Question: E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 Daniel Company uses a periodic inventory

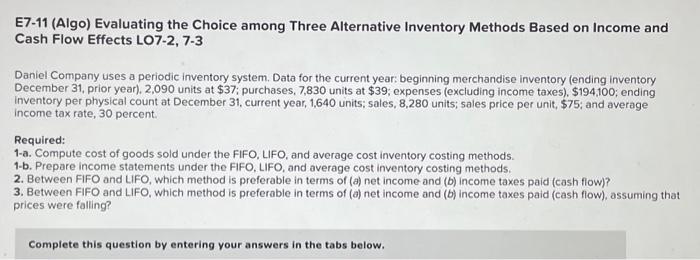

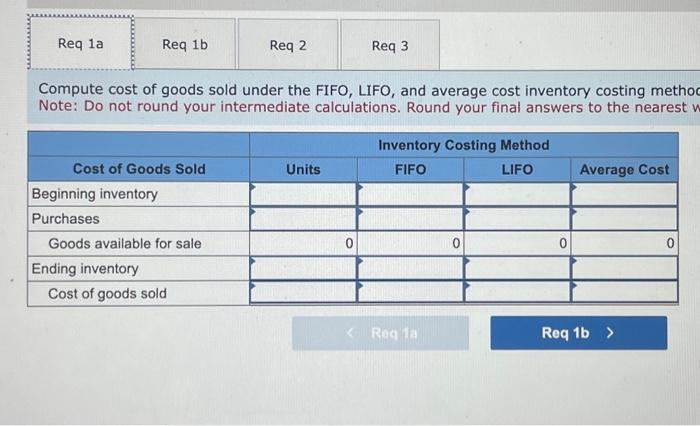

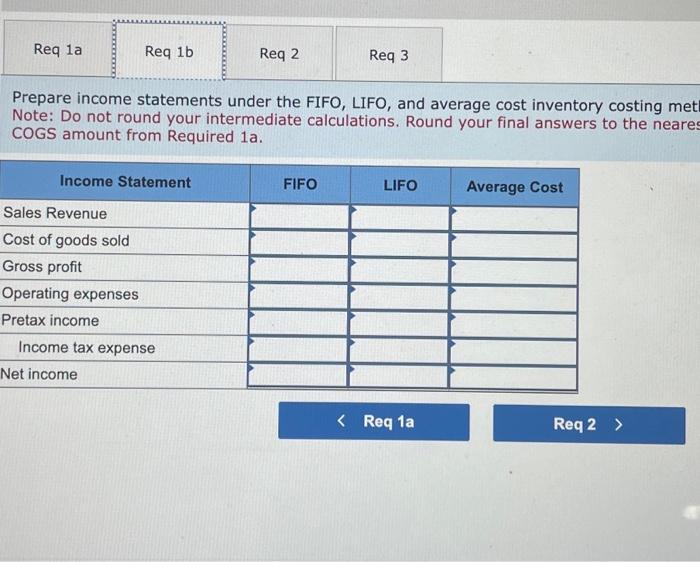

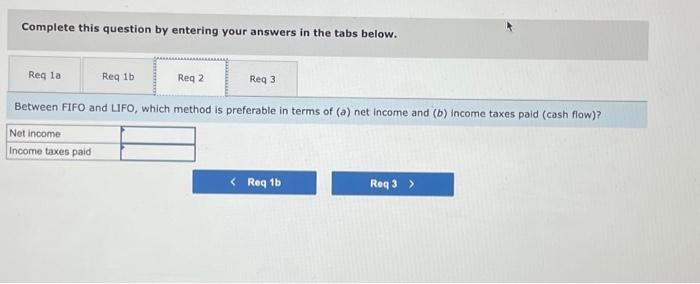

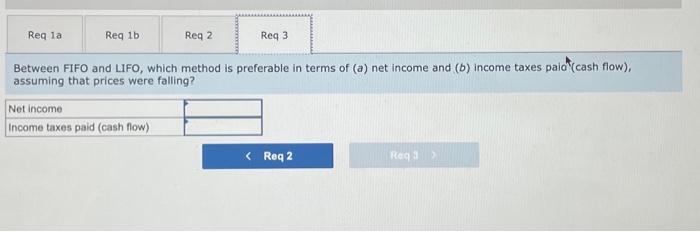

E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,090 units at $37; purchases, 7,830 units at $39; expenses (excluding income taxes), $194,100;; ending inventory per physical count at December 31 , current year, 1,640 units; sales, 8,280 units; sales price per unit, $75; and average income tax rate, 30 percent. Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 1-b. Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. 2. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow)? 3. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow), assuming that prices were folling? Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing meth Note: Do not round your intermediate calculations. Round your final answers to the nearest Prepare income statements under the FIFO, LIFO, and average cost inventory costing met Note: Do not round your intermediate calculations. Round your final answers to the neare COGS amount from Required 1 a. Complete this question by entering your answers in the tabs below. setween FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow)? Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid' (cash flow), assuming that prices were falling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts