Question: E6-13 (Algo) Computing Bad Debt Expense Using Aging Analysis LO6-2 Lin's Dairy uses the aging approach to estimate bad debt expense. The ending balance of

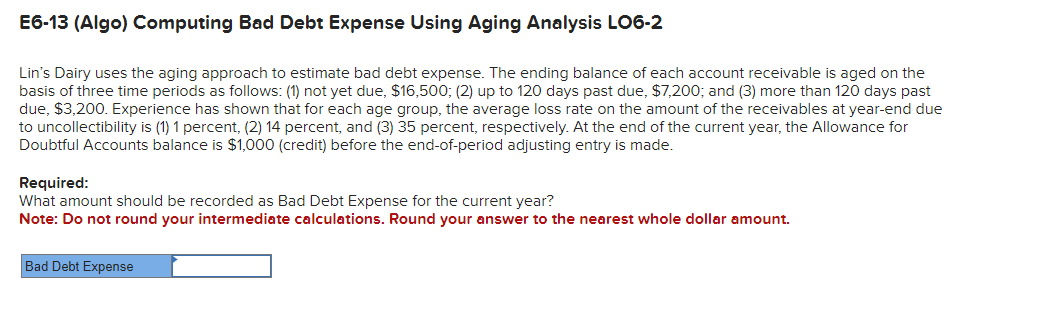

E6-13 (Algo) Computing Bad Debt Expense Using Aging Analysis LO6-2 Lin's Dairy uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $16,500; (2) up to 120 days past due, $7,200; and (3) more than 120 days past due, $3,200. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 1 percent, (2) 14 percent, and (3) 35 percent, respectively. At the end of the current year, the Allowance for Doubtful Accounts balance is $1,000 (credit) before the end-of-period adjusting entry is made. Required: What amount should be recorded as Bad Debt Expense for the current year? Note: Do not round your intermediate calculations. Round your answer to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts