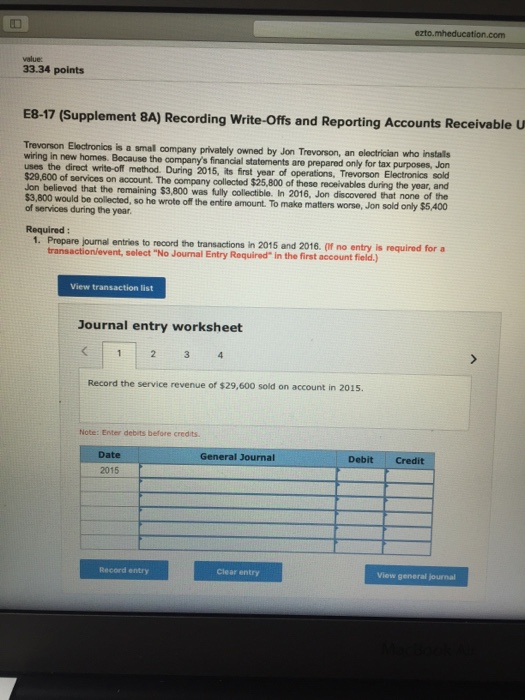

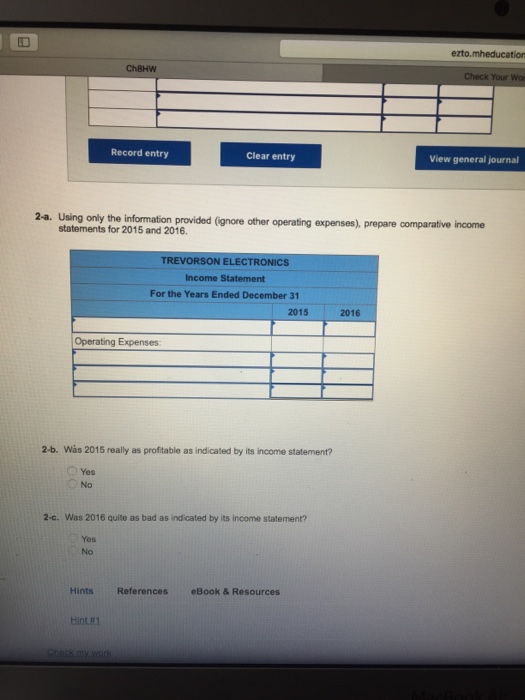

Question: Please help ASAP ezto. value: 33.34 points E8-17 (Supplement 8A) Recording Write-Offs a nd Reporting Accounts Receivable U wiring in new homes. Because the company's

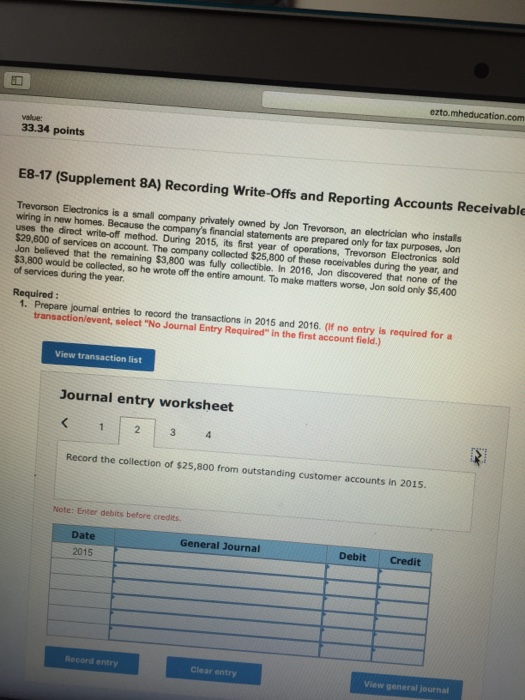

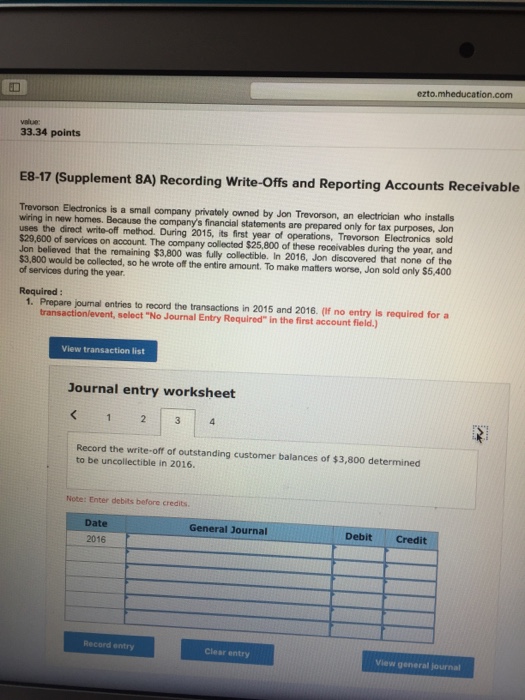

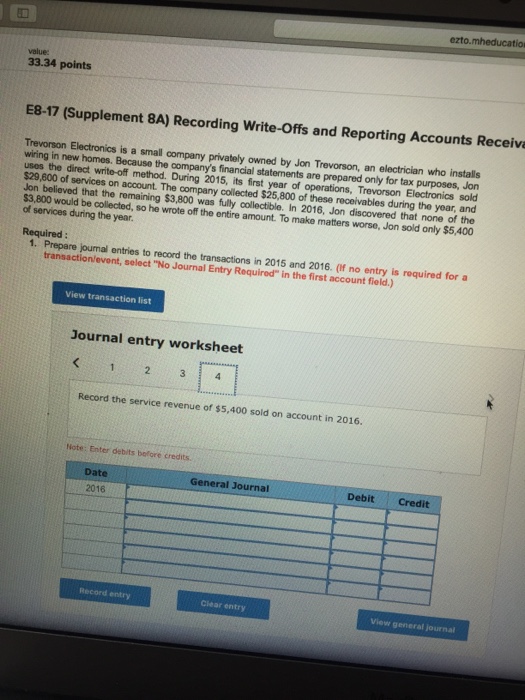

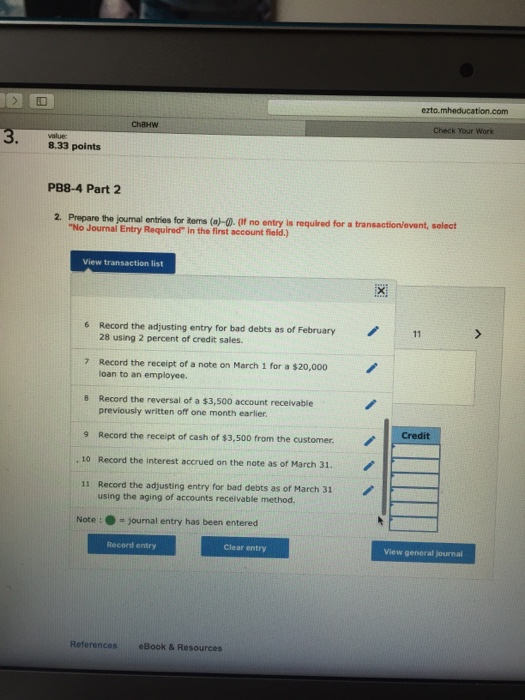

ezto. value: 33.34 points E8-17 (Supplement 8A) Recording Write-Offs a nd Reporting Accounts Receivable U wiring in new homes. Because the company's financial statements are prepared only for tax purposes, Jon uses the direct write-off method. During 2015, its first year of operations, Trevorson $29,600 of services on account. The company collected $25,800 of these reoeivables during the year, and Jon believed that the remaining $3,800 was fully collectible. In $3,800 would be ollected, so he wrote off the entre amount. To make matters worse, Jon sold only $6,400 of services during the year owned by Jon Trevorson, an electrician who installs Electronics sold 2016, Jon discovered that none of the Required: 1. Propare journal entries to record tho transactions in 2015 and 2018. (f no entry is required for a transactionlevent, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the service revenue of $29,600 sold on account in 2015. Note: Enter debits before credits. Date General Journal Debit Credit 2015 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts