Question: E4-20 Differences in Accounting for Property Taxes between the General Fund and Governmental Activities [LO 4-1] During the current year, the City of Plattsburgh recorded

E4-20 Differences in Accounting for Property Taxes between the General Fund and Governmental Activities [LO 4-1]

During the current year, the City of Plattsburgh recorded the following transactions related to its property taxes:

- Levied property taxes of $6,700,000, of which 2 percent is estimated to be uncollectible.

- Collected current property taxes amounting to $6,075,000.

- Collected $61,000 in delinquent taxes and $4,800 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year.

- Imposed penalties and interest in the amount of $7,200 but only expects to collect $6,200 of that amount.

- Reclassified uncollected taxes and interest and penalties as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year.

Required

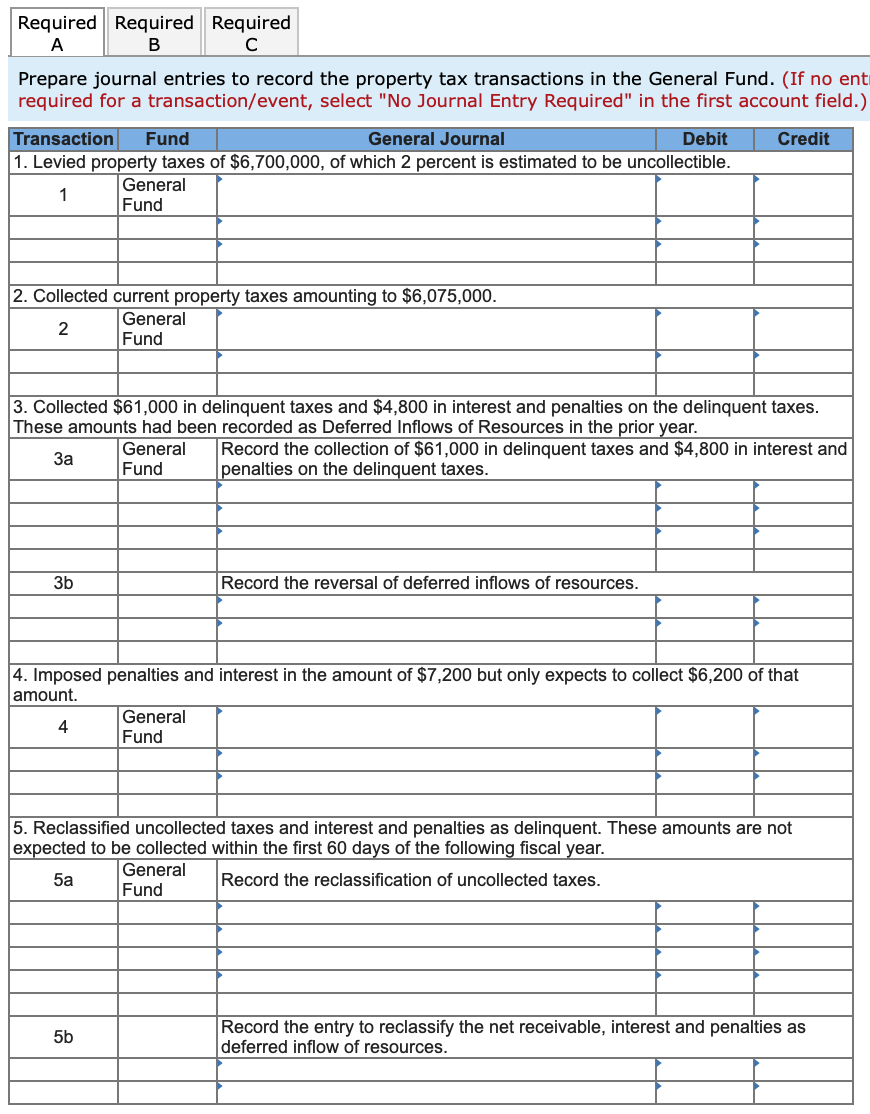

- Prepare journal entries to record the property tax transactions in the General Fund.

-

- Prepare journal entries to record the property tax transactions in the governmental activities journal.

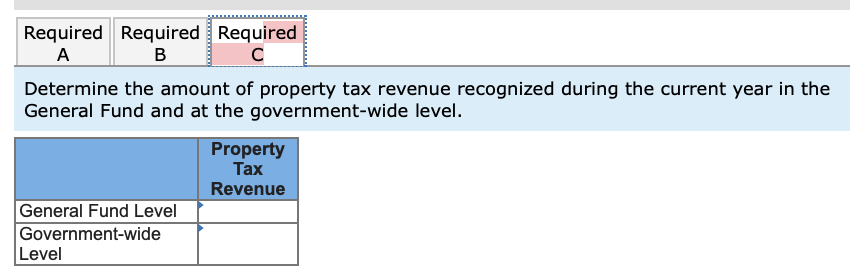

- Determine the amount of property tax revenue recognized during the current year in the General Fund and at the government-wide level.

-

Required Required Required A | B | C Prepare journal entries to record the property tax transactions in the General Fund. (If no enti required for a transaction/event, select "No Journal Entry Required" in the first account field.) Credit Transaction Fund General Journal Debit 1. Levied property taxes of $6,700,000, of which 2 percent is estimated to be uncollectible. General Fund 2. Collected current property taxes amounting to $6,075,000. General Fund - 2 3. Collected $61,000 in delinquent taxes and $4,800 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year. General Record the collection of $61,000 in delinquent taxes and $4,800 in interest and Fund penalties on the delinquent taxes. 3b Record the reversal of deferred inflows of resources. 4. Imposed penalties and interest in the amount of $7,200 but only expects to collect $6,200 of that amount. General Fund 5. Reclassified uncollected taxes and interest and penalties as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year. General 5a Record the reclassification of uncollected taxes. Fund 5b Record the entry to reclassify the net receivable, interest and penalties as deferred inflow of resources. Required Required Required A | B | C Prepare journal entries to record the property tax transactions in the governmental activities journal. entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Credit Fund / Transaction Governmental General Journal Debit Activties 1. Levied property taxes of $6,700,000, of which 2 percent is estimated to be uncollectible. Governmental Activities 2. Collected current property taxes amounting to $6,075,000. Governmental Activities 3. Collected $61,000 in delinquent taxes and $4,800 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year. Governmental Activities 4. Imposed penalties and interest in the amount of $7,200 but only expects to collect $6,200 of that amount. Governmental Activities 5. Reclassified uncollected taxes and interest and penalties as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year. Governmental Activities Required Required Required Determine the amount of property tax revenue recognized during the current year in the General Fund and at the government-wide level. Property Tax Revenue General Fund Level Government-wide Level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

![Governmental Activities [LO 4-1] During the current year, the City of Plattsburgh](https://s3.amazonaws.com/si.experts.images/answers/2024/07/6692493f693f8_0386692493eeac41.jpg)