Question: E) geospatial platforms Problem 1 Part A You are a manufacturer who distributes your product through a channel of distribution that includes wholesalers, retailers and

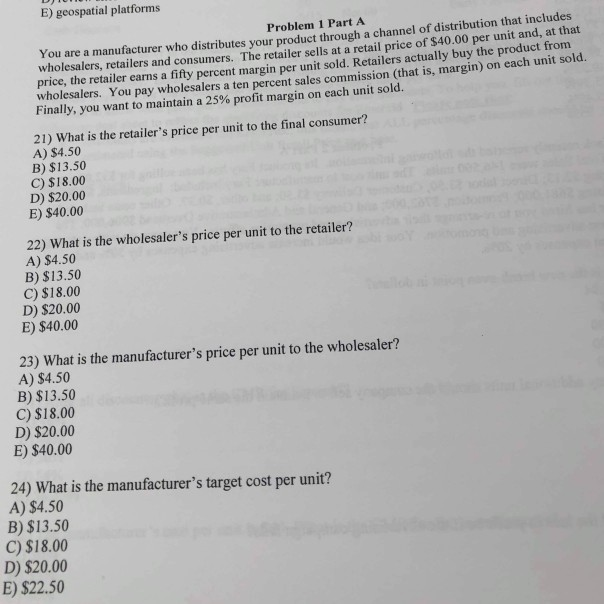

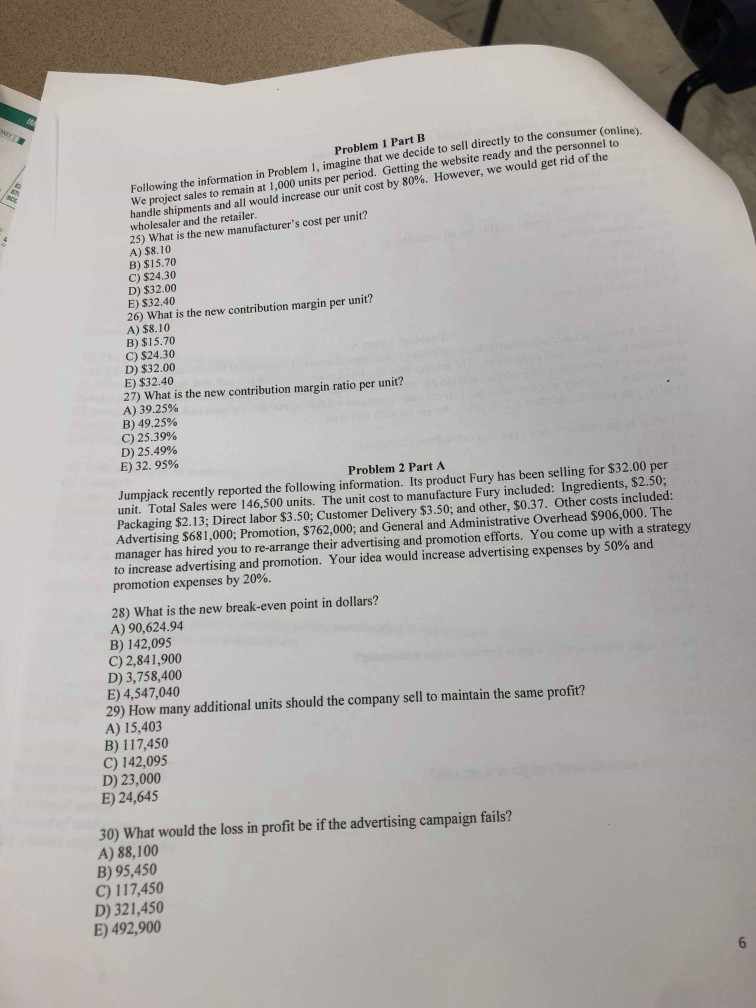

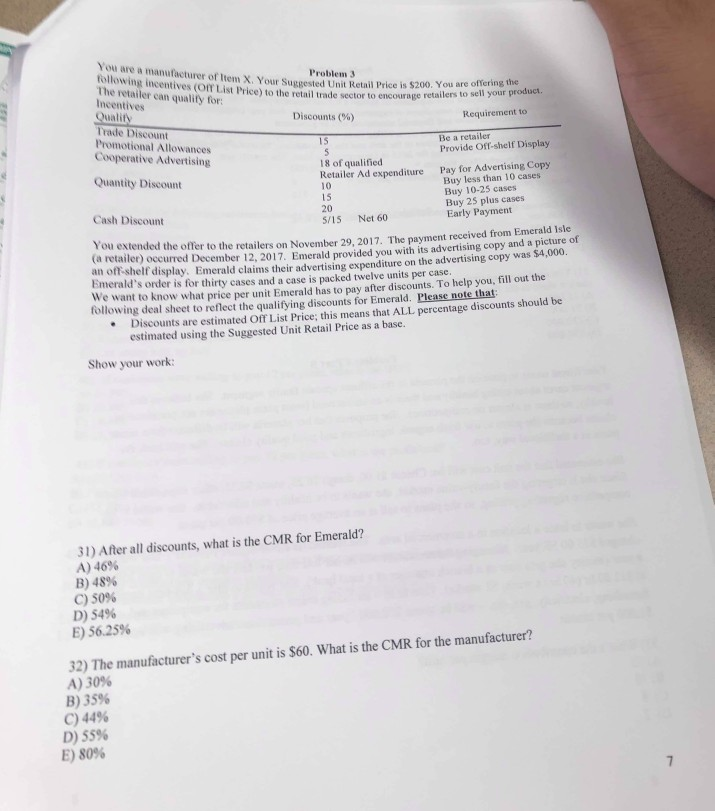

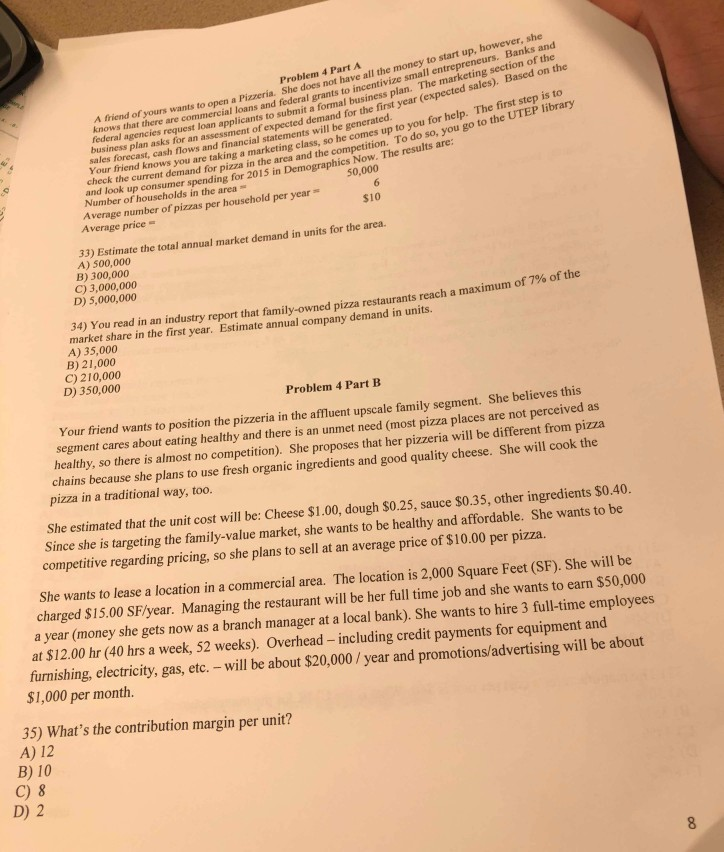

E) geospatial platforms Problem 1 Part A You are a manufacturer who distributes your product through a channel of distribution that includes wholesalers, retailers and consumers. The retailer sells at a retail price of $40.00 per unit and, at that price, the retailer earns a fifty percent margin ner unit sold. Retailers actually buy the product from wholesalers. You pay wholesalers a ten percent sales commission that is, margin) on each unit sold. Finally, you want to maintain a 25% profit margin on each unit sold. 21) What is the retailer's price per unit to the final consumer? A) $4.50 B) $13.50 C) $18.00 D) $20.00 E) $40.00 22) What is the wholesaler's price per unit to the retailer? A) $4.50 B) $13.50 C) $18.00 D) $20.00 E) $40.00 23) What is the manufacturer's price per unit to the wholesaler? A) $4.50 B) $13.50 C) $18.00 D) $20.00 E) $40.00 24) What is the manufacturer's target cost per unit? A) $4.50 B) $13.50 C) $18.00 D) $20.00 E) $22.50 Problem 1 Part B Following the information in Problem 1. imagine that we decide to sell directly to the consumer online We project sales to remain at 1.000 units per period. Getting the website ready and the personnel to handle shipments and all would increase our unit cost by 80%. However, we would get rid of the wholesaler and the retailer. 25) What is the new manufacturer's cost per unit? A) $8.10 B) $15.70 C) $24.30 D) $32.00 E) $32.40 26) What is the new contribution margin per unit? A) $8.10 B) $15.70 C) $24.30 D) $32.00 E) $32.40 27) What is the new contribution margin ratio per unit? A) 39.25% B) 49.25% C) 25.39% D) 25.49% E) 32.95% Problem 2 Part A Jumpjack recently reported the following information. Its product Fury has been selling for $32.00 per unit. Total Sales were 146,500 units. The unit cost to manufacture Fury included: Ingredients, $2.50; Packaging $2.13; Direct labor $3.50; Customer Delivery $3.50; and other, $0.37. Other costs included: Advertising $681,000; Promotion, $762,000; and General and Administrative Overhead $906,000. The manager has hired you to re-arrange their advertising and promotion efforts. You come up with a strategy to increase advertising and promotion. Your idea would increase advertising expenses by 50% and promotion expenses by 20%. 28) What is the new break-even point in dollars? A) 90,624.94 B) 142,095 C) 2,841,900 D) 3,758,400 E) 4,547,040 29) How many additional units should the company sell to maintain the same profit? A) 15,403 B) 117,450 C) 142,095 D) 23,000 E) 24,645 30) What would the loss in profit be if the advertising campaign fails? A) 88,100 B) 95,450 C) 117,450 D) 321,450 E) 492,900 You are a manufacturer of Item X. Your Suggested following incentives (Or List Price) to the retail The retailer can quality for Incentives cturer of ltem x Your Susted It Betail price is $200. You are offering the Problem 3 es (OIT List Price to the retail trade or to encourage retailers to sell your pro to sell your product. Quality Discounts (%) Requirement to Trade Discount Promotional Allowances Cooperative Advertising TT Quantity Discount 10 Cash Discount Be a retailer Provide Off-shell Display 18 of qualified Retailer Ad expenditure Pay for Advertising Copy Buy less than 10 cases 15 Buy 10-25 cases 20 Buy 25 plus cases 5/15 Net 60 Early Payment You extended the offer to the retailers on November 19 2017 The payment received from Emerald iste (retailer) occurred December 13 2017 Emerald provided you with its advertising copy and a picture of an oft-shell display. Emerald claims their advertising expenditure on the advertising copy was $4,000. Emerald's order is for thirty cases and a case is packed twelve units per case. We want to know what price per unit Emerald has to pay after discounts. To help you, fill out the following deal sheet to reflect the qualifying discounts for Emerald. Please note that Discounts are estimated Off List Price; this means that ALL percentage discounts should be estimated using the Suggested Unit Retail Price as a base. Show your work: 31) After all discounts, what is the CMR for Emerald? A) 46% B) 48% C) 50% D) 54% E) 56.25% 32) The manufacturer's cost per unit is $60. What is the CMR for the manufacturer? A) 30% B) 35% C) 44% D) 55% E) 80% demand for the first year (expected sales). Based on the class, so he goetition. Toesults are Problem 4 Part A do yours wants to open a Pizzeria She does not have all the money to start up, however, she knows that there are commercial loans and federal federal agencies request loan applicants are are commercial loans and federal grants to incentivize small entrepreneurs. Banks and request loan applicants to submit a formal business plan. The marketing section of the business plan asks for an assessment of expected demand for the first year (expo sales forecast, cash flows and financial statements will be generated. check the current demand for pizza in the area and the competition. To do so, you are taking a marketing class, so he comes up to you for help. The first step is to and look up consumer spending for 2015 in Demographics Now. The results are id the competition. To do so, you go to the UTEP library 50,000 Your friend knows you are taking a marketing c $10 Number of households in the area Average number of pizzas per household per year Average price 33) Estimate the total annual market demand in units for the area. A) 500,000 B) 300,000 C) 3,000,000 D) 5,000,000 34) You read in an industry report that family-owned pizza restaurants reach a maximum o market share in the first year. Estimate annual company demand in units. A) 35,000 B) 21,000 C) 210,000 D) 350,000 Problem 4 Part B Your friend wants to position the pizzeria in the affluent upscale family segment. She believes this segment cares about eating healthy and there is an unmet need (most pizza places are not perceived as healthy, so there is almost no competition). She proposes that her pizzeria will be different from pizza chains because she plans to use fresh organic ingredients and good quality cheese. She will cook the pizza in a traditional way, too. She estimated that the unit cost will be: Cheese $1.00, dough $0.25, sauce $0.35, other ingredients $0.40. Since she is targeting the family-value market, she wants to be healthy and affordable. She wants to be competitive regarding pricing, so she plans to sell at an average price of $10.00 per pizza. She wants to lease a location in a commercial area. The location is 2,000 Square Feet (SF). She will be charged $15.00 SF/year. Managing the restaurant will be her full time job and she wants to earn $50,000 a year (money she gets now as a branch manager at a local bank). She wants to hire 3 full-time employees at $12.00 hr (40 hrs a week, 52 weeks). Overhead - including credit payments for equipment and furnishing, electricity, gas, etc. - will be about $20,000/ year and promotions/advertising will be about $1,000 per month 35) What's the contribution margin per unit? A) 12 B) 10 C) 8 D) 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock