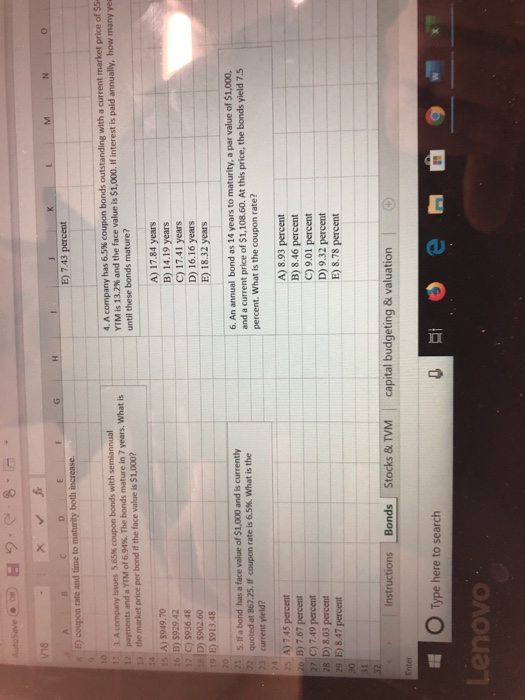

Question: E) 7.43 both E) coupon rate and time to 4. A company has 6.5% coupon bonds outstanding with a current market price of SS YTM

E) 7.43 both E) coupon rate and time to 4. A company has 6.5% coupon bonds outstanding with a current market price of SS YTM is 3.2% and the face value is $1,000. If interest is paid annually, how many ye until these bonds mature? t 3. A company issues 5.65% coupon bonds with semiannual 12 I payments and a YTM of 6.94%, The bonds mature in 7 years. What is 13 the market price per bond if the face value is $1,000? A) 17.84 years B) 14.19 years C) 17.41 years D) 16.16 years E) 18.32 years SA) S949.70 6B) $929.42 C) $936.48 D) $902.60 9 E) S913.48 6. An annual bond as 14 years to maturity, a par value of $1,000, and a current price of $1,108.60. At this price, the bonds yield 7.s percent. What is the coupon rate? 21 22 5. If a bond has a face value of $1,000 and is currently quoted at 867.25. If coupon rate is 6.5%. What is the 23 current yield? 75 A) 7.45 percent 26 B) 7.67 percent 27 C) 7.49 percent 28 D) 8.03 percent 29 E) 8.47 percent A) 8.93 percent B) 8.46 percent C)9.01 percent D) 9.32 percent E) 8.78 percent Instructions Bonds Stocks & TVM capital budgeting&valuation Enter O Type here to search Lenovo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts