Question: E6-9 (Algo) Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2 E6-9 (Algo) Recording Bad Debt Expense Estimates and

E6-9 (Algo) Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2

E6-9 (Algo) Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2

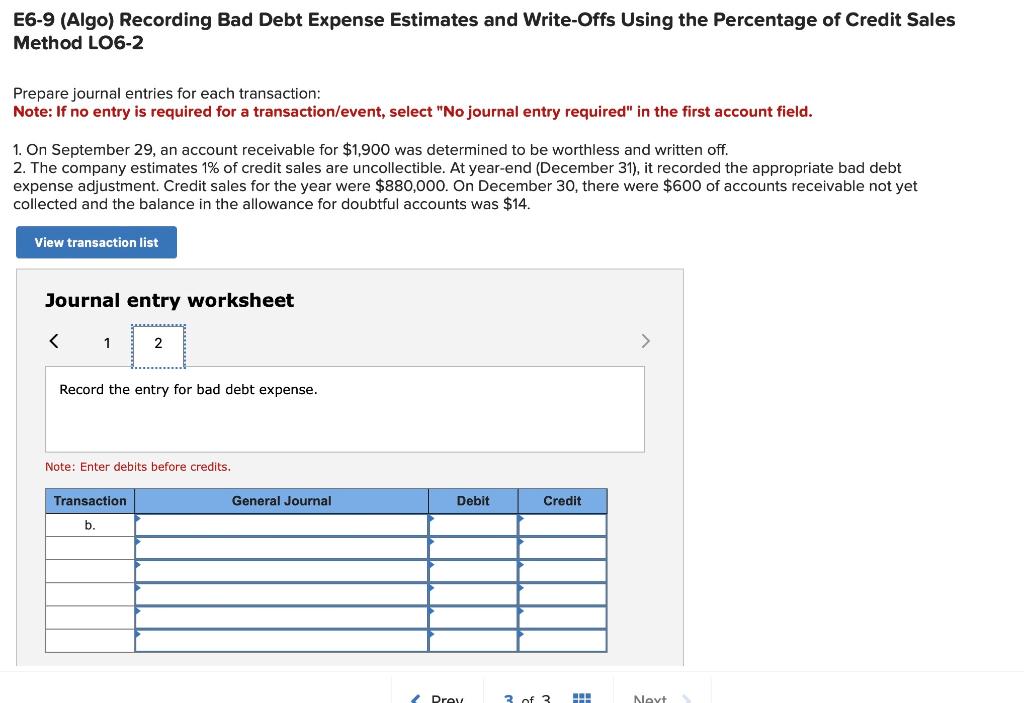

E6-9 (Algo) Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2 Prepare journal entries for each transaction: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. 1. On September 29 , an account receivable for $1,900 was determined to be worthless and written off. 2. The company estimates 1% of credit sales are uncollectible. At year-end (December 31), it recorded the appropriate bad debt expense adjustment. Credit sales for the year were $880,000. On December 30 , there were $600 of accounts receivable not yet collected and the balance in the allowance for doubtful accounts was $14. Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts