Question: E 8-8 Subsidiary issues additional stock under different assumptions Pam Corporation owns two-thirds (600,000 shares) of the outstanding $1 par common stock of Sun Company

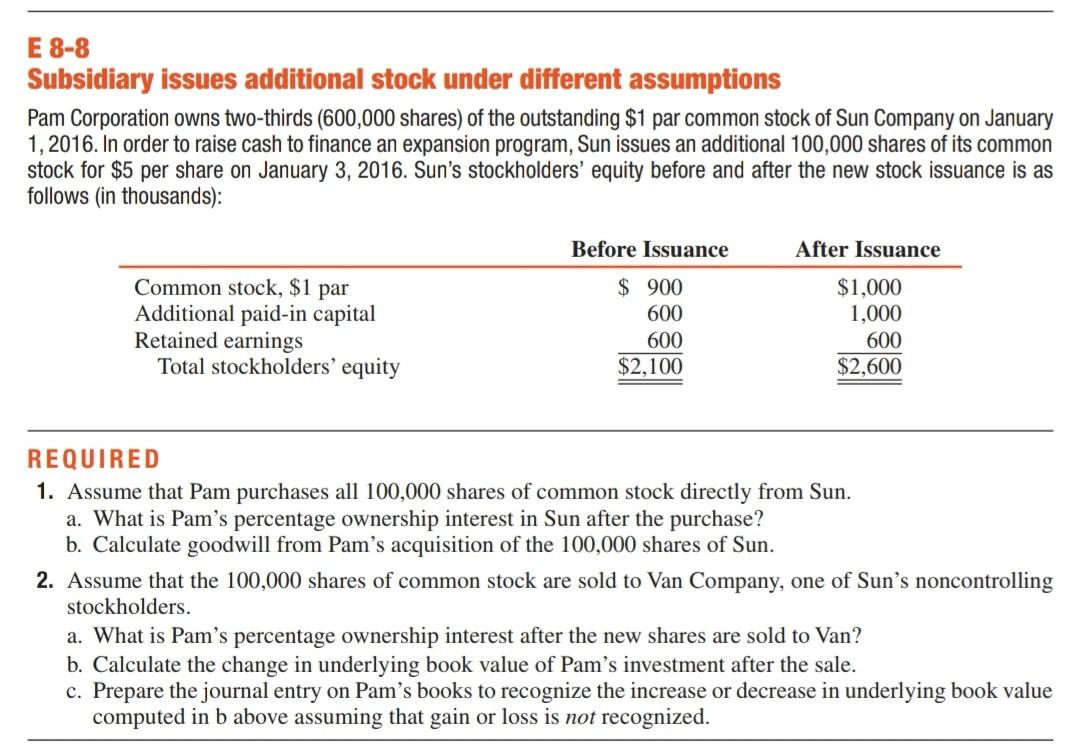

E 8-8 Subsidiary issues additional stock under different assumptions Pam Corporation owns two-thirds (600,000 shares) of the outstanding $1 par common stock of Sun Company on January 1, 2016. In order to raise cash to finance an expansion program, Sun issues an additional 100,000 shares of its common stock for $5 per share on January 3, 2016. Sun's stockholders' equity before and after the new stock issuance is as follows (in thousands): Before Issuance After Issuance Common stock, $1 par Additional paid-in capital Retained earnings Total stockholders' equity $ 900 600 600 $2,100 $1,000 1,000 600 $2,600 REQUIRED 1. Assume that Pam purchases all 100,000 shares of common stock directly from Sun. a. What is Pam's percentage ownership interest in Sun after the purchase? b. Calculate goodwill from Pam's acquisition of the 100,000 shares of Sun. 2. Assume that the 100,000 shares of common stock are sold to Van Company, one of Sun's noncontrolling stockholders. a. What is Pam's percentage ownership interest after the new shares are sold to Van? b. Calculate the change in underlying book value of Pam's investment after the sale. c. Prepare the journal entry on Pam's books to recognize the increase or decrease in underlying book value computed in b above assuming that gain or loss is not recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts