Question: E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement

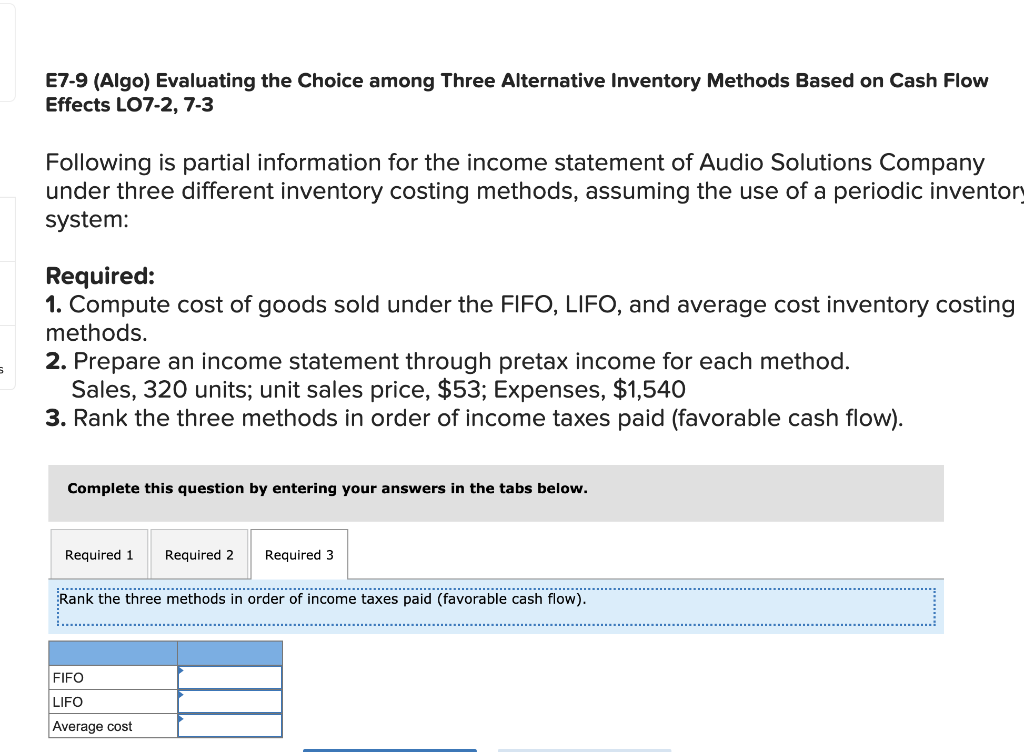

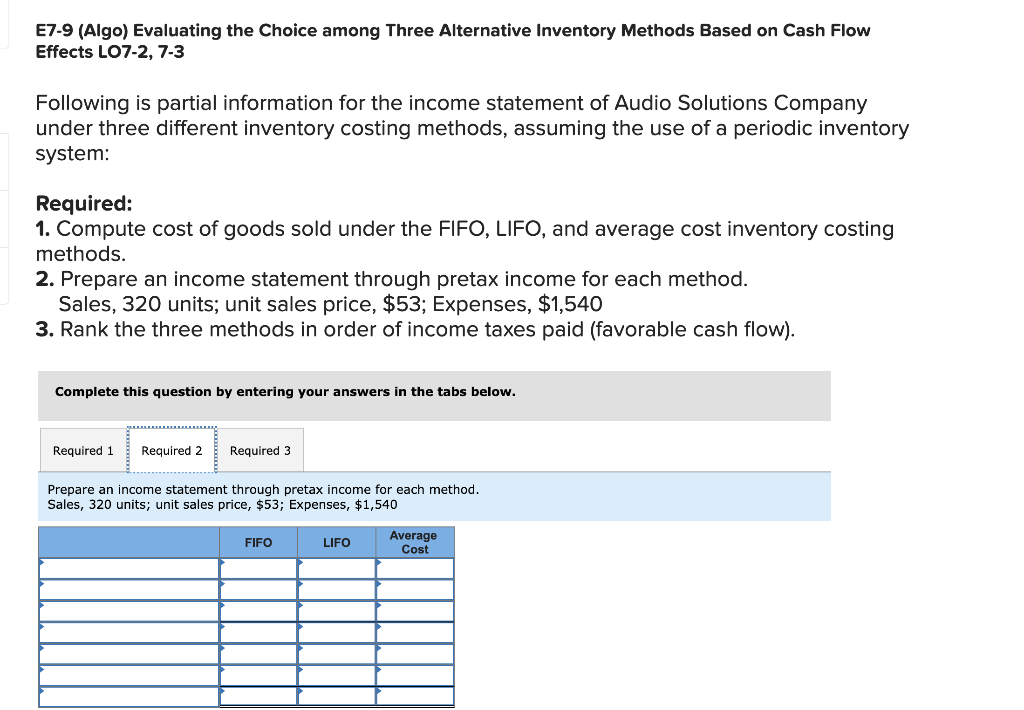

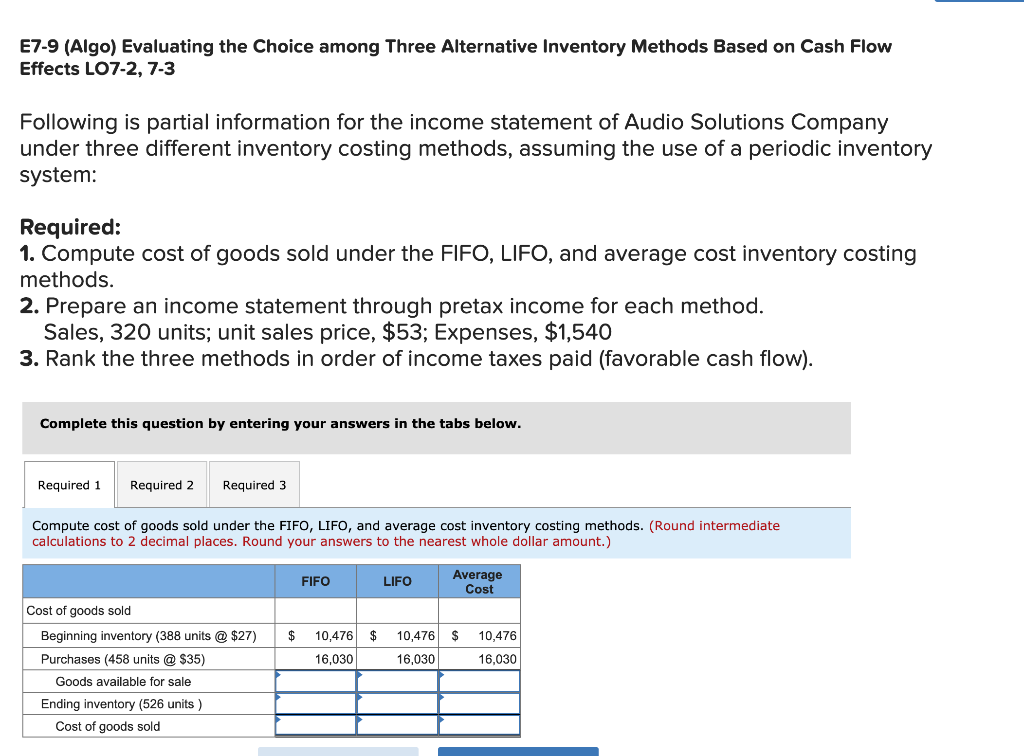

E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 320 units; unit sales price, $53; Expenses, $1,540 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 PS....................................... Rank the three methods in order of income taxes paid (favorable cash flow). FIFO LIFO Average cost E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 320 units; unit sales price, $53; Expenses, $1,540 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement through pretax income for each method. Sales, 320 units; unit sales price, $53; Expenses, $1,540 FIFO LIFO Average Cost E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 320 units; unit sales price, $53; Expenses, $1,540 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Round intermediate calculations to 2 decimal places. Round your answers to the nearest whole dollar amount.) FIFO LIFO Average Cost $ $ $ 10,476 16,030 10,476 16,030 10,476 16,030 Cost of goods sold Beginning inventory (388 units @ $27) Purchases (458 units @ $35) Goods available for sale Ending inventory (526 units) Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts