Question: E8-8 Computing Depreciation under Alternative Methods LO8-3 Purity lce Cream Company bought a new ice cream maker at the beginning of the year at a

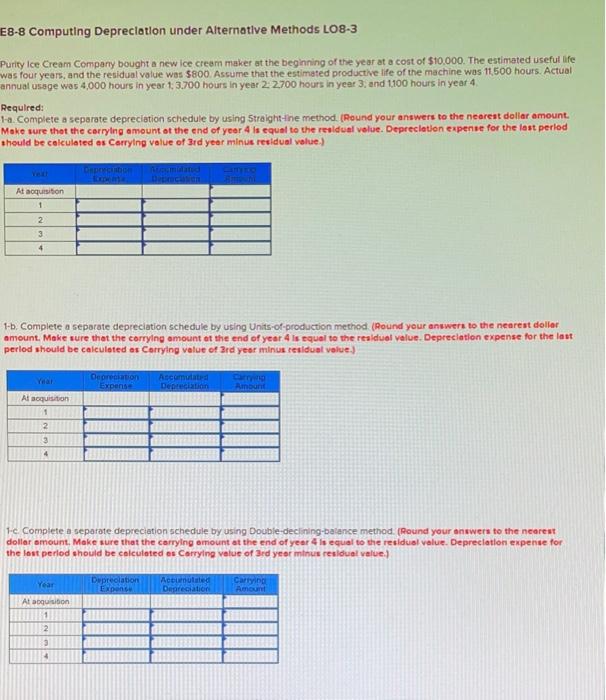

E8-8 Computing Depreciation under Alternative Methods LO8-3 Purity lce Cream Company bought a new ice cream maker at the beginning of the year at a cost of $10.000. The estimated useful life was four years, and the residual volue was $800. Assume that the estimated productive life of the machine was 11,500 hours. Actual annual ussge was 4,000 hours in year 1,3,700 hours in year 2,2,700 hours in year 3 , and 1,100 hours in yeat 4. Required: 1-a. Complete a separate depreciation schedule by using Straight-ine method. (Round your answers to the neareat dollar amount. Make sure thot the carrylng amount of the end of year 4 is equal to the residual volue. Depreclation expense for the last perlod theuld be colculated as Carrylng value of 3rd year minus residual value.) 1-b. Complete a separate depreciation schedule by using Units-of-production method. (Round your anwwern to the nearest dollar amount. Make sure that the corrylng amount of the end of year 4 is tqual to the realdual value. Depreciation expense for the last perlod should be calculated as Corrying value of 3rd yeer minus realduat value.) 1. Complete a separate depreciation schedule by using Double-decining-balance method. (Round your answers to the nearest dollar omount. Make sure that the carrying omount at the end of yes 4 is equal to the residual value. Depreclation expense for the lost perlod should be colculated os Carrying velue of 3rd yeor minus residual value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts