Question: E M , and ROA = N P M AU . Go into more detail to explain why the NPM went down based on trends

and ROA AU Go into more detail to explain why the NPM

went down based on trends in the GPM and OPM, and why the AU went

down a little bit based on trends in days AR days inventory, and fixed asset

turnover.

d Dupont Performance Trend Comparison for to forecast:

Explain why the forecast ROE and ROA are higher than in

where ROEROA; and ROA Go into more detail to

explain why the NPM is higher in based on the GPM and OPM, and

why the AU is lower in based on days AR days inventory, and fixed

asset turnover

e Dupont Forecast versus Industry Average Comparison:

Explain why the firm has a higher ROE than the industry average for the

forecast where ROEROA; and ROA AU Go into

more detail to explain why the forecast NPM is higher than the industry

average, based on the GPM and OPM, and why the AU is higher based on

days AR days inventory, and fixed asset turnoverPart : Module : Loan Analysis: MiniCase: Super Sports, Inc.

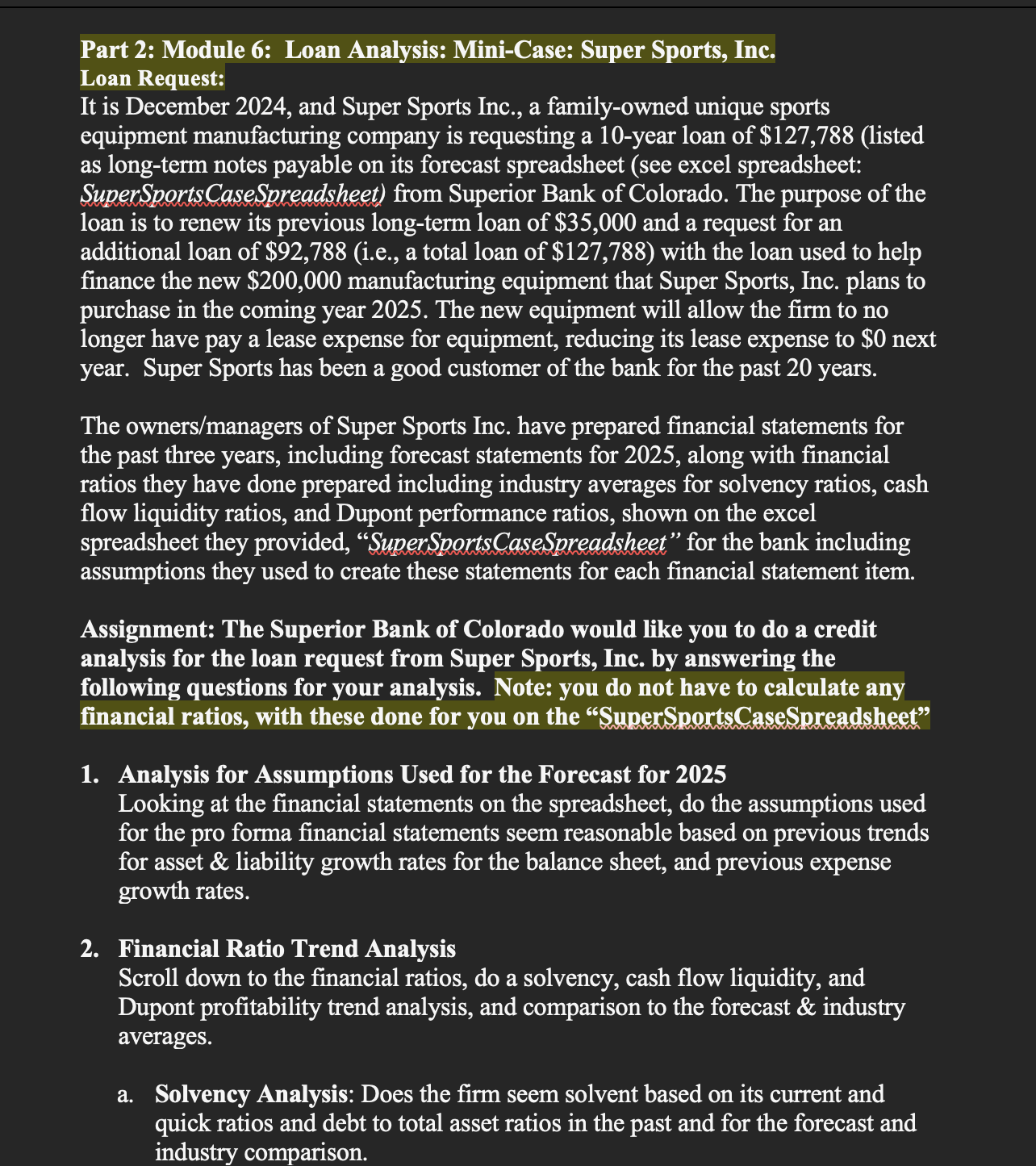

Loan Request:

It is December and Super Sports Inc., a familyowned unique sports

equipment manufacturing company is requesting a year loan of $listed

as longterm notes payable on its forecast spreadsheet see excel spreadsheet:

SuperSports CaseSpreadsheet from Superior Bank of Colorado. The purpose of the

loan is to renew its previous longterm loan of $ and a request for an

additional loan of $ie a total loan of $ with the loan used to help

finance the new $ manufacturing equipment that Super Sports, Inc. plans to

purchase in the coming year The new equipment will allow the firm to no

longer have pay a lease expense for equipment, reducing its lease expense to $ next

year. Super Sports has been a good customer of the bank for the past years.

The ownersmanagers of Super Sports Inc. have prepared financial statements for

the past three years, including forecast statements for along with financial

ratios they have done prepared including industry averages for solvency ratios, cash

flow liquidity ratios, and Dupont performance ratios, shown on the excel

spreadsheet they provided, "SuperSportsCaseSpreadsheet" for the bank including

assumptions they used to create these statements for each financial statement item.

Assignment: The Superior Bank of Colorado would like you to do a credit

analysis for the loan request from Super Sports, Inc. by answering the

following questions for your analysis. Note: you do not have to calculate any

financial ratios, with these done for you on the "Super SportschaseSpreadshet"

Analysis for Assumptions Used for the Forecast for

Looking at the financial statements on the spreadsheet, do the assumptions used

for the pro forma financial statements seem reasonable based on previous trends

for asset & liability growth rates for the balance sheet, and previous expense

growth rates.

Financial Ratio Trend Analysis

Scroll down to the financial ratios, do a solvency, cash flow liquidity, and

Dupont profitability trend analysis, and comparison to the forecast & industry

averages.

a Solvency Analysis: Does the firm seem solvent based on its current and

quick ratios and debt to total asset ratios in the past and for the forecast and

industry comparison.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock