Question: e ame: pXCompany spent $7,900 on an engineering study that revealed that Product A could be manufactured more efficiently of $0.93 per unit. However, there

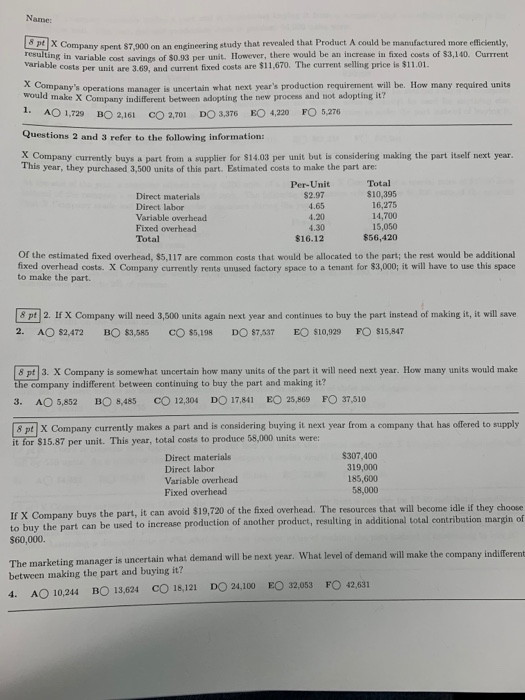

e ame: pXCompany spent $7,900 on an engineering study that revealed that Product A could be manufactured more efficiently of $0.93 per unit. However, there would be an increase in fixed costs of $3,140. Currrent ariable costs per unit are 3.69, and current fixed costs are $11,670. The current selling price is $11.01. X Company's operations manager is uncertain what next year's production requirement will be. How many required units would make X Company indifferent between adopting the new process and not adopting it? 1. AO 1,729 BO 2161 co 2,701 DO 3,376 EO 4,220 FO 5276 Questions 2 and 3 refer to the following information Company currently buys a part from a supplier for $14.03 per unit but is considering imaking the part itself next year. T his year, they purchased 3,500 units of this part. Estimated costs to make the part are: Per-Unit Total Direct materials Direct labor Variable overbead Fixed overhead Total $2.97 .65 4.20 4.30 $16.12 $10,395 16,275 14,700 15,050 856,420 Of the estimated fixed overhead, $5,117 are common costs that would be allocated to the part; the rest would be additional fixed overhead costs. X Company currently rents unused factory space to a tenant for $3,000; it will have to use this space to make the part 8 pt 2. If X Company will need 3,500 units again next year and continues to buy the part Instend of making it, it will ave 2. A$2,472 BO s3,585 cO s5,198 DO s7,537 EO s10,929 FO s15847 s pt 3. X Company is somewhat uncertain how many units of the part it will need next year. How many units would make company indifferent between continuing to buy the part and making it? 3. AO 5,852 BO 8,485 12,304 DO 17,841 E25,869 FO 37,510 8 pt X Company currently makes a part and is considering buying it next year from a company that has offered to supply it for $15.87 per unit. This year, total costs to produce 58,000 units were: Direct materials Direct labor Variable overhead Fixed overhead $307,400 319,000 185,600 58,000 y buys the part, it can avoid $19,720 of the fixed overhead. The resources that will become idle if they choose If X Compan to buy the part can be used to increase production of another product, resulting in additional total contribution margin of $60,000. uncertain what demand will be next year. What level of demand will make the company indifferent The marketing manager is between making the part and buying it? 4. AO 10,244 BO 13,624 CO 18,121 DO 24,100 EO 32,053 FO 42,631

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts