Question: e. Consider two bonds A and B with payments Ct, where t = 1,2, ...,10. Both bonds have $1,000 face value. Bond A has just

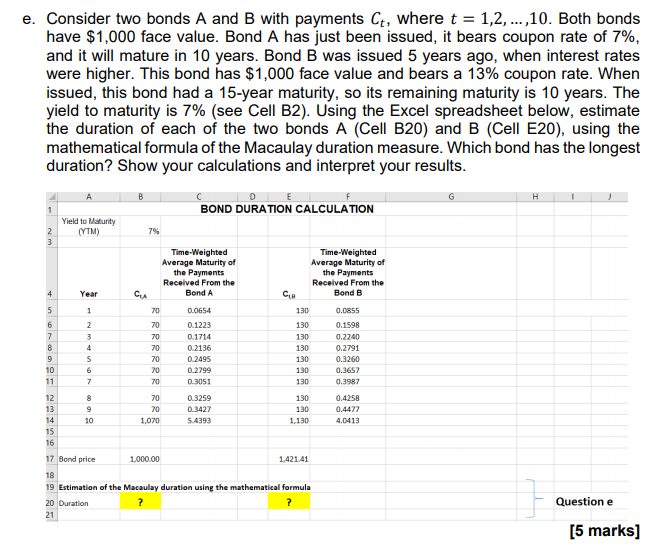

e. Consider two bonds A and B with payments Ct, where t = 1,2, ...,10. Both bonds have $1,000 face value. Bond A has just been issued, it bears coupon rate of 7%, and it will mature in 10 years. Bond B was issued 5 years ago, when interest rates were higher. This bond has $1,000 face value and bears a 13% coupon rate. When issued, this bond had a 15-year maturity, so its remaining maturity is 10 years. The yield to maturity is 7% (see Cell B2). Using the Excel spreadsheet below, estimate the duration of each of the two bonds A (Cell B20) and B (Cell E20), using the mathematical formula of the Macaulay duration measure. Which bond has the longest duration? Show your calculations and interpret your results. H 1 BOND DURATION CALCULATION Yield to Maturity (YTM) 7% 2. 3 Time-Weighted Average Maturity of the Payments Received From the Bond A Time-Weighted Average Maturity of the Payments Received From the CUR Bond B 130 0.0855 4 Year CA 5 1 70 70 4 6 7 8 9 10 11 em MONS 70 70 70 70 0.0654 0.1223 0.1714 0.2136 0.2495 0.2799 0.3051 130 130 130 130 130 130 0.1598 0.2240 0.2791 0.3260 0.3657 0.3987 7 12 13 14 15 16 70 70 1,070 0.3259 0.3427 5.4393 130 130 1.130 0.4258 0.4477 4.0413 17 Bond price 1,000.00 1.421.41 18 19 Estimation of the Macaulay duration using the mathematical formula 20 Duration ? ? 21 1 Question e [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts