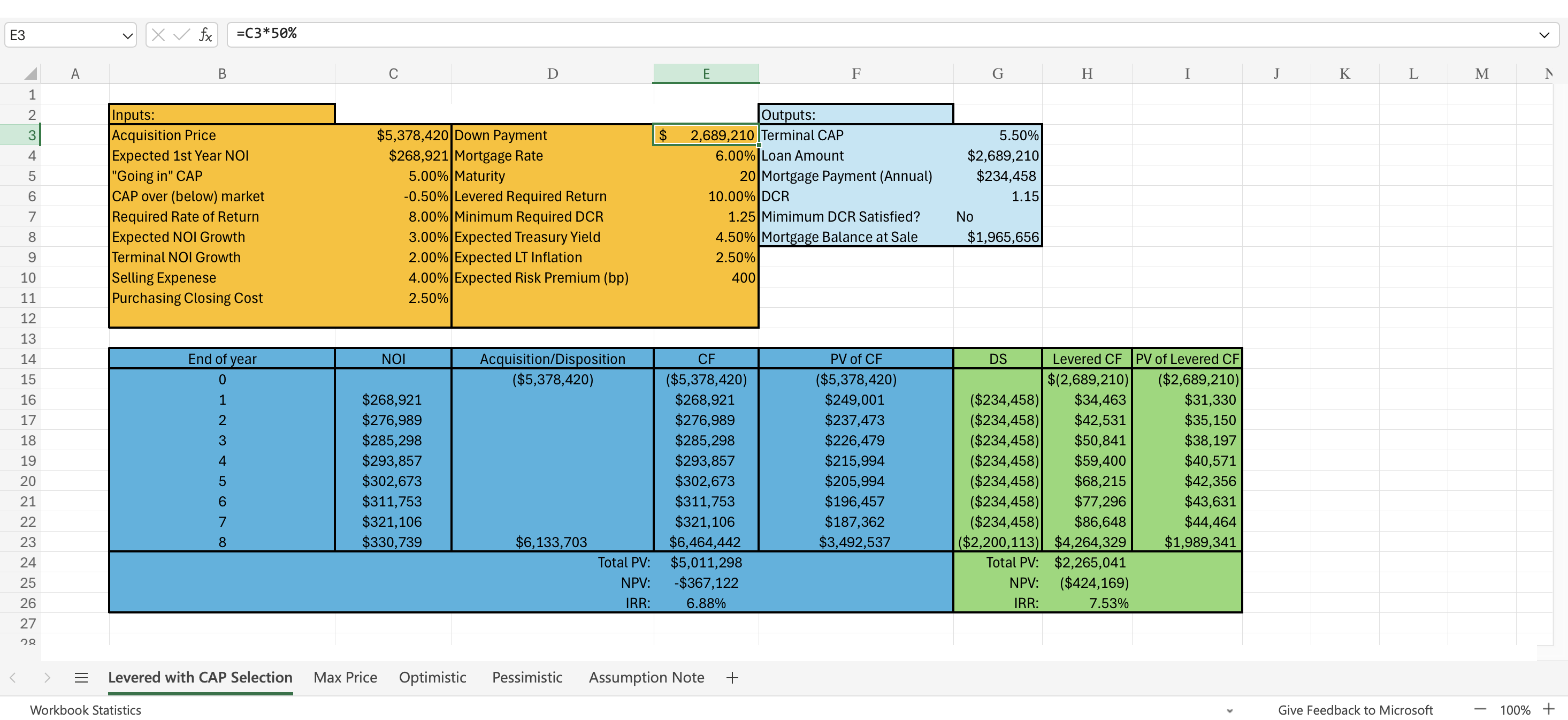

Question: E3 v X fx =C3*50% A B C D E F G H I J K L M Inputs: Outputs: Acquisition Price $5,378,420 Down Payment

E3 v X fx =C3*50% A B C D E F G H I J K L M Inputs: Outputs: Acquisition Price $5,378,420 Down Payment $ 2,689,210 Terminal CAP 5.50% Expected 1st Year NOI $268,921 Mortgage Rate 6.00% Loan Amount $2,689,210 OUT A W Going in" CAP 5.00% Maturity 20 Mortgage Payment (Annual) $234,458 CAP over (below) market 0.50% Levered Required Return 10.00% DCR 1.15 Required Rate of Return 8.00% Minimum Required DCR 1.25 Mimimum DCR Satisfied? No Expected NOI Growth 3.00% Expected Treasury Yield 4.50% Mortgage Balance at Sale $1,965,656 6 00 Terminal NOI Growth 2.00% Expected LT Inflation 2.50% 10 Selling Expenese 4.00% Expected Risk Premium (bp) 400 11 Purchasing Closing Cost 2.50% 12 13 14 End of year NOI Acquisition/Disposition CF PV of CF S Levered CF PV of Levered CF 15 $5,378,420) $5,378,420) ($5,378,420) $(2,689,210) ($2,689,210) 16 $268,921 $268,921 $249,001 ($234,458) $34,463 $31,330 17 $276,989 $276,989 $237,473 ($234,458) $42,531 $35, 150 18 $285,298 $285,298 $226,479 ($234,458) $50,841 $38,197 19 $293,857 $293,857 $215,994 ($234,458) $59,400 $40,571 20 $302,673 $302,673 $205,994 ($234,458) $68,215 $42,356 21 $311,753 $311,753 $196,457 ($234,458) $77,296 $43,631 22 $321, 106 $321, 106 $187,362 ($234,458) $86,648 $44,464 23 $330,739 $6, 133,703 $6,464,442 $3,492,537 ($2,200,113) $4,264,329 $1,989,341 24 Total PV: $5,011,298 Total PV: $2,265,041 25 NPV: -$367,122 NPV: ($424,169) 26 IRR: 6.88% IRR: 7.53% 27