Question: E5.4 Help please. 4 Consolidating a VIE at the Date of Acquisition to obtain secured debt. It sells customer timeshare agreements to the entity, who

E5.4 Help please.

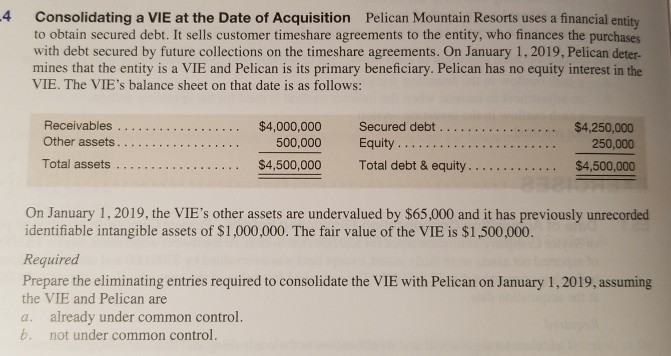

4 Consolidating a VIE at the Date of Acquisition to obtain secured debt. It sells customer timeshare agreements to the entity, who finances the purchases with debt secured by future collections on the timeshare agreements. On January 1, 2019, Pelican deter- mines that the entity is a VIE and Pelican is its primary beneficiary. Pelican has no equity interest in the VIE. The VIE's balance sheet on that date is as follows: Pelican Mountain Resorts uses a financial entity Receivables $4,000,000 500,000 Secured debt Equity $4,250,000 250,000 S4,500,000 Total debt & equity On January 1,2019, the VIE's other assets are undervalued by $65,000 and it has previously unrecorded identifiable intangible assets of $1,000,000. The fair value of the VIE is $1,500,000. Required Prepare the eliminating entries required to consolidate the VIE with Pelican on January 1,2019, assuming the VIE and Pelican are a. already under common control. b. not under common control

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts