Question: E10-9 (Static) Evaluating Managerial Performance Using Return on Investment, Residual Income [LO 10- 4, 10-5) Luke Company has three divisions: Peak, View, and Grand. The

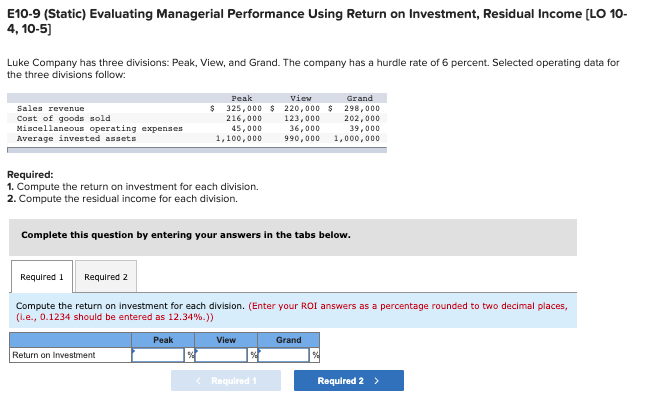

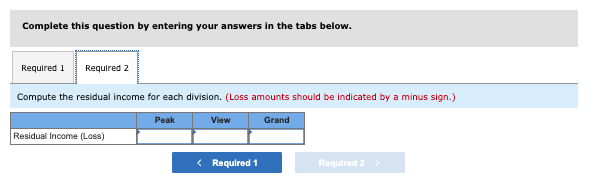

E10-9 (Static) Evaluating Managerial Performance Using Return on Investment, Residual Income [LO 10- 4, 10-5) Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6 percent. Selected operating data for the three divisions follow: Sales revenue Cost of goods sold Miscellaneous operating expenses Average invested assets Peak View Grand $ 325,000 $ 220,000 $ 298,000 216,000 123,000 202,000 45,000 36,000 39,000 1,100,000 990,000 1,000,000 Required: 1. Compute the return on investment for each division. 2. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the return on investment for each division. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Peak View Grand Return on Investment Required 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the residual income for each division. (Loss amounts should be indicated by a minus sign.) Grand Peak View Residual Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts