Question: e Question 4 (20 marks) Use the following information for parts A and B. The commercial banks in Country A are required to maintain a

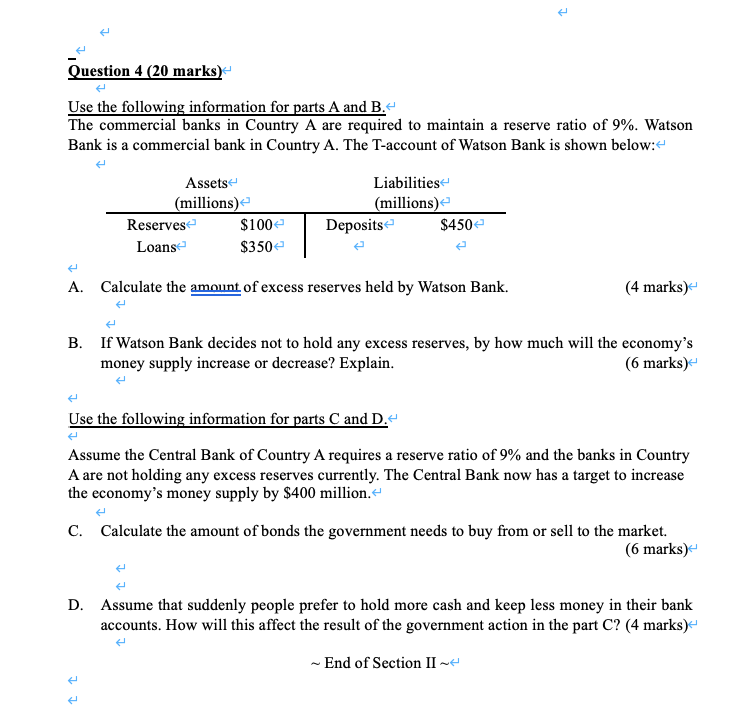

e Question 4 (20 marks) Use the following information for parts A and B. The commercial banks in Country A are required to maintain a reserve ratio of 9%. Watson Bank is a commercial bank in Country A. The T-account of Watson Bank is shown below:- Assets (millions) Reserves $100 Loans $350 Liabilities (millions) Deposits $450 A. Calculate the amount of excess reserves held by Watson Bank. (4 marks) B. If Watson Bank decides not to hold any excess reserves, by how much will the economy's money supply increase or decrease? Explain. (6 marks) Use the following information for parts C and D. Assume the Central Bank of Country A requires a reserve ratio of 9% and the banks in Country A are not holding any excess reserves currently. The Central Bank now has a target to increase the economy's money supply by $400 million. C. Calculate the amount of bonds the government needs to buy from or sell to the market. (6 marks) D. Assume that suddenly people prefer to hold more cash and keep less money in their bank accounts. How will this affect the result of the government action in the part C? (4 marks) - End of Section II ~

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts