Question: E8-17 (Supplement 8A) Recording Write-Offs and Reporting Accounts Receivable Using the Direct Write-Off Method [LO 8-S1 Trevorson Electronics is a small company privately owned by

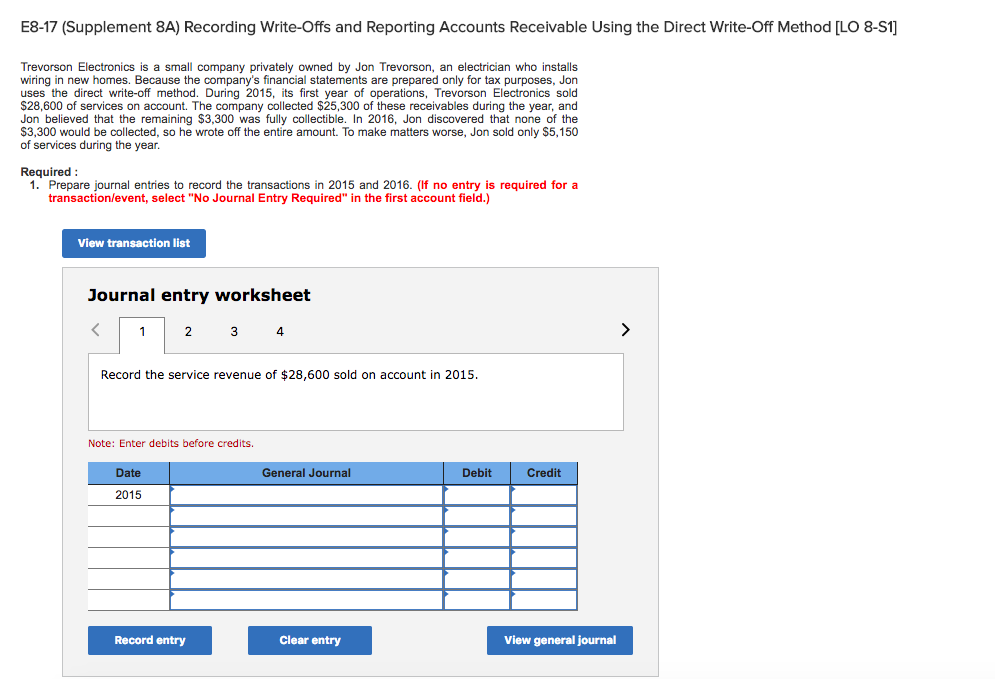

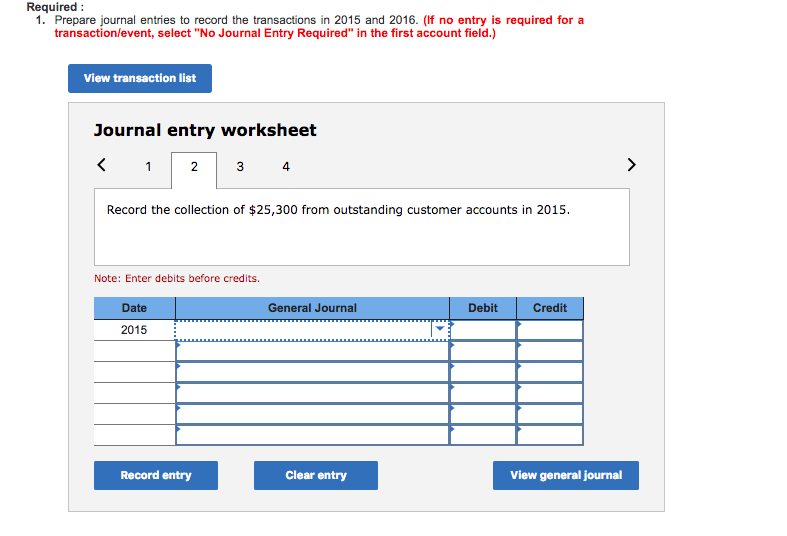

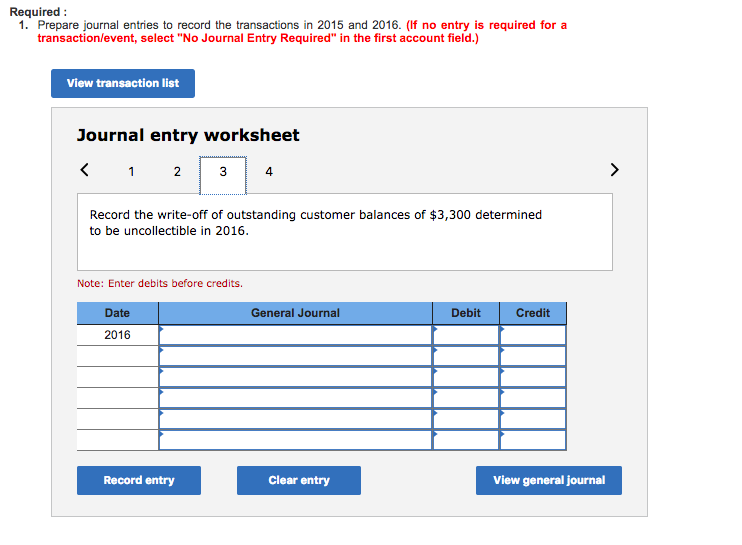

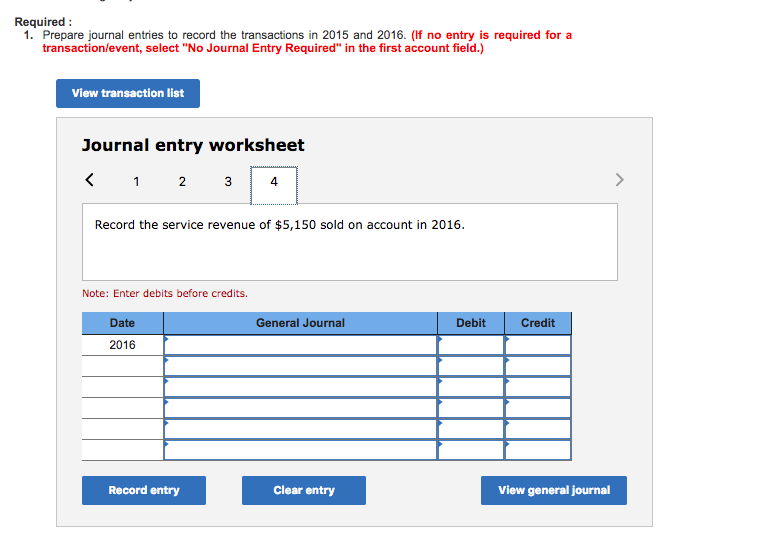

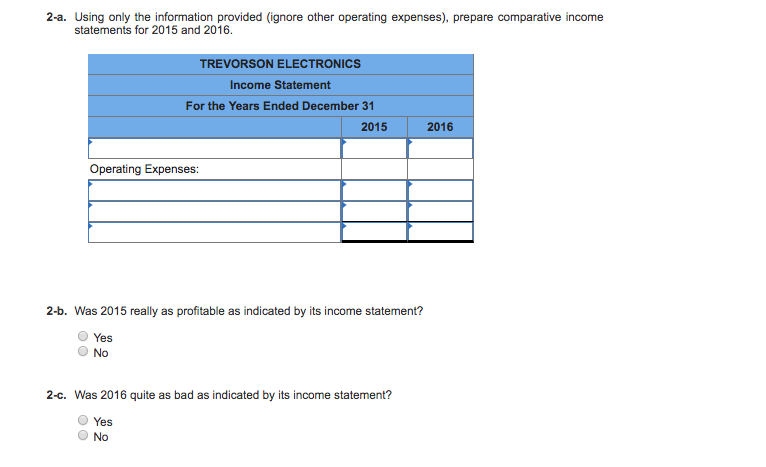

E8-17 (Supplement 8A) Recording Write-Offs and Reporting Accounts Receivable Using the Direct Write-Off Method [LO 8-S1 Trevorson Electronics is a small company privately owned by Jon Trevorson, an electrician who installs wiring in new homes. Because the company's financial statements are prepared only for tax purposes, Jon uses the direct write-off method. During 2015, its first year of operations, Trevorson Electronics sold S28,600 of services on account. The company collected $25,300 of these receivables during the year, and Jon believed that the remaining $3,300 was fully collectible. In 2016, Jon discovered that none of the $3,300 would be collected, so he wrote off the entire amount. To make matters worse, Jon sold only $5,150 of services during the year Required 1. Prepare journal entries to record the transactions in 2015 and 2016. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 4 Record the service revenue of $28,600 sold on account in 2015 Note: Enter debits before credits. Date General Journal Debit Credit 2015 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts