Question: E 6 - 3 4 ( 1 0 pt ) i Help 1 1 5 points begin { tabular } { | c |

E pt i

Help

points

begintabularc

hline eBook

hline Hint

hline Print

hline References

hline

endtabular

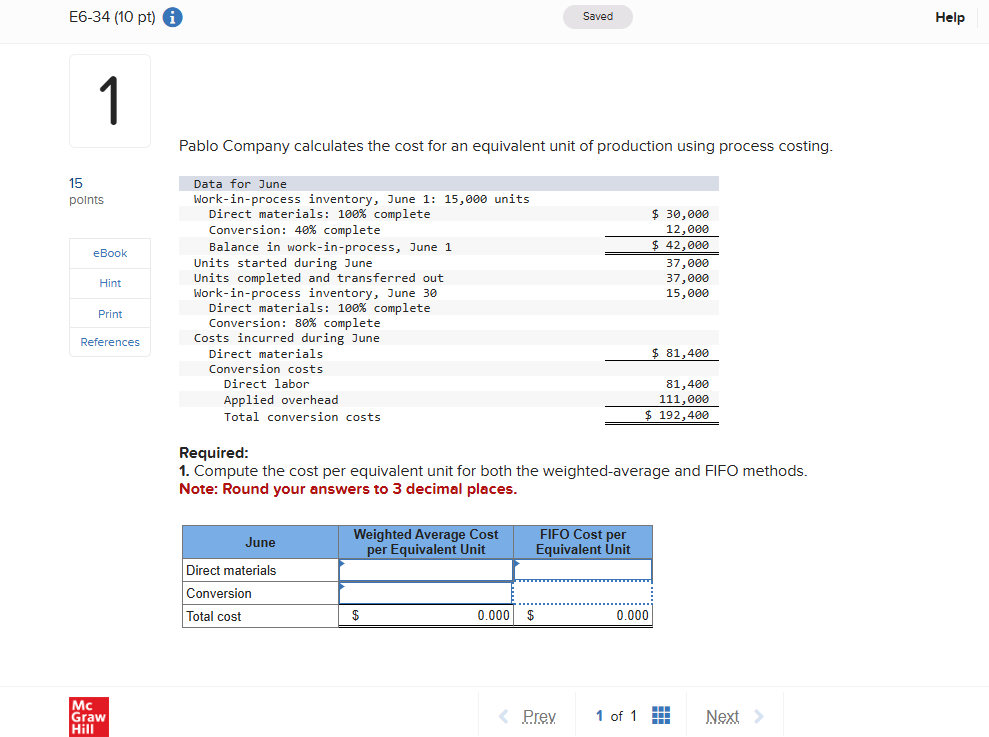

Pablo Company calculates the cost for an equivalent unit of production using process costing.

begintabularl

Data for June

Workinprocess inventory, June : units

Direct materials: complete

Conversion: complete

Balance in workinprocess, June

Units started during June

Units completed and transferred out

Workinprocess inventory, June

Direct materials: complete

begintabularl

Conversion: complete

Costs incurred during June

Direct materials

Conversion costs

Direct labor

Applied overhead

Total conversion costs

endtabular

hline hline

endtabular

Required:

Compute the cost per equivalent unit for both the weightedaverage and FIFO methods.

Note: Round your answers to mathbf decimal places.

begintabularccccc

hline June & multicolumnlWeighted Average Cost per Equivalent Unit & multicolumnrFIFO Cost per Equivalent Unit

hline Direct materials & & & &

hline Conversion & & & &

hline Total cost & $ & & $ &

hline

endtabular

Mc

Graw

Hili

Prey

of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock