Question: (e) Convert all your discount factors to continuous compounded spot rates. 2. You are valuing a semi-annual fixed-floating swap with 1.3 years to go and

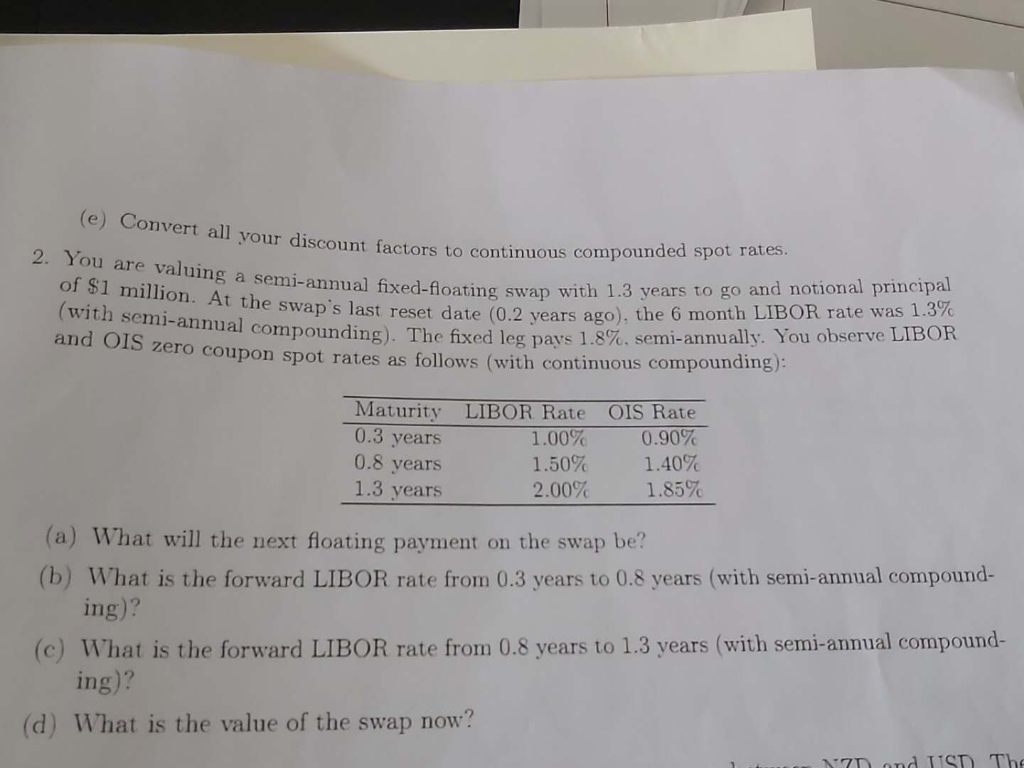

(e) Convert all your discount factors to continuous compounded spot rates. 2. You are valuing a semi-annual fixed-floating swap with 1.3 years to go and notional principal of $1 million. At the swap's last reset date (0.2 years ago), the 6 month LIBOR rate was 1.3% (with semi-annual compounding). The fixed leg pays 1.8%, semi-annually. You observe LIBOR and OIS zero coupon spot rates as follows (with continuous compounding): Maturity LIBOR Rate 0.3 years 1.00% 1.50% 1.3 years 2.00% OIS Rate 0.90% 1.40% 1.85% 0.8 years (a) What will the next floating payment on the swap be? (b) What is the forward LIBOR rate from 0.3 years to 0.8 years (with semi-annual compound- ing)? (c) What is the forward LIBOR rate from 0.8 years to 1.3 years (with semi-annual compound- ing)? (d) What is the value of the swap now? N7 ond TIST) The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts