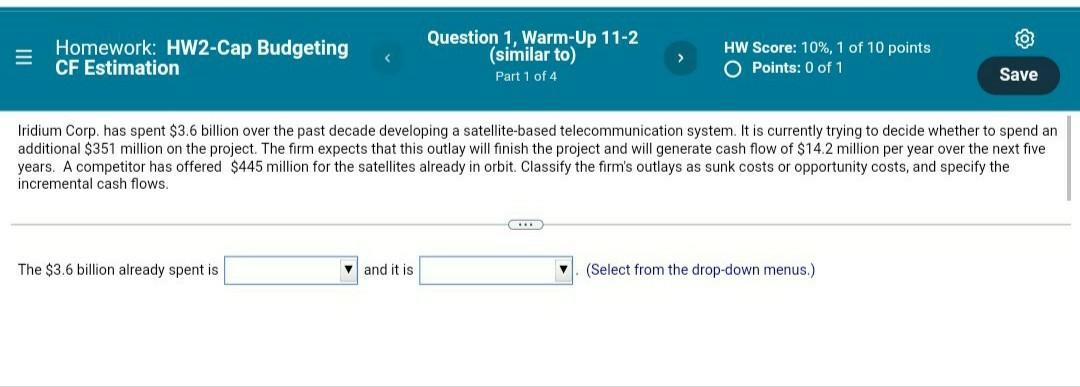

Question: E Homework: HW2-Cap Budgeting CF Estimation Question 1, Warm-Up 11-2 (similar to) Part 1 of 4 > HW Score: 10%, 1 of 10 points O

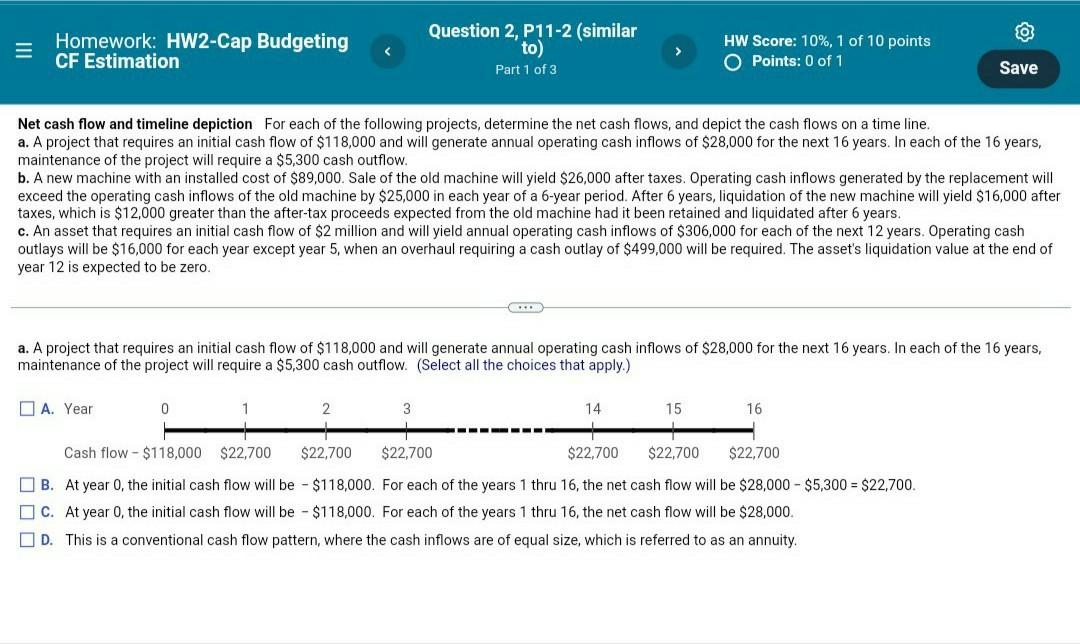

E Homework: HW2-Cap Budgeting CF Estimation Question 1, Warm-Up 11-2 (similar to) Part 1 of 4 > HW Score: 10%, 1 of 10 points O Points: 0 of 1 Save Iridium Corp. has spent $3.6 billion over the past decade developing a satellite-based telecommunication system. It is currently trying to decide whether to spend an additional $351 million on the project. The firm expects that this outlay will finish the project and will generate cash flow of $14.2 million per year over the next five years. A competitor has offered $445 million for the satellites already in orbit. Classify the firm's outlays as sunk costs or opportunity costs, and specify the incremental cash flows. The $3.6 billion already spent is and it is (Select from the drop-down menus.) E Homework: HW2-Cap Budgeting CF Estimation Question 2, P11-2 (similar to) Part 1 of 3 HW Score: 10%, 1 of 10 points O Points: 0 of 1 Save Net cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial cash flow of $118,000 and will generate annual operating cash inflows of $28,000 for the next 16 years. In each of the 16 years, maintenance of the project will require a $5,300 cash outflow. b. A new machine with an installed cost of $89,000. Sale of the old machine will yield $26,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $25,000 in each year of a 6-year period. After 6 years, liquidation of the new machine will yield $16,000 after taxes, which is $12,000 greater than the after-tax proceeds expected from the old machine had it been retained and liquidated after 6 years. c. An asset that requires an initial cash flow of $2 million and will yield annual operating cash inflows of $306,000 for each of the next 12 years. Operating cash outlays will be $16,000 for each year except year 5, when an overhaul requiring a cash outlay of $499,000 will be required. The asset's liquidation value at the end of year 12 is expected to be zero. a. A project that requires an initial cash flow of $118,000 and will generate annual operating cash inflows of $28,000 for the next 16 years. In each of the 16 years, maintenance of the project will require a $5,300 cash outflow. (Select all the choices that apply.) A. Year 0 1 2 3 14 15 16 LO Cash flow - $118,000 $22,700 $22,700 $22,700 $22,700 $22,700 $22,700 B. At year 0, the initial cash flow will be - $118,000. For each of the years 1 thru 16, the net cash flow will be $28,000 - $5,300 = $22,700. C. At year, the initial cash flow will be - $118,000. For each of the years 1 thru 16, the net cash flow will be $28,000. D. This is a conventional cash flow pattern, where the cash inflows are of equal size, which is referred to as an annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts