Question: E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement

E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3

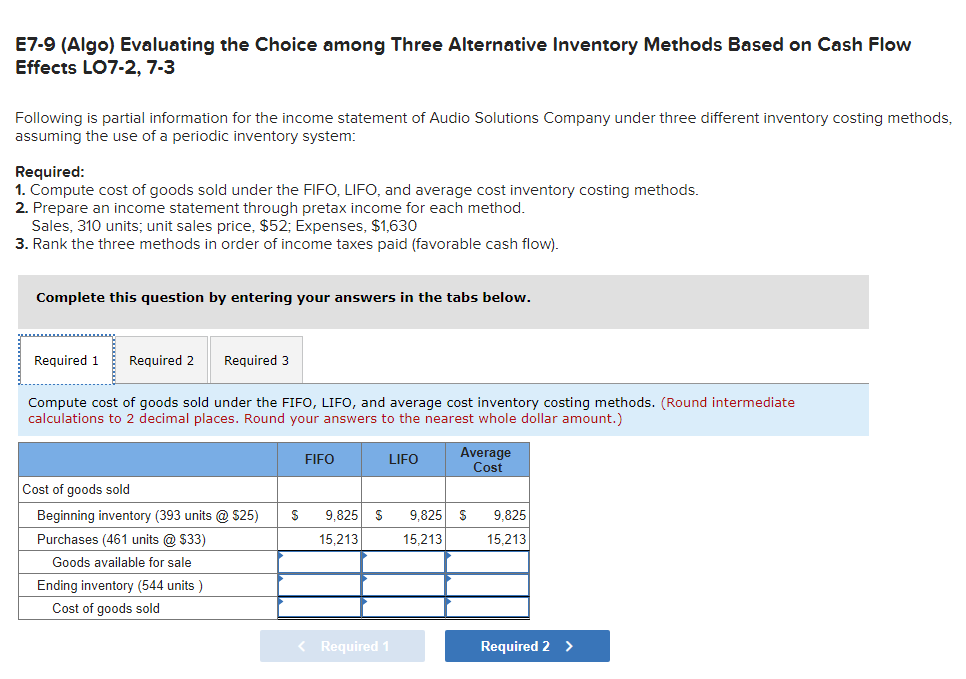

Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system:

Required:

1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

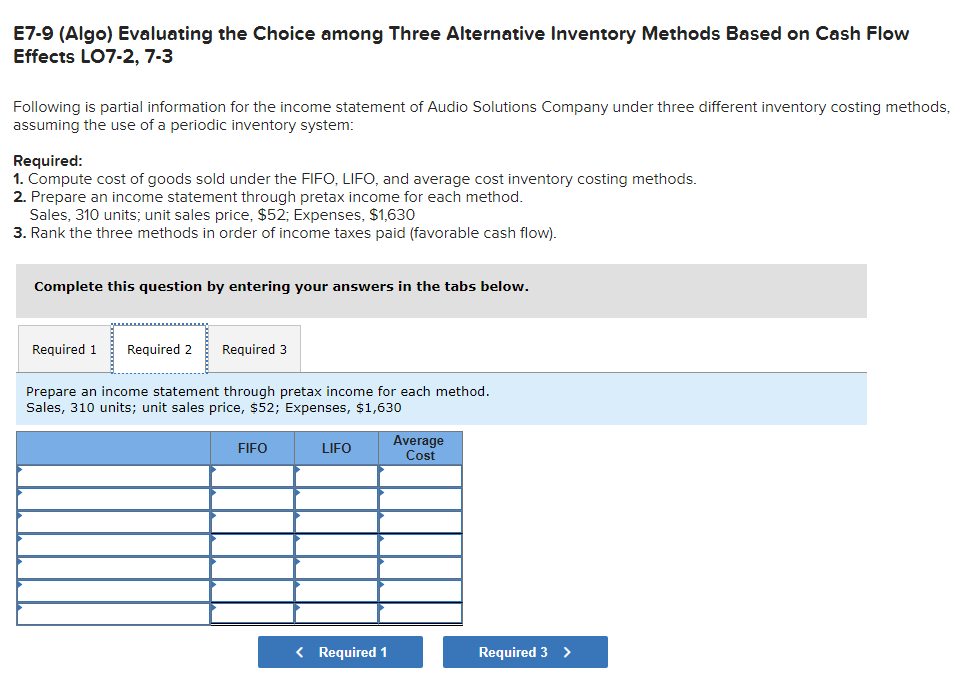

2. Prepare an income statement through pretax income for each method.

Sales, 310 units; unit sales price, $52; Expenses, $1,630

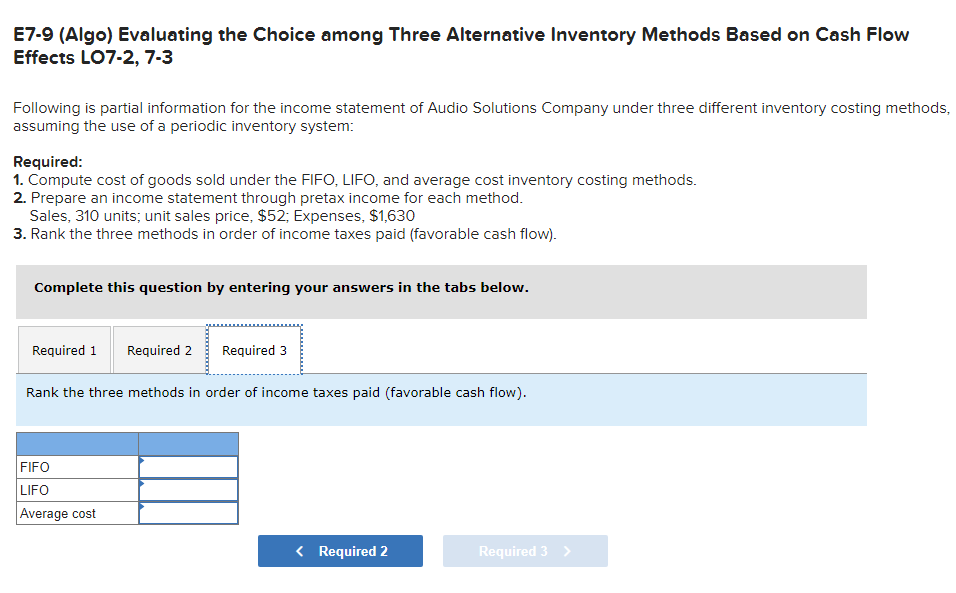

3. Rank the three methods in order of income taxes paid (favorable cash flow).

E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 310 units; unit sales price, $52; Expenses, $1,630 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Round intermediate calculations to 2 decimal places. Round your answers to the nearest whole dollar amount.) FIFO LIFO Average Cost S 9.825 S 9.825 S 15,213 9,825 15.213 15,213 Cost of goods sold Beginning inventory (393 units @ $25) Purchases (461 units @ $33) Goods available for sale Ending inventory (544 units ) Cost of goods sold E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects LO7-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 310 units; unit sales price, $52; Expenses, $1,630 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement through pretax income for each method. Sales, 310 units; unit sales price, $52; Expenses, $1,630 FIFO LIFO Average Cost E7-9 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow Effects L07-2, 7-3 Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 310 units; unit sales price, $52; Expenses, $1,630 3. Rank the three methods in order of income taxes paid (favorable cash flow). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Rank the three methods in order of income taxes paid (favorable cash flow). FIFO LIFO Average cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts