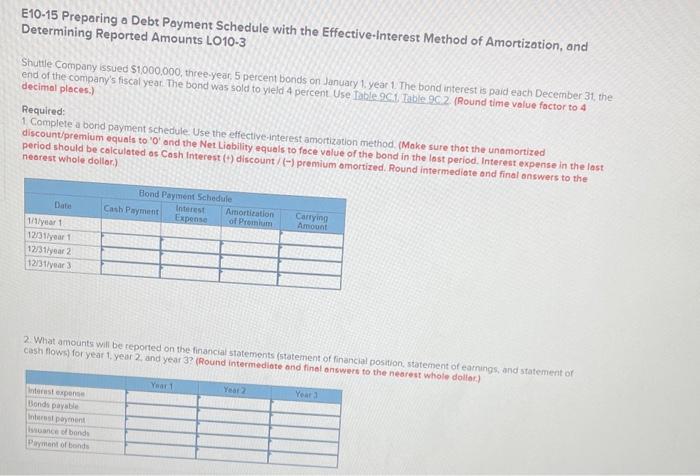

Question: E10-15 Preparing a Debt Payment Schedule with the Effective-Interest Method of Amortization, and Determining Reported Amounts LO10-3 Shutle Company issued $1,000,000, three-year, 5 percent bonds

E10-15 Preparing a Debt Payment Schedule with the Effective-Interest Method of Amortization, and Determining Reported Amounts LO10-3 Shutle Company issued \$1,000,000, three-year, 5 percent bonds on Januacy 1. year 1. The bond interest is paid each December 31 , the end of the company's fiscal year. The bond was sold to yleld 4 percent Use table 9Cd table 902 . (Round time volue foctor to 4 decimal places.) 1 Complele a bond payment schedule Use the effective-interest amortization method. (Moke sure thot the unamortized) discountpremlum equals to ' 0 ' ond the Net Liobility equals to foce value of the bond in the lost period. Interest expense in the last period should be calculated os Cash Interest (t) discount/ () premium omortized. Round intermediote ond final onswers to the neorest whole dollor.) 2. What amounts will be reported on the linancial statements (5tatement of financial position, statement of earnings, and statement of: cash fows) for yeat 1, year 2 and year 3? (Round intermediate and final ancwars to the nearest whole dollor.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts