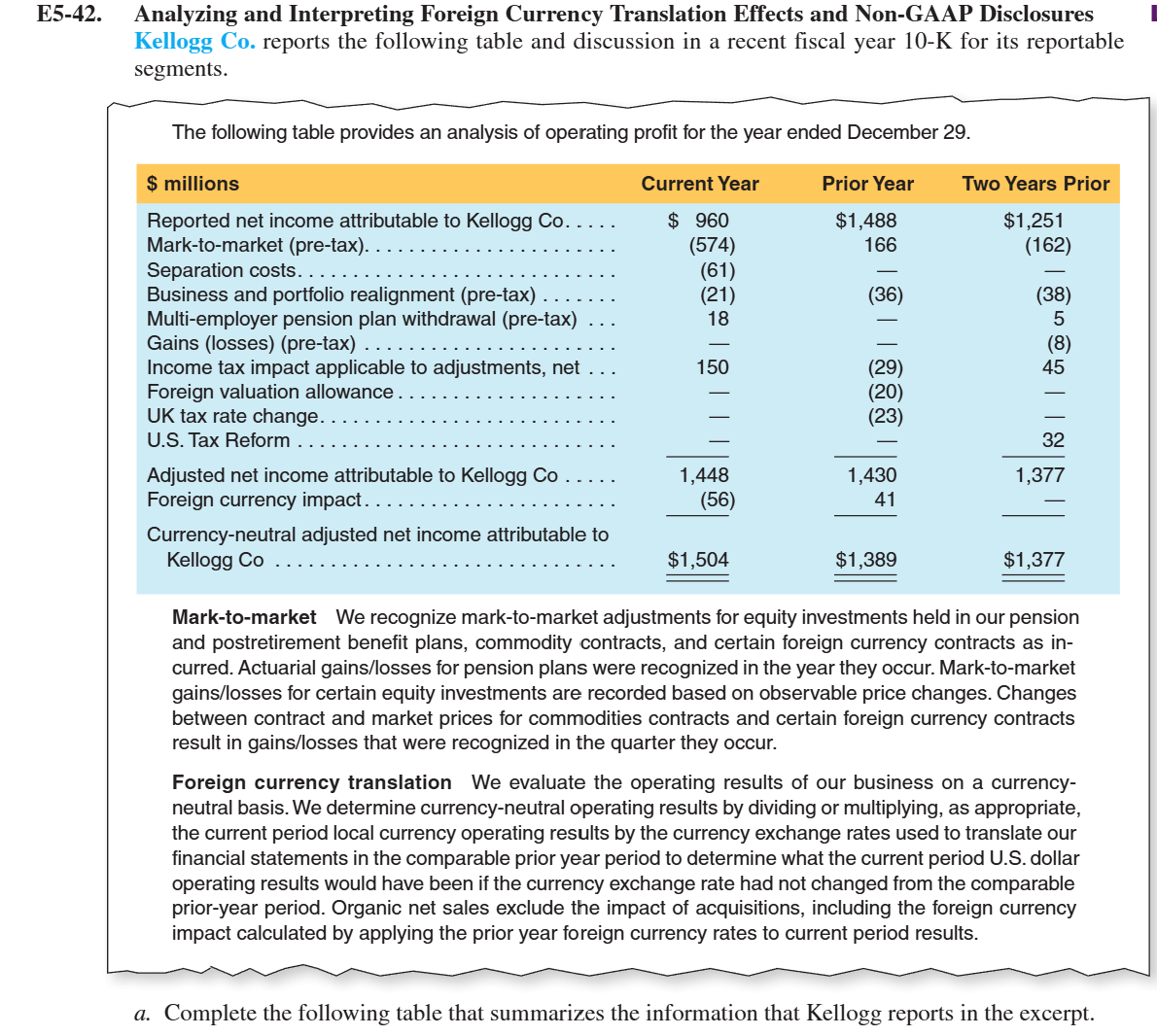

E Analyzing and Interpreting Foreign Currency Translation Effects and NonGAAP Disclosures Kellogg Co reports the following table and discussion in a recent fiscal year K for its reportable segments. The following table provides an analysis of operating profit for the year ended December Currencyneutral adjusted net income attributable to Kellogg Co Marktomarket We recognize marktomarket adjustments for equity investments held in our pension and postretirement benefit plans, commodity contracts, and certain foreign currency contracts as incurred. Actuarial gainslosses for pension plans were recognized in the year they occur. Marktomarket gainslosses for certain equity investments are recorded based on observable price changes. Changes between contract and market prices for commodities contracts and certain foreign currency contracts result in gainslosses that were recognized in the quarter they occur. Foreign currency translation We evaluate the operating results of our business on a currencyneutral basis. We determine currencyneutral operating results by dividing or multiplying, as appropriate, the current period local currency operating results by the currency exchange rates used to translate our financial statements in the comparable prior year period to determine what the current period US dollar operating results would have been if the currency exchange rate had not changed from the comparable prioryear period. Organic net sales exclude the impact of acquisitions, including the foreign currency impact calculated by applying the prior year foreign currency rates to current period results. a Complete the following table that summarizes the information that Kellogg reports in the excerpt.

b During the current year, does the foreign currency impact have a positive or negative effect on net income? Do we conclude that the US$ weakened or strengthened with respect to all other currencies in which the company does business?

c During the prior year, did the foreign currency impact have a positive or negative effect on net income? Do we conclude that the US$ weakened or strengthened with respect to all other currencies in which the company does business?

d True or false: The market to market adjustments represent gains and losses the company realized due to fluctuations in the yearend value of certain assets and liabilities?

e Which of the following types of assets and liabilities would not be included in the markettomarket adjustments that Kellogg includes in its NonGAAP reconciliation?

i US treasury bonds held in Kellogg's pension plan

ii Corn and orange juice futures contracts

iii. Eurodenominated property, plant, and equipment

iv Interest rate swaps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock