Question: no handwriting please E6-13 (Algo) Computing Bad Debt Expense Using Aging Analysis LO6-2 Lin's Dairy uses the aging approach to estimate bad debt expense. The

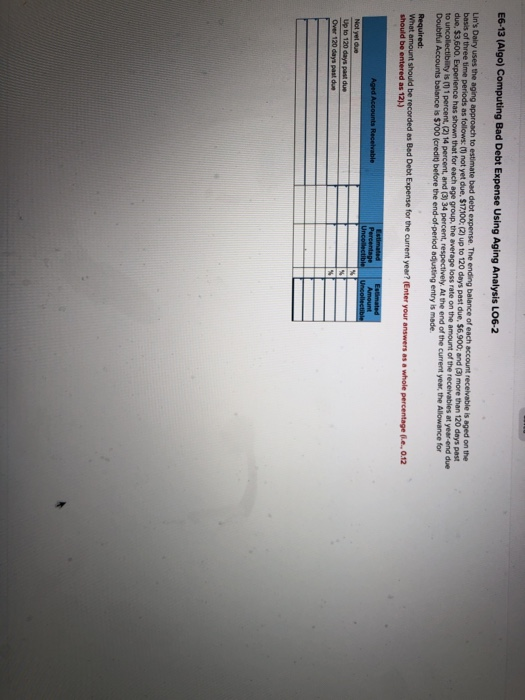

E6-13 (Algo) Computing Bad Debt Expense Using Aging Analysis LO6-2 Lin's Dairy uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $17,100: (2up to 120 days past due, S6,900, and more than 120 days past due, $3,600. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectiblity is percent (2) 14 percent, and (534 percent, respectively. At the end of the current year, the Allowance for Doubtful Account balance is $700 (credit before the end of period adjusting entry is made Required: What amount should be recorded as Bed Debt Expense for the current year? (Enter your answers as a whole percentage ... 0.12 should be entered as 12-) Estimated Aged Accounts Receivable Up to 120 days pas due Over 120 days past due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts