Question: e. (6 points) Perform a B/C analysis and select the best alternative. Treat the salvage value as we did in class (subtract it in the

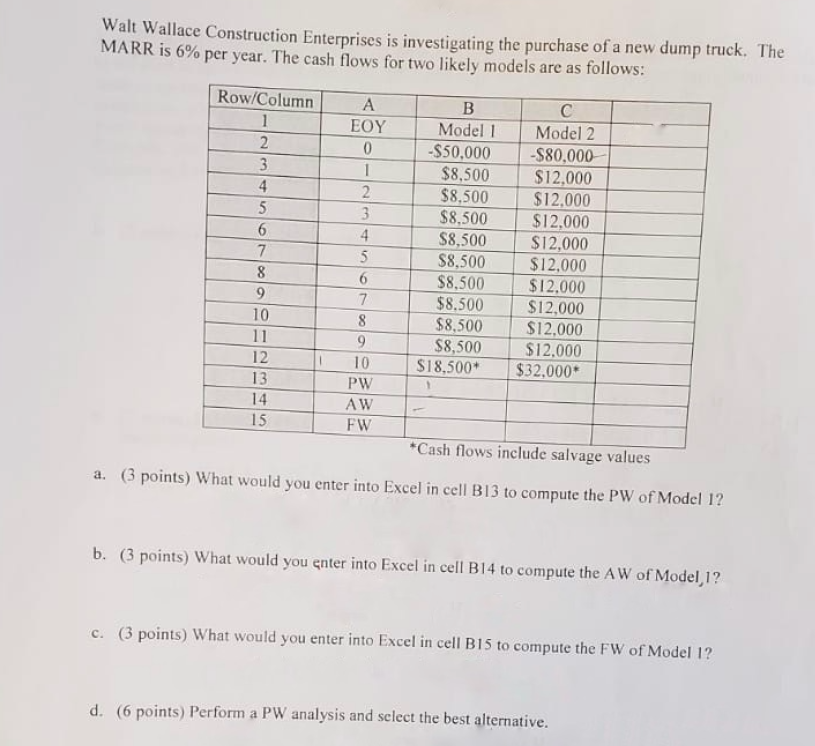

e. (6 points) Perform a B/C analysis and select the best alternative. Treat the salvage value as we did in class (subtract it in the denominator). ComPote f. (6 points) Compute the PBP for both alternatives and select the best alternative. Do the PBP results support your conclusions in part a above? If not, why not? f. (6 points) Compute the DPBP for both alternatives and select the best alternative. You may represent your answers as a range of values, but show your work.Walt Wallace Construction Enterprises is investigating the purchase of a new dump truck. The MARR is 6% per year. The cash flows for two likely models are as follows: Row/Column A B C E JOG G UA W N EOY Model I Model 2 0 OVItWN- -$50,000 -$80.000 $8,500 $12,000 $8,500 $12,000 $8,500 $12,000 $8,500 $12,000 $8,500 $12,000 $8,500 $12,000 7 $8.500 $12,000 8 $8,500 9 $12,000 12 $8,500 10 $12,000 13 $18,500* $32,000* PW 14 AW 15 FW *Cash flows include salvage values a. (3 points) What would you enter into Excel in cell B13 to compute the PW of Model 1? b. (3 points) What would you enter into Excel in cell B14 to compute the AW of Model, 1? c. (3 points) What would you enter into Excel in cell B15 to compute the FW of Model 1? d. (6 points) Perform a PW analysis and select the best alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts