Question: E Homework: Chapter 11 Homework Question 12, P11-24 (si... HW Score: 25%, 4 of 16 points O Points: 0 of 1 Save Part 1 of

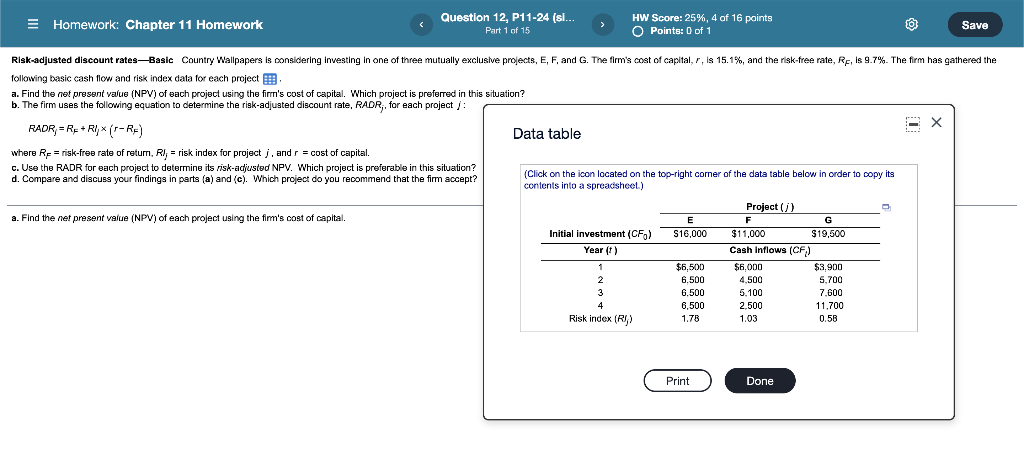

E Homework: Chapter 11 Homework Question 12, P11-24 (si... HW Score: 25%, 4 of 16 points O Points: 0 of 1 Save Part 1 of 15 Risk-adjusted discount ratesBasic Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 15.1%, and the risk-free rate, RF, is 9.7%. The firm has gathered the following basic cash flow and risk index data for each project a. Find the net present value (NPV) of each project using the firm's cost of capital. Which project is preferred in this situation? b. The firm uses the following equation to determine the risk-adjusted discount rate, RADR,, for each project : RADR-R+RI* (r-R-) X Data table where Rp = risk-free rate of retum, RI, = risk index for project, and r = cost of capital. c. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in this situation? d. Compare and discuss your findings in parts (a) and (c). Which project do you recommend that the firm accept? (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) = a. Find the net present value (NPV) of each project using the fim's cost of capital. E S16,000 Initial investment (CF) Year it) 1 2 > 3 4 $6,500 6.500 6.500 6,500 1.78 Project F G $11,000 $19,500 Cash Inflows (CF) $6.00 $3.900 4.500 5,700 5.100 7.600 2.500 11.700 1.03 0.58 Risk index (R) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts