Question: E8-14B. Allowance Method versus Direct Write-Off Method On March 10, Barnes, Inc., declared a $3,700 LOG account receivable from Lamas Company as uncollectible and wrote

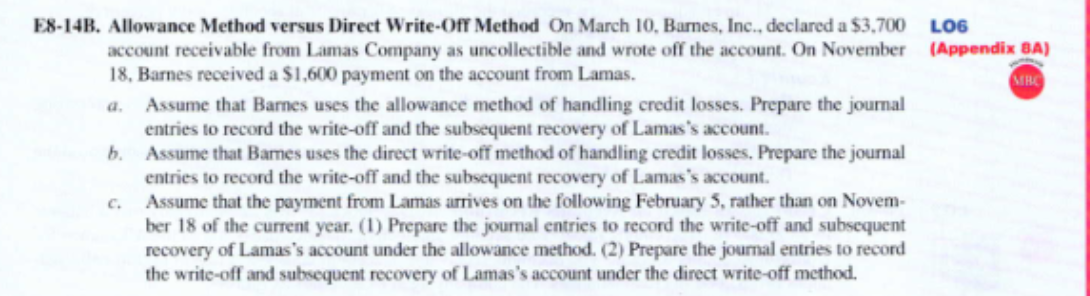

E8-14B. Allowance Method versus Direct Write-Off Method On March 10, Barnes, Inc., declared a $3,700 LOG account receivable from Lamas Company as uncollectible and wrote off the account. On November (Appendix BA) 18, Barnes received a $1,600 payment on the account from Lamas. MHC a. Assume that Barnes uses the allowance method of handling credit losses. Prepare the journal entries to record the write-off and the subsequent recovery of Lamas's account. b. Assume that Barnes uses the direct write-off method of handling credit losses. Prepare the journal entries to record the write-off and the subsequent recovery of Lamas's account. c. Assume that the payment from Lamas arrives on the following February 5, rather than on Novem- ber 18 of the current year. (1) Prepare the journal entries to record the write-off and subsequent recovery of Lamas's account under the allowance method. (2) Prepare the journal entries to record the write-off and subsequent recovery of Lamas's account under the direct write-off method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts