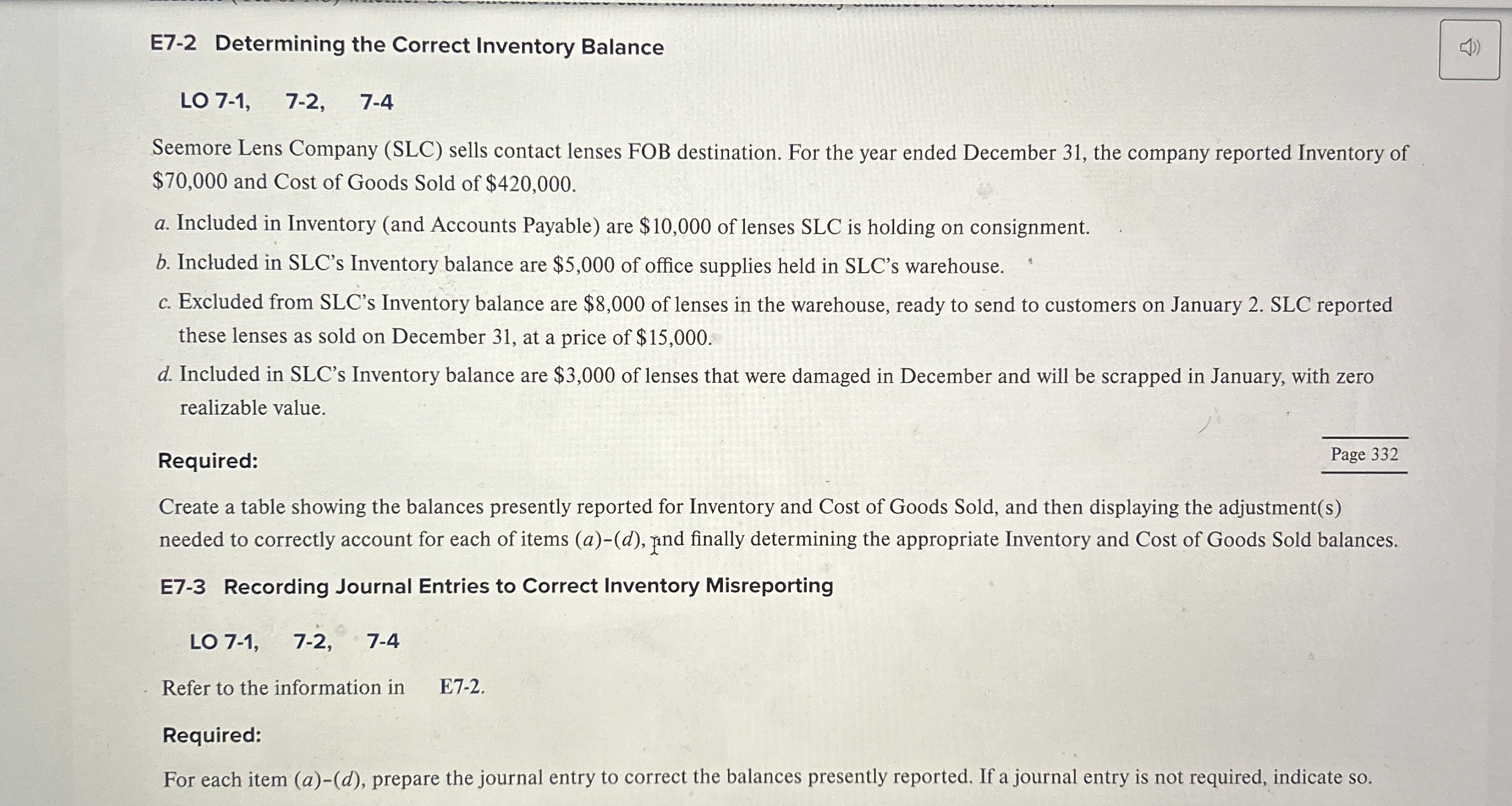

Question: E 7 - 2 Determining the Correct Inventory Balance LO 7 - 1 , 7 - 2 , , 7 - 4 Seemore Lens Company

E Determining the Correct Inventory Balance

LO

Seemore Lens Company SLC sells contact lenses FOB destination. For the year ended December the company reported Inventory of $ and Cost of Goods Sold of $

a Included in Inventory and Accounts Payable are $ of lenses SLC is holding on consignment.

b Included in SLCs Inventory balance are $ of office supplies held in SLCs warehouse.

c Excluded from SLCs Inventory balance are $ of lenses in the warehouse, ready to send to customers on January SLC reported these lenses as sold on December at a price of $

d Included in SLCs Inventory balance are $ of lenses that were damaged in December and will be scrapped in January, with zero realizable value.

Required:

Page

Create a table showing the balances presently reported for Inventory and Cost of Goods Sold, and then displaying the adjustments needed to correctly account for each of items and finally determining the appropriate Inventory and Cost of Goods Sold balances.

E Recording Journal Entries to Correct Inventory Misreporting

LO

Refer to the information in

E

Required:

For each item a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock