Question: E8-21 Journalizing transactions using the direct write-off method versus the allowance method During August 2018, Lima Company recorded the following . Sales of $133,300 ($122,000

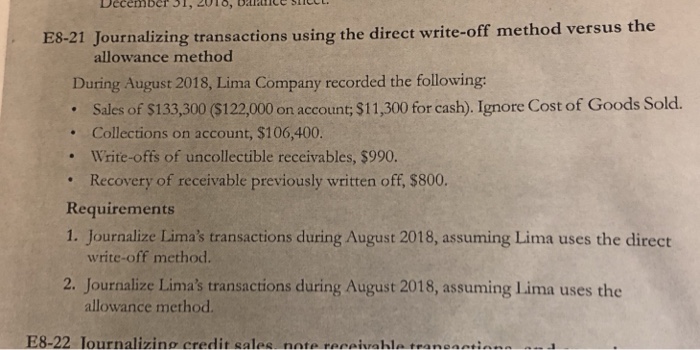

E8-21 Journalizing transactions using the direct write-off method versus the allowance method During August 2018, Lima Company recorded the following . Sales of $133,300 ($122,000 on account $11,300 for cash). Ignore Cost of Goods Sold. Collections on account, $106,400. . Write-offs of uncollectible receivables, $990. . Recovery of receivable previously written off, $800. Requirements 1. Journalize Lima's transactions during August 2018, assuming Lima uses the direct write-off method 2. Journalize Lima's transactions during August 2018, assuming Lima uses the allowance method. E8-22 lournalizing credit sales nate receiuahle transatinn n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts